Specialty chemicals company Ami Organics will launch its initial public offering (IPO) on September 1. This would be the second IPO to open on the same date after Vijaya Diagnostic Centre.

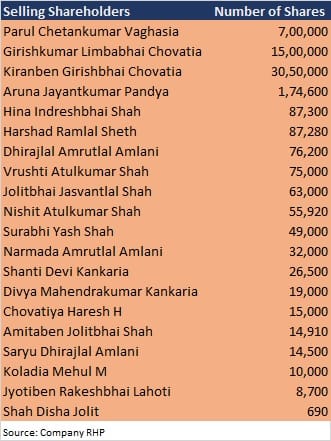

The public issue comprises a fresh issue of Rs 200 crore and an offer for sale (OFS) of 60,59,600 equity shares by selling shareholders including Parul Chetankumar Vaghasia, Girishkumar Limbabhai Chovatia, and Kiranben Girishbhai Chovatia.

The company has reduced its fresh issue size to Rs 200 crore from Rs 300 crore after fundraising of Rs 100 crore in a pre-IPO placement.

The net fresh issue proceeds will be utilised for repaying debts, and working capital besides general corporate purposes.

The price band and lot size will be announced through a press conference on August 27. The public issue will close on September 3.

To Know All IPO Related News, Click Here

The company manufactures specialty chemicals that are used towards the development and manufacturing of advanced pharmaceutical intermediates for regulated and generic active pharmaceutical ingredients (APIs) and New Chemical Entities (NCE), and key starting material for agrochemical and fine chemicals. It is one of the major manufacturers of pharma intermediates for certain key APIs, including Dolutegravir, Trazodone, Entacapone, Nintedanib, and Rivaroxaban.

It has developed and commercialised over 450 pharma intermediates for APIs across 17 key therapeutic areas since inception and NCE. Revenue from pharma intermediates business contributed 88.41 percent to total revenue in FY21.

Along with the domestic market, the company also supplies pharma intermediates to various multi-national pharmaceutical companies in large and fast-growing markets of Europe, China, Japan, Israel, UK, Latin America, and the USA. In FY21, exports contributed 51.57 percent to total revenue.

Promoters Nareshkumar Ramjibhai Patel, Chetankumar Chhaganlal Vaghasia, Shital Nareshbhai Patel, and Parul Chetankumar Vaghasia held 45.17 percent pre-offer stake in the company. Among others, Plutus Wealth Management LLP has a 1.5 percent stake and IIFL Special Opportunities Fund – Series 7 has a 1 percent shareholding in the company.

Intensive Fiscal Services, Ambit, and Axis Capital are the book running lead managers to the issue.