Want to improve your investment performance? Then cut through the noise and take a moment to learn the essentials from among the best in the business.

In this spirit, I recently caught up with Neal Kaufman, who manages the Baron Health Care Fund BHCFX, +0.14%.

In its short three-year lifespan, the mutual fund is shooting out the lights. The fund crushes its S&P 1500 Health Care index benchmark and health-care category by more than 12 percentage points, annualized, over the past three years, according to Morningstar.

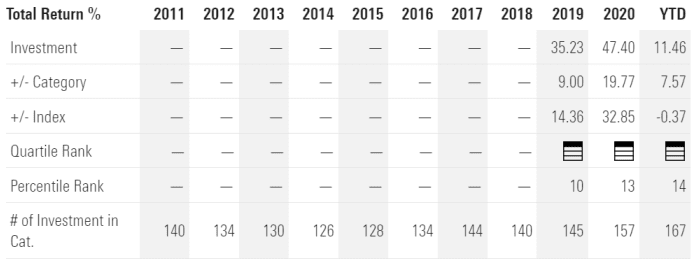

Here’s a table from Morningstar showing calendar-year returns and rankings through Oct. 11.

How does Kaufman get those returns? He cites five principles that guide him in stock selection. Here’s a review, with company examples.

#1. Look for open-ended growth opportunities

One of the core tenets at New York-based Baron Capital is to invest in companies selling into large and expanding markets, says Kaufman.

That’s the case with a medical-device company called DexCom DXCM, -1.81%. It offers continuous glucose monitors for diabetics. The company’s G6 monitor is convenient because it eliminates the need for finger sticks. The monitor sends readouts to smartphones, providing alerts of dangerously high or low blood sugar levels.

Unfortunately, diabetes is on the rise, in part because of the obesity epidemic. By 2045, the number of people in the world with diabetes will increase over 50%, compared to 2019, to 700 million, predicts the International Diabetes Federation. Diabetes is the seventh-leading cause of death by disease in the United States, says the Centers for Disease Control and Prevention. DexCom is in the process of getting regulatory approval for an upgraded version of its device called the G7.

#2. Ride the secular tailwinds

In investing, “secular” refers to business trends that aren’t vulnerable to changes in the economic cycle. Catching secular trends is another core investing principle at Baron Capital. There are lots of secular trends in health care. One is the adoption of minimally invasive surgery.

This is preferable because it reduces blood loss during surgery, and pain levels during recovery. Baron Health Care owns two companies in this space: Intuitive Surgical ISRG, +0.17%, which sells robots that help with surgery, and Edwards Lifesciences EW, +0.53%, which offers a system that helps doctors perform less invasive aortic valve replacement.

#3. Invest in companies with a durable competitive advantage

This one comes up so often among outperforming managers, from Warren Buffett on down, that it’s a “must have” on your list of qualities to look for at companies.

Protective moats give companies coveted pricing power. And, of course, by definition, they protect market share. Companies attain moats via strong brands, superior technology, leadership in a sector, a large installed base that elevates switching costs, or services that benefit from the “network effect.” This means the more people use a service, the more valuable it becomes to everyone in the network. Think social media platforms.

For moats, Kaufman cites Guardant Health GH, -2.53%, a market leader in liquid biopsies, or the use of genetic sequencing to detect signs of cancer in blood samples. Guardant earns a moat because of its technology platform, regulatory approvals and solid reimbursement profile among insurers. Intuitive Surgical is another example, because of its innovative technology, large installed base and regulatory approvals.

Also consider Schrodinger SDGR, +0.64%, which offers software that interprets the physics of drug molecules to predict how they might tweak body chemistry to treat diseases.

“This is traditionally done by medicinal chemists,” says Joshua Riegelhaupt, assistant portfolio manager at the Baron Health Care Fund. “This is expensive and it takes years.”

Using Schrodinger software, researchers can screen hundreds of compounds to find a short list of potential winners, reducing research time and costs.

By last year, all of the top 20 pharmaceutical companies licensed Schrodinger software. This vast installed base and Schrodinger’s technological edge give it a moat. The company says its approach can be used in research in many other areas, including aerospace, energy, semiconductors and electronic displays.

#4. Invest for the long term

Stocks never go straight up. Not even the shares of quality companies. When controversy and turbulence strike, a long-term investing horizon helps you stick with a name and avoid getting shaken out. Anyone who followed the early controversies and twists and turns at Tesla TSLA, +3.02% may remember Ron Baron kept an outsized position in various Baron Funds even as the electric-vehicle company was vilified. Tesla went on to be a “10-bagger,” having risen 10-fold.

“We’re not investing in companies based on what could happen in the next quarter or two. We are looking out five years,” says Kaufman. “There will be setbacks. Having long-term perspective helps us.”

Holdings that are worthy of purchasing after selloffs include Guardant Health, which is down because of rumors it might make an acquisition. Another is Arrowhead Pharmaceuticals ARWR, -1.00%, as investors may have misinterpreted study data and misjudged biotech’s weakness this year.

#5. Invest in recurring revenue

The Baron Health Care Fund has big exposure to proverbial “picks and shovels” plays in health care. These are the companies that have predictable revenue because they offer equipment, chemicals, software and other products that help big pharma and biotech companies research therapies.

“We like investing in companies where we can have confidence in the recurring revenue, and model the margins and what their earnings can be,” says Kaufman. The steady nature of these businesses also offsets the volatility among biotech names.

Examples of solid recurring revenue companies in Kaufman’s fund include: Thermo Fisher Scientific TMO, +0.87%, Bio-Techne TECH, +0.03% and Mettler-Toledo International MTD, +1.32%, all of which sell instruments and reagents used in research and diagnostics; Icon ICLR, -0.01%, which offers clinical research services; and Schrodinger, the company that offers analytical software used in drug research.

Michael Brush is a columnist for MarketWatch. At the time of publication, he owned ARWR. Brush has suggested DXCM, TSLA, ARWR, TMO in his stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks.