The pandemic has driven changes in behavior that are important to investors, as they underline growth opportunities that are likely to extend for many years, according to Alex Ely of Macquarie Asset Management.

Ely manages the $ 5.1 billion Delaware Smid Cap Growth Fund DFDIX, +1.82%, which is rated five stars (the highest rating) by Morningstar. There’s more information about the fund’s performance below.

The Delaware Smid Cap Growth Fund typically holds about 35 stocks of small-cap and mid-cap companies that Ely believes are well-positioned to continue growing quickly as they take advantage of disruptive trends.

During an interview, Ely said the pandemic was a “tipping point” for “massive disruptions through innovation,” including remote work and video conferencing in place of business travel, to name two examples. He sees the digital transitions as being deflationary because of efficiency improvements, and believes these trends will mitigate inflation over the long term.

But when selecting stocks, the growth opportunities from disruptions in the economy that Ely identifies don’t necessarily spring from digital innovation. He described a “pure growth approach” that avoids overconcentration in any sector or industry, and named four companies as examples held by the Delaware Smid Cap Growth Fund:

- Trex Co. TREX, -0.69% is the world’s largest supplier of composite materials used in place of wood, including decking, fencing and railing. Manufacturing is done in the U.S. and the company says it is “one of the largest recyclers of waste polyethylene plastic film in North America.” Trex’s primary market is residential, but you may have seen its faux wood products used at outdoor restaurants, parks or docks.

- SiteOne Landscape Supply Inc. SITE, -0.97% is “wrapping up the fragmented business of landscape distribution — dirt, topsoil, trees and gravel,” according to Ely. This is an obvious play in a country that is very much on the move, as technological changes eliminate the need for some people to live within commuting distance of offices in large cities. SiteOne’s acquisition strategy in the highly fragmented landscape supply industry offers a long runway for growth and efficiency improvement, Ely said.

- TopBuild Corp. BLD, -0.50% installs insulation and distributes other building products. With housing demand so high in the U.S., the company’s ability to install insulation at low cost makes it appealing to home builders of various sizes.

- Yeti Holdings Inc. YETI, +4.11% is what Ely calls a “lifestyle” brand. It makes products for use in outdoor and recreational activities. About half of the company’s sales are made directly to consumers through its website, according to Ely, who called the online sales momentum “massively deflationary.”

“Everything in the portfolio has revenue growth of at least 10%,” Ely said. Looking ahead, here are consensus sales estimates for the four companies’ sales (in millions of dollars) through 2023, among analysts polled by FactSet.

| Company | Est. sales – 2021 | Est. sales – 2022 | Est. sales – 2023 | Two-year est. sales CAGR |

| Trex Co. TREX, -0.69% | $ 1,190 | $ 1,377 | $ 1,542 | 13.8% |

| SiteOne Landscape Supply Inc. SITE, -0.97% | $ 3,403 | $ 3,680 | $ 3,943 | 7.6% |

| TopBuild Corp. BLD, -0.50% | $ 3,449 | $ 4,518 | $ 4,924 | 19.5% |

| Yeti Holdings Inc. YETI, +4.11% | $ 1,410 | $ 1,642 | $ 1,878 | 15.4% |

| Source: FactSet | ||||

Calendar-year estimates are used because some companies have fiscal years or quarters that don’t match the calendar. Comparable numbers for the fund’s benchmark, the Russell 2500 Growth Index R25IG, -0.65%, aren’t available. However, the estimated sales CAGR from 2021 through 2023 are 7.7% for the iShares Morningstar Small-Cap Growth ETF ISCG, -0.69% and 8.9% for the iShares Morningstar Mid-Cap Growth ETF IMCG, -0.13%, according to FactSet.

A note about outperformance

There is a tendency in the money management industry for investors to chase performance — that is, to move money into a fund this year that performed well last year. That sort of move can backfire, as it can take many years for an equity growth strategy to play out. If you keep chasing performance, regardless of the portfolio managers’ strategies, you might keep buying high and selling relatively low.

It is also important to consider that the calendar year is arbitrary — it happens to end on Dec. 31 and it happens to take the Earth 365 days to go around the sun.

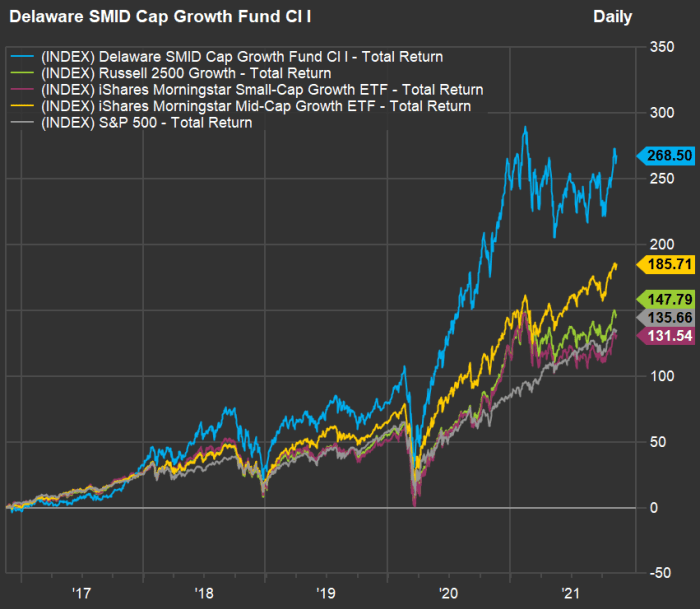

The long-term performance of the Delaware Smid Cap Growth Fund against its benchmark has been excellent. But in any one year, it might trail the broad market. First, look at a five-year chart showing the total return of the fund’s institutional shares against the Russell 2500 Growth Index, the two iShares ETFs and, for reference, the S&P 500 Index SPX, -0.00% (all with dividends reinvested):

FactSet

That is an impressive five-year showing, which explains Morningstar’s five-star rating for the fund, within the investment research firm’s “mid-growth” category.

Now look at the fund’s performance for full years 2017 through 2020 and year-to-date through Nov. 12, 2021:

| Fund or index | Total return – 2021 through Nov. 12 | Total return – 2020 | Total return – 2019 | Total return – 2018 | Total return – 2017 |

| Delaware Smid Cap Growth Fund – Institutional | 6% | 94% | 36% | 0% | 35% |

| Russell 2500 Growth Index | 14% | 40% | 33% | -7% | 24% |

| iShares Morningstar Small-Cap Growth ETF | 7% | 43% | 28% | -7% | 25% |

| iShares Morningstar Mid-Cap Growth ETF | 19% | 46% | 36% | -4% | 26% |

| S&P 500 Index | 26% | 18% | 31% | -4% | 22% |

| Source: FactSet | |||||

It turns out that 2021 hasn’t been a good year for small-cap stocks or for the Delaware Smid Cap Growth Fund.

“Growth is where it’s at. Long-term thinking is the only way to approach it,” Ely said.

Top holdings

Here are the 10 largest holdings (of 33) of the Delaware Smid Cap Growth Fund as of Oct. 31:

| Company | Share of portfolio |

| Progyny Inc. PGNY, +2.87% | 6.3% |

| Bill.com Holdings Inc. BILL, -2.66% | 5.4% |

| Yeti Holdings Inc. YETI, +4.11% | 5.1% |

| Inari Medical Inc. NARI, -4.63% | 5.0% |

| TopBuild Corp. BLD, -0.50% | 4.8% |

| SiteOne Landscape Supply Inc. SITE, -0.97% | 4.7% |

| Trex Co. TREX, -0.69% | 3.7% |

| Etsy Inc. ETSY, +0.21% | 3.7% |

| Invitae Corp. NVTA, -2.14% | 3.7% |

| Trade Desk Inc. Class A TTD, +5.10% | 3.5% |

| Source: Macquarie Asset Management | |

Click on the tickers for more about each company. Click here for Tomi Kilgore’s detailed guide to the wealth of information for free on the MarketWatch quote page.