Fundstrat Global Advisors is one of the more bullish outfits around, and the investment firm is now even more optimistic about the stock market.

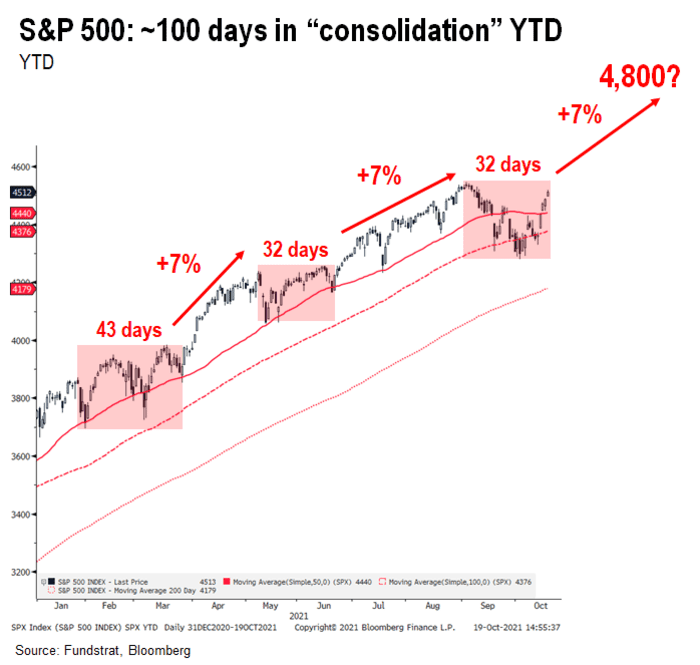

The firm raised its year-end price target for the S&P 500 SPX, +0.74% to 4,800 from 4,700, which would be a 6% gain from Tuesday’s close of 4,519.63.

Strategists led by Tom Lee said such a rise is consistent with other rallies in 2021 following consolidations.

The year-end seasonal pattern is strong after October, they noted. Bitcoin BTCUSD, -0.27% rallying to new highs is a signal of a strong risk-on environment. The strategists also argue COVID-19 is tracking better than consensus fears, and economic resilience remains strong.

“The future is uncertain. And financial markets are inherently unpredictable. Thus, one should view our S&P 500 target as merely a directional observation. That said, we believe a strong risk-on environment is underway. We do not think consensus is that bullish. We already know that investors got very pessimistic in September,” they said.

The improvement in market technicals, such as the clearing of the 50-day moving average, “is actually suggesting that underlying trends are getting stronger.”

The price-to-earnings ratio of 21.9 times 2022 earnings isn’t cheap per se, but is actually cheaper than the 23 price-to-yield multiple that high-yield bonds JNK, +0.07% have.

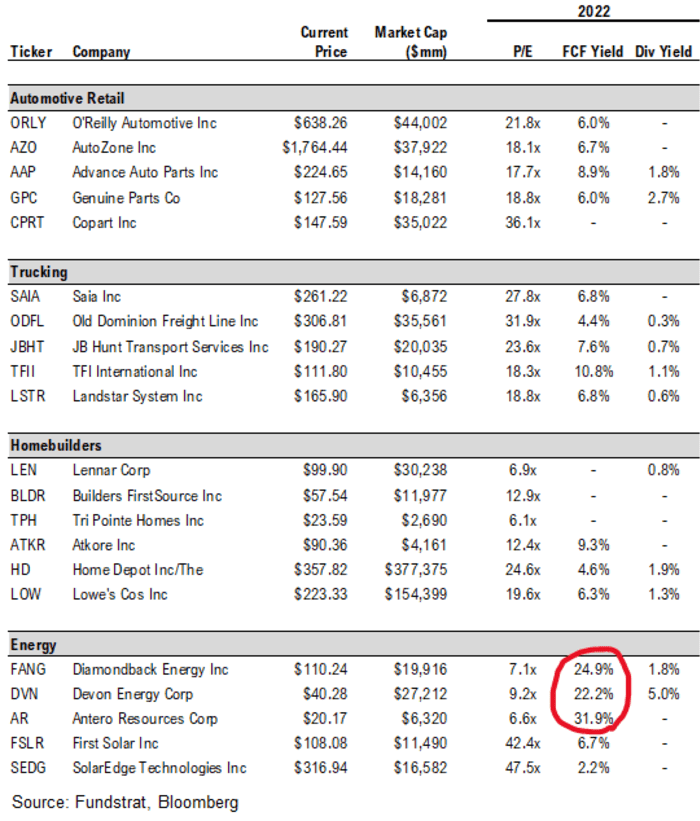

More specifically, the firm said automotive retail and trucking will benefit from a pro-cyclical environment and are reflationary trades as well. They highlighted 22 stocks from those sectors including O’Reilly Automotive ORLY, -0.01% and Saia SAIA, -1.05%, as well as homebuilders and energy, they see as technically the strongest.