This article is reprinted by permission from NextAvenue.org.

We’ve all known that COVID-19 has taken a cruel toll on the health of older Americans. Now, a new study from the Commonwealth Fund foundation finds that the coronavirus has been equally brutal financially.

In fact, the 2021 International Health Policy Survey of Older Adults shows Americans 65+ have been facing greater economic hardship and health care disruption than people their age in 10 other wealthy nations. In some cases, far greater.

The findings were released a day after the U.S. Census reported that median household income for Americans 65+ fell by 3.3% from 2019-20. It’s now roughly $ 46,400, said David Waddington, chief of social, economic and housing statistics at the Census. (The median household income dropped by 2.6% for those under 65).

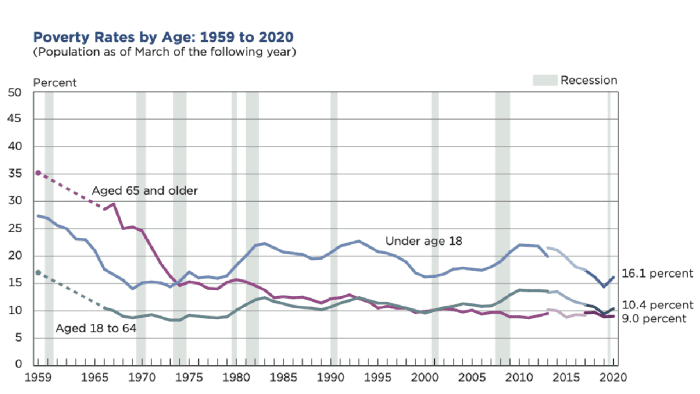

Some 9% of Americans 65 and older are now living in poverty. Half of Medicare beneficiaries have incomes below $ 30,000, according to the National Council on Aging.

A poor showing for U.S. for ‘retiree well-being’

Another new international survey, from Natixis Investment Managers, named the U.S. No. 17 in the world for “retiree well-being.” (Iceland was No. 1 for the third year running.) America’s rank is down a spot from last year. This survey’s respondents — individuals with at least $ 100,000 in investible assets — said COVID-19 has made retiring securely more difficult.

In addition, the Commonwealth Fund President Dr. David Blumenthal said during a call with the media, in the U.S., “Black and Hispanic older adults suffered disproportionately from the pandemic’s economic fallout.”

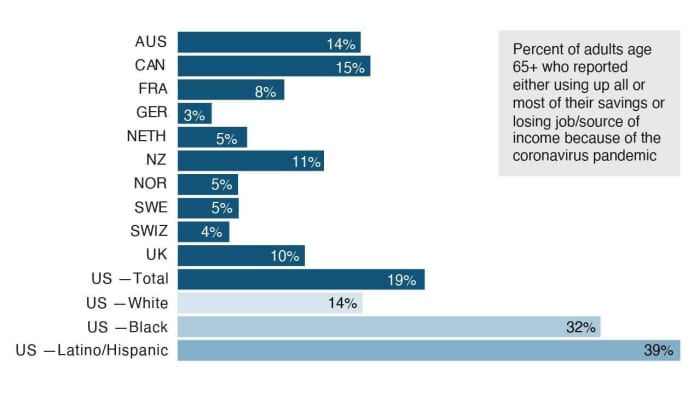

The Commonwealth Fund surveyed 18,477 adults 65+ from March to June 2021 in Australia, Canada, France, Germany, the Netherlands, New Zealand, Norway, Sweden, Switzerland, the United Kingdom and the U.S. Among its stark findings:

Nineteen percent of older Americans reported they used up their savings or lost their main source of income because of the pandemic. That’s four to six times the rate in Germany, Switzerland, the Netherlands and Sweden.

Nearly 4 in 10 older Hispanic adults and 1 in 3 older Black adults said they experienced economic difficulties related to the pandemic. By contrast, just 14% of older white adults said so.

Source: The Commonwealth Fund

Thirty-seven percent of older Americans with two or more chronic conditions reported pandemic-related disruptions in their health care. Compared with all the other countries in the survey, they were the most likely to have medical appointments canceled or postponed due to the pandemic. In Germany, for instance, just 11% of people 65+ reported such results.

The Commonwealth Fund says 68% of its U.S. respondents reported having two or more chronic conditions; 42% had three or more — significantly higher rates than in the other 10 countries and slightly lower than the percentages for Medicare beneficiaries in the U.S. overall.

Twenty-three percent of Americans 65+ who needed help with activities of daily living during the pandemic — like eating or getting dressed — didn’t receive such help because caregiving services were canceled or very limited. Only people 65 and older in Canada and the United Kingdom had things worse (31% and 30% respectively).

All of these findings are despite our nation spending the highest percentage of its gross domestic product overall on health care. And despite the vast majority of Americans 65+ having health insurance, either through traditional Medicare, private Medicare Advantage plans or Medicaid.

In fact, Sharon Stern, assistant division chief for employment statistics at the Census said on Tuesday, Sept. 14 that its new figures showed just 1% of Americans 65+ lack health insurance. The percentage who are uninsured is slightly higher than 0.9% in 2018.

Don’t miss: Think you’ll stop working in your 60s? Get real

Economic challenges, despite health insurance

Still, said Reginald D. Williams II, the Commonwealth Fund’s vice president for international health policy and practice innovations, “At the end of the day, despite having health insurance, older adults [in the U.S.] face higher economic challenges compared to those in other countries.”

Very few older Americans surveyed said they weren’t planning to get COVID-19 vaccinations. “The vaccination story overall was pretty positive,” said Williams.

Blumenthal noted that one of the advantages of comparing just Americans 65+ with those of a similar age in other countries is that Medicare is the closest the U.S. comes to having the kind of national health insurance the other nations have for all their residents.

He called Medicare a “critical lifeline” for Americans 65+, but also said it is a “flawed program” with significant gaps for vulnerable beneficiaries.

Because of those gaps, Blumenthal said, some on Medicare have sizable out-of-pocket health care expenses. “We could make Medicare more affordable by putting caps on out-of-pocket costs and by covering more health services, including dental, vision and hearing,” he noted.

U.S. Census

Sadly, almost half of all Medicare beneficiaries didn’t see a dentist in the past year or don’t have dental coverage, the National Council on Aging reports.

See: Hearing aids could soon cost less than $ 1,000 and be bought at the drugstore

Legislation that President Joe Biden has proposed and is under discussion by Congress would add dental, vision and hearing coverage to Medicare. The vision coverage would begin in October 2022, the hearing coverage in October 2023 and the dental coverage in January 2028, according to the National Council on Aging’s Howard Bedlin.

Proposals for broadening Medicare coverage

“This is history in the making,” said National Council on Aging Chair-Elect Kathy Greenlee, the former Assistant Secretary for Aging under President Barack Obama, speaking about the potential for broadening Medicare during an online panel discussion Wednesday.

But whether any of those Medicare reforms will become law is far from certain. Already, medical and dental lobbying groups are fighting the proposed extra coverage, fearing lower reimbursements to physicians and dentists.

Read: Social Security is the nation’s most valuable program. Congress needs to fix it

Some Republicans believe the added coverage would be too costly for the U.S. government. A 2019 proposal to add dental, vision and hearing to Medicare was estimated to cost $ 358 billion over 10 years, according to the Brookings Institution.

The Commonwealth Fund’s report concludes with this call to action: “The U.S. has the means to take steps to reduce this burden on older Americans and to ensure that their health needs are met.”

The foundation’s researchers say the U.S. can do more to help older adults meet their care needs by: improving access to telehealth services and integrating them fully with regular primary care; further improving the economic security of older Americans and addressing the racial and ethnic inequities the pandemic has exacerbated.”

Richard Eisenberg is the Senior Web Editor of the Money & Security and Work & Purpose channels of Next Avenue and Managing Editor for the site. He is the author of “How to Avoid a Mid-Life Financial Crisis” and has been a personal finance editor at Money, Yahoo, Good Housekeeping, and CBS Moneywatch.

This article is reprinted by permission from NextAvenue.org, © 2021 Twin Cities Public Television, Inc. All rights reserved.

More from Next Avenue: