The folks at Fundstrat Global Advisors have some good news and bad news for Wall Street, as investors and traders face the penultimate week of action in 2021: Monday’s stock slump is a precursor to more pain, but things could get better for the bulls closer to Christmas.

Read: Dow plunges and Nasdaq nears correction because stock-market investors don’t see a Christmas cavalry coming to the rescue

That is the takeaway from a report on the technical setup for the markets after the Dow Jones Industrial Average DJIA, -1.23%, the S&P 500 SPX, -1.14% and the Nasdaq Composite COMP, -1.24% all notched their third consecutive losses Monday, with the decline for the technology-heavy Nasdaq bringing the benchmark to its lowest level since Oct. 15 and putting it nearly 7% below its Nov. 19 record close.

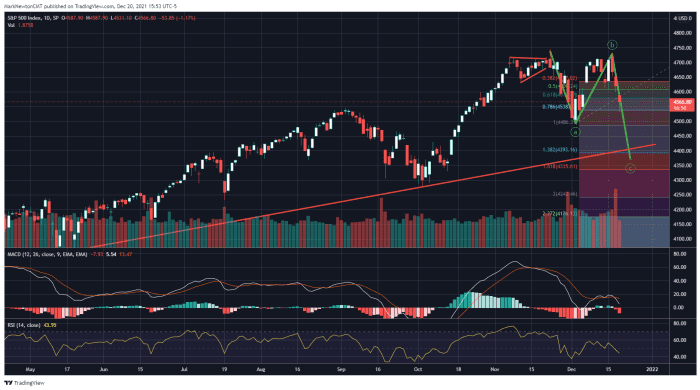

via Fundstrat Global

“Monday’s break of 4,600 has resulted in further near-term deterioration, but also suggests additional selling lies in store for SPX ahead of any low later this week,” wrote Fundstrat’s Mark Newton.

Sign up for our MarketWatch Newsletters here.

Newton said that a deterioration in so-called FAANG stocks — the group consisting of Meta Platforms Inc. FB, -2.50% (formerly known as Facbook Inc.), Apple Inc. AAPL, -0.81%, Amazon.com AMZN, -1.73%, Netflix Inc. NFLX, +1.19% and Google holding company Alphabet Inc. GOOGL, -0.08% GOOG, -0.28% — is pointing to additional declines in stocks, as gauged by the Invesco QQQ Trust QQQ, -0.97% and NY-FANG Composite Index.

Check out: These are the big levels to watch for the S&P 500 and Nasdaq. Expect ‘wild trade,’ if they break, warns this strategist.

“QQQ break of 383 from last week keeps the near-term trend negative here also, and should allow for extensions down to 371 before rallies into year-end get under way,” the Fundstrat note said. The popular QQQ, which represents the largest companies in the Nasdaq Composite, closed Monday at 380.69, and is down 3.3% in the month to date but up 21.3% in 2021 thus far.

via Fundstrat Global

Meanwhile, Newson wrote that the NY-FANG Composite index, along with the addition of Microsoft Corp. MSFT, -1.20%, has neared “‘Make-or-Break’ levels from a mild uptrend from Spring 2021 lows.”

Read: Cathie Wood says stocks have corrected into ‘deep value territory’ and won’t let benchmarks ‘hold our strategies hostage’

Newton said he is expecting the downturn to provide opportunities for investors, despite technical indicators pointing to further selling in the coming days.

“Sentiment has turned quite negative near-term, and bearish sentiment combined with bullish seasonality looks to be an effective 1-2 combo to buy dips ahead of Christmas,” he wrote.

Newton said that a confluence of factors suggests that the atmosphere could improve by the end of the week, but cautioned that if trend lines are broken, “one will need to hold out for some evidence of stabilization.”

Fundstrat also remains bullish on the so-called Santa Claus Rally period, which is technically the final five trading days of a calendar year and the first two sessions in January.