The Nifty 50 is expected to range between 18,000 and 18,400 in the F&O expiry week, experts said, and all eyes are on the banking sector.

Sunil Shankar Matkar

October 25, 2021 / 10:29 AM IST

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

Bears stalled the bull run that had taken the stock markets to record high levels, after which the benchmark indices declined over four consecutive sessions, resulting in a 1.2 percent loss during the week ended October 22 and a fall of 2.6 percent from the all-time high October 19.

Midcap and smallcap counters, which had rallied quite sharply, also fell, denting overall market sentiment. The Nifty Midcap 100 and Smallcap 100 indices dropped over 4 percent and 5 percent, respectively, last week.

The Nifty 50 would have dropped below the 18,000 mark last week if banks had not advanced. The Nifty Bank index crossed 40,000, gaining 2.5 percent last week. The Nifty 50 is expected to range between 18,000 and 18,400 in the F&O expiry week, experts said.

“Two major indices (Nifty 50 and Nifty Bank) are showing complete divergence, so going forward, it would be interesting to see whether the Bank Nifty’s strength lifts the Nifty higher or vice versa. Hence, all eyes are on the banking space going forward because a follow-up move from hereon will certainly lift the overall sentiments in the market,” said Sameet Chavan, chief analyst-technical and derivatives, at Angel One.

He said 18,060-18,000 are considered crucial support levels for the Nifty 50, whereas on the flipside, 18,260-18,400 would be seen as the immediate hurdles.

“Since the weekly chart of Midcap index is showing a bearish formation, which can be termed as ‘Engulfing’ candle, we advise traders not to create aggressive longs in high beta counters,” he added. “Below 18,000 for Nifty, the near-term uptrend gets negated and then we are up for some correction, which is overdue.”

Here are 10 buy calls for next 3-4 weeks:

Expert: Nagaraj Shetti, Technical Research Analyst at HDFC Securities

ABB India: Buy | LTP: Rs 1,909.30 | Stop Loss: Rs 1,765 | Target: Rs 2,110 | Return: 10.5 percent

After being largely rangebound for seven weeks, the stock price witnessed a sustainable upside bounce… The stock is currently attempting to stage an upside breakout from the sideways consolidation at Rs 1,930-1,940 levels.

A larger degree of higher bottoms is intact on the weekly chart and the recent swing low of Rs 1,790 could be considered as a new higher bottom. Volumes have started to expand as the stock price shows an upside breakout.

Weekly 14 period RSI (relative strength index) has turned up from near 60-62 levels, which signals further strengthening of upside momentum. Buying can be initiated in ABB at CMP, add more on dips down to Rs 1,825, wait for the upside target of Rs 2,110 in the next 3-4 weeks. Place a stop-loss of Rs 1,765.

Triveni Turbine: Buy | LTP: Rs 179 | Stop Loss: Rs 167 | Target: Rs 198 | Return: 10.6 percent

A sustainable up-move of last week indicates chances of an upside breakout at Rs 185-190 levels. Volumes have started to expand and the weekly 14 period RSI shows positive indication.

One may buy Triveni Turbine at CMP, add more on dips down to Rs 173 and wait for the upside target of Rs 198 in 3-4 weeks. Place a stop-loss of Rs 167.

IFB Industries: Buy | LTP: Rs 1,297.05 | Stop Loss: Rs 1,220 | Target: Rs 1,445 | Return: 11.4 percent

After minor weakness with rangebound action in the past month, the stock witnessed a sharp upside breakout at Rs 1,250 last week and closed higher.

The up-move emerged from near a key support of 10-week EMA (exponential moving average) at Rs 1,160 levels. Volumes have expanded with the upside breakout in the stock price.

The weekly ADX/DMI (Average Directional Index/Direction Movement Index) signals chances of further strengthening of the upside momentum in the stock.

One may buy IFB Industries at CMP, add on dips down to Rs 1,260 and wait for a target of Rs 1,445 in 3-4 weeks. Place a stop-loss of Rs 1,220.

Expert: Shrikant Chouhan, Head – Equity Research (Retail) at Kotak Securities

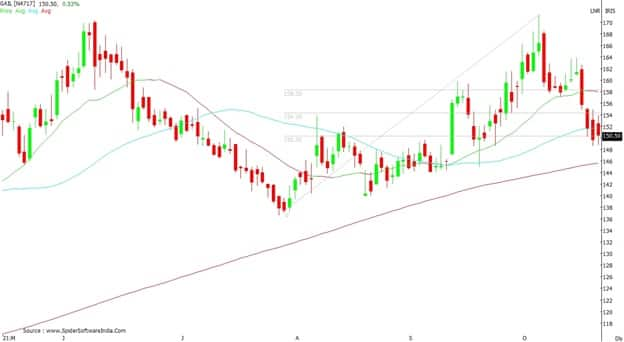

GAIL India: Buy | LTP: Rs 150.50 | Stop Loss: Rs 145 | Target: Rs 160-165 | Return: 6.3-9.6 percent

After a robust rally, the stock witnessed a technical correction from the Rs 170 resistance level. So far this month, it corrected over 10 percent from the Rs 170 level. However, the medium-term formation is positive and likely to continue.

Currently, it trades near an important retracement level and the texture of the chart suggests a strong possibility of a fresh rally. For positional traders, the 200-day SMA (simple moving average) or Rs 145 would be the sacrosanct level, above which the reversal wave will continue to Rs 160-165.

Tech Mahindra: Buy | LTP: Rs 1,517.45 | Stop Loss: Rs 1,465 | Target: Rs 1,620 | Return: 6.8 percent

After a short-term price correction, the stock has formed a double-bottom near the 50-day SMA and reversed sharply. Despite tepid market conditions, Tech Mahindra maintained a strong momentum throughout the week.

For trend-following traders, Rs 1,465 or the 20-day SMA, would be the key support level to watch for above which the same uptrend formation is likely to continue up to Rs 1,600-1,620.

HDFC: Buy | LTP: Rs 2903.95 | Stop Loss: Rs 2,800 | Target: Rs 3,125 | Return: 7.6 percent

After a strong uptrend rally, the stock hovered in the range of Rs 2,850 to Rs 2,700. Post a short-term correction, the stock took support near the 50-day SMA and reversed sharply.

On the daily and weekly charts, it is in a promising range-breakout formation and after a long time closed above Rs 2,900, which is broadly positive.

Expert: Vijay Dhanotiya, Lead of Technical Research at CapitalVia Global Research

Coromandel International: Buy | LTP: Rs 824.25 | Stop Loss: Rs 760 | Target: Rs 1,000 | Return: 21.3 percent

The stock has been following an uptrend. We can see a channel pattern in the daily chart and trade in the range of the channel lines. The stock has taken support at the 55- and 200-day EMA line.

The stock traded around Rs 864 and we can expect it to reach Rs 1,000. We have observed indicators like EMA and MACD (moving average convergence/divergence) indicating the momentum in the stock is likely to continue.

We recommend a ‘buy’ in Coromandel above Rs 825 with a target of Rs 1,000. Investors are advised to maintain a stop-loss of Rs 760.

UPL: Buy | LTP: Rs 704.35 | Stop Loss: Rs 500 | Target: Rs 900 | Return: 27.8 percent

UPL has been rising from the trendline support of the 200 EMA line in the daily charts. We expect bullish sentiment in the stock from this support level.

The RSI suggests momentum in the stock will likely continue and we recommend a ‘buy’ in UPL above Rs 705 with a target of Rs 900 and a stop-loss of Rs 500.

Shriram Transport Finance: Buy | LTP: Rs 1,518.60 | Stop Loss: Rs 1,150 | Target: Rs 1,900 | Return: 25.1 percent

Shriram Transport is following a bullish trend in the daily chart. A flag pattern formation confirms continuation of the trend. The stock has taken support of the 55- and 200-day EMA line and had taken a reversal from the 200 EMA line near Rs 1,311.

The MACD indicates the momentum in the stock is likely to continue. We recommend a ‘buy’ in Shriram Transport above Rs 1,519 with the target of Rs 1,900. Investors are advised to maintain a stop-loss of Rs 1,150.

Expert: Mehul Kothari, AVP – Technical Research at Anand Rathi Shares and Stock Brokers

Axis Bank: Buy | LTP: Rs 816.70 | Stop Loss: Rs 790 | Target: Rs 910 | Return: 11.4 percent

The Nifty Bank index has been an outperformer for quite a few sessions. Axis Bank is on the verge of a multi-year breakout. The breakout will get confirmed above the Rs 828 mark and once that is taken we expect a fast upside momentum in the stock.

Traders are advised to buy the stock above Rs 828 with a stop-loss of Rs 790 for an upside target of Rs 910 in the coming 3-4 weeks.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.