A standard part of many Federal Reserve speeches by policy makers over the last few years went something like this: “If inflation rears its ugly head, we know what to do.”

Such tough talk is easier when the economy is growing and inflation is low.

In 2022, it may be harder for the Fed to be tough on inflation ahead of midterm elections in November 2022 and with segments of the workforce still lagging badly in regaining lost jobs, said Stephen Englander, head of North America Macro Strategy at Standard Chartered Bank.

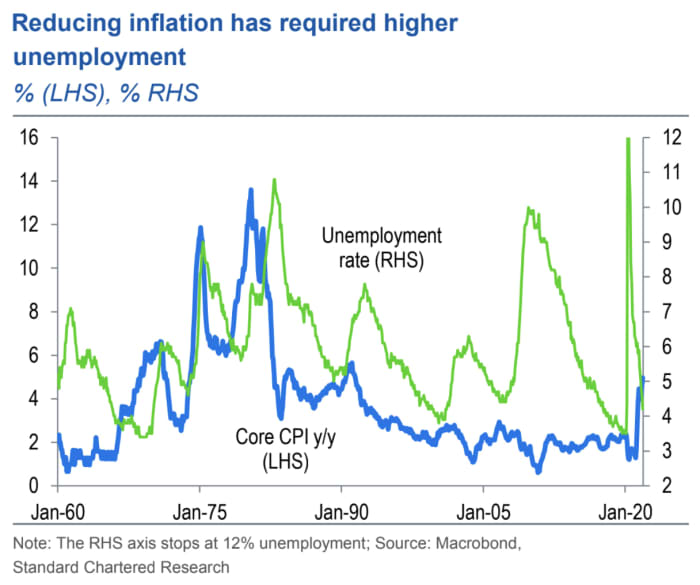

Hawks and doves at the Fed have not addressed how much added unemployment will be needed to get inflation back to target, Englander said. Instead, Fed officials seem to believe in some form of “immaculate disinflation,” where inflation moderates on its own, he noted.

The U.S. consumer price inflation rate surged to an almost 40 year high of 6.8% in November. It was 1.1% in the same month last year.

Historically, reducing inflation has required an increase in unemployment, Englander said.

The Fed has two mandates — stable inflation at a 2% annual rate and maximum employment. Fed decision making is easy when the two goals are aligned.

But when inflation is moving higher, the Fed has to perform a balancing act.

In the statement of its longer-run goals, the Fed said that when its objectives are not complimentary, the Fed will take into account “the employment shortfalls and inflation deviations and the potentially different time horizons over which employment and inflation are projected to return to levels judged consistent with its mandate.”

Michael Gapen, chief U.S. economist at Barclays, said it won’t’ look good for the Fed to be raising interest rates when several million workers are still out of the workforce as the economy recovers from the pandemic and participation is subdued.

“It’s not a great position to be in — but it’s the one they’re in currently,” Gapen said in an interview on Bloomberg.

If inflation does moderate in 2022, the Fed could shift back to focusing on full employment, Gapen added.

The Fed will announce its plans to combat inflation on Wednesday. The central bank is expected to decide to bring forward the end of its bond buying program and signal a slightly higher path of interest rates. Essentially, Fed officials believe that the higher inflation is just an one-time increase in prices that won’t be repeated, said Steven Ricchiuto, chief economist at Mizuho Securities USA.

Some ex-Fed officials want the central bank to be more aggressive.

U.S. stock futures traded mixed early Wednesday, with signs that technology stocks will come under pressure again as markets await a decision by the Federal Open Market Committee later. S&P 500 futures ES00, -0.02% were flat at 4,626.