A much bigger overnight parking spot for Wall Street cash is about to open up, as market participants wait for the U.S. debt-ceiling clash to play out.

Starting Thursday, banks, money-market funds and other financial firms can park up to $ 160 billion overnight each at the Federal Reserve Bank in New York’s reverse repurchase program (RRP), double what was allowed under the earlier cap.

“Investors, such as money market funds, are able to use the RRP as a ‘safe harbor’ for the cash,” Joseph Abate, interest rate strategist at Barclays wrote, in a note Wednesday.

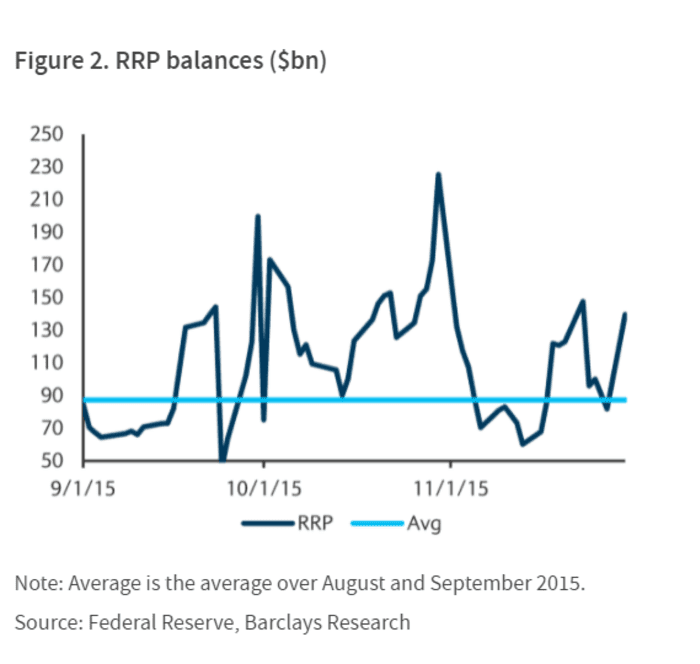

He also noted (with a chart) that ahead of the Nov. 3, 2015 debt ceiling expiration date that “balances in the Fed’s collateralized program surged,” rising above their then-average of $ 90 billion.

Reverse repos surged during 2015 debt ceiling fight

Markets have been awash in cash as the Federal Reserve and lawmakers in Washington flooded the U.S. economy during the pandemic with trillions of dollars in stimulus.

The Fed’s reverse repo program, which pays users 5 basis points, has emerged as a popular place for Wall Street to park cash overnight, particularly with the dwindling Treasury-bill market and debt-ceiling suspension expiring earlier this summer.

Now, with a potential government shutdown looming in October without a debt-ceiling deal, investors have begun to focus on a raft of issues that could rattle markets in the year’s final three months.

Read: Why the debt limit fight makes Washington a stock-market ‘wild card’

Jim Vogel, interest rate strategist at FHN Financial in Memphis, said the Fed’s larger counterparty caps can be partially attributed to the debt-ceiling limit, but also to “fiscal policy uncertainty” that may continue to disrupt or linger after the bill-market returns in size, once the debt ceiling standoff has been resolved.

See: Here’s what’s in the bipartisan infrastructure bill that the House aims to pass — and how it’s paid for

“Finally, they have to start thinking about year-end volume,” Vogel told MarketWatch, speaking to the liquidity crunch and volatility that can crop up as each year winds down.

Demand for the Fed facility on Wednesday touch a new record of $ 1.28 trillion, according to Fed data.

“To accommodate anticipated demand created by debt ceiling anxiety, the Fed doubled the counterparty size cap on the RRP — to $ 160bn — at this week’s FOMC meeting,” Abate wrote.

“In addition to being a safe harbor, cash held in the RRP is quickly available for money funds to redeploy into the bill market once the debt ceiling is lifted.”

Stocks SPX, +0.95% booked their best daily gain in about two months on Wednesday, after Federal Reserve Chairman Jerome Powell and other rate-setting officials opted not yet to start removing its pandemic support for markets. Yields on the 10-year Treasury TMUBMUSD10Y, 1.339% rose less than a basis point to 1.332%.