Investors are watching closely for any signs that the surge in the cost of living during the pandemic may be starting to ebb, with Wells Fargo Investment Institute among financial firms pointing to possible relief ahead.

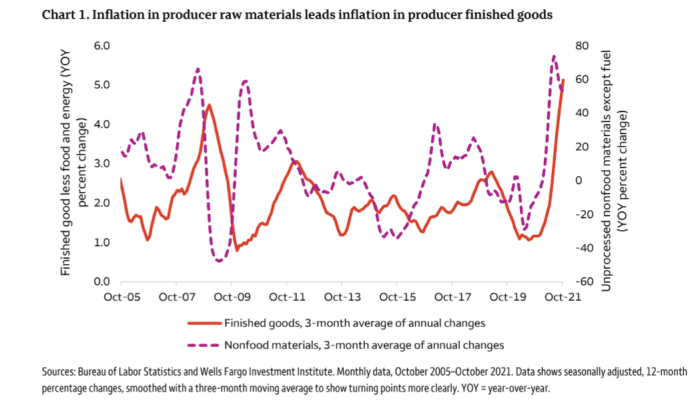

“Inflation is in the process of peaking out,” Scott Wren, senior global market strategist at Wells Fargo Investment Institute, told MarketWatch in a phone interview. The recent decline in prices of raw materials for finished goods may be a sign of that, he said, as the ups and downs in costs of finished goods typically follow raw-materials prices with a lag.

Raw-materials prices may have “peaked out,” Wren said, referencing a chart in a Wells Fargo Investment Institute report this week (see below).

WELLS FARGO INVESTMENT INSTITUTE REPORT DATED NOV. 15 2021

Price changes in raw materials tend to predict consumer inflation 12 months ahead, according to the report, which was co-authored by Wren and Paul Christopher, head of global market strategy at Wells Fargo Investment Institute.

“If the broad trend continues, we expect consumer inflation to slow somewhat by midyear and materially by year-end 2022,” Wren and Christopher wrote. “Lumber, copper, and soybean prices, for example, are significantly lower than they were earlier in the year and holding.”

Read: Why investors should buy the dip in copper over the next 3 months amid a commodity ‘supercycle’

In futures trading Wednesday, December copper HGZ21, -3.42% fell 2% to $ 4.266 a pound. That’s below price levels of more than $ 4.70 seen in mid-October and May for the industrial metal, but still above the beginning of 2021 when copper was quoted below $ 4 a pound.

U.S. inflation jumped in October, pushing the year-over-year rate to a 31-year high of 6.2%, as measured by the consumer-price index. Meanwhile, the rise in the producer-price index in October showed the 12-month pace of wholesale inflation was high — but flat — at about 8.6%.

While the higher cost of living, as measured by the CPI index, may remain elevated into next year, Wren said that it’s probably in the “process of topping out.” Wells Fargo is now estimating that the pace of inflation may decelerate to around 4% next year, he told MarketWatch.

Related: ‘WIN’ buttons look like a terrible inflation hedge, but here’s what they say about the battle against rising prices

In another sign that inflation could ease, “from the suppliers’ side, factories in Asia are reopening and some transportation costs are peaking,” Wren and Christopher wrote in the Wells Fargo note.

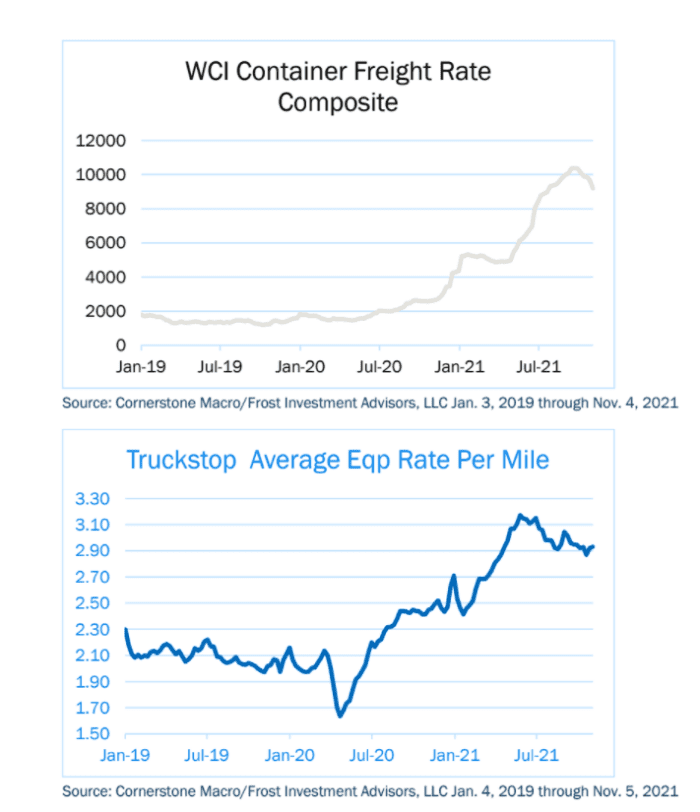

Frost Investment Advisors also pointed to declining shipping costs in a recent report.

“We’re seeing some early signs that the trade bottlenecks may be easing a bit,” Frost said in its note on market news and views for the week of Nov 8. “While the number of ships anchored off California waiting to unload is still very high, freight rates appear to be moderating, both for containers and for trucking.”

FROST INVESTMENT ADVISORS REPORT, WEEK OF NOV. 8, 2021

While rates remain “quite high,” Frost said “any improvement is welcome.”

The course of inflation is important for investors to watch as it’s “one of the most prominent risks to portfolios today,” according to the Wells Fargo report. “We believe inflation will moderate in 2022, but we expect the path to lower inflation to begin with higher inflation in the front half of the year.”

For tactical positioning over the next year and a half that considers “above-average inflation,” Wren said by phone that “we want to lean toward recovery” and into cyclical sectors such as industrials, commodities and financials. As for the energy sector, Wells Fargo recently shifted to “even” weight from overweight, he said, explaining that energy has seen “a pretty outsized run.”

“So we took a little money off the table there,” he said.

The S&P 500 index’s energy sector SP500EW.10, -2.45% fell sharply Wednesday, but still has gained more than 50% so far this year, FactSet data show.

Commodities and cyclical equity sectors should “outperform with growth and inflation near a peak,” according to the Wells Fargo note. “The sectors we prefer to avoid tactically are those that we expect to underperform under a strong economy, rising interest rates, and inflation that has not yet peaked. One important example is long-term fixed income.”

Wren and Christopher also cited their “unfavorable rating on short-term fixed income while investors price an eventual Federal Reserve response to inflation.”

Read: Treasurys remain mixed, with 10-year rate little changed, as investors await Fed speakers

Although the Fed has maintained its view that elevated inflation will be “transitory,” LPL Financial’s asset allocation strategist Barry Gilbert said in a research report this week that its peak may still be ahead amid “supply chain challenges and tight labor markets combined with high demand as the global economy bounces back” in the pandemic.

“But market participants don’t need to wait until CPI is back under 3% to feel a sense of relief,” wrote Gilbert. “It would be enough to know that we’re past the peak, something that might not happen until 2022.”

Beyond supply chain concerns and energy and commodity prices, Gilbert said investors should watch for signs that housing costs may be stabilizing.

“Shelter excluding energy costs, essentially housing costs and rents, makes up about 1/3 of CPI and just over 40% of core CPI (excluding food and energy),” he wrote. “Housing costs have jumped the last three months and housing inflation is a concern — both because it represents such a high proportion of consumer spending and because it tends to be relatively sticky.”

He suggested that “consecutive monthly readings near 0.3% would be a good sign that housing costs have stabilized,” even though at that level costs may continue to climb on a year-over-year basis in the first several months of 2022. “But if rising housing costs and consumer expectations make higher inflation stickier, we could see the first rate hike pulled into 2022,” Gilbert said.

Read:Federal Reserve should ‘tack in a more hawkish direction,’ Bullard says