The Indian equity market saw another month of consolidation in July as Nifty showed the lowest change in July in the last 10 years.

The benchmark index touched its all-time highs of 15,967 only to see profit-booking at a higher level.

Last week, we witnessed huge volatility as Nifty again slipped towards 15,500. But it bounced back sharply. Nifty gyrated in the 15,880-15,500-15,300 band and ended the week with a marginal loss of 0.49 percent.

The Bank Nifty, too, showed consolidating moves. It formed a broader range of 35,200-34,100. Overall, Bank Nifty ended the week with a marginal loss of 1 percent with an open interest ( OI ) increase of 10 percent.

Call writers are showing aggression by building more positions compared to Put writers. Nifty vital resistance stands at 15,900 with 43 lakh shares- the highest among all – followed by 15,800 with 41 lakh shares.

On the lower side, 15,700 stands as the vital support level with nearly 27 lakh shares, followed by 15,800 with an addition of 25 lakh shares.

For Bank Nifty, immediate resistance stands at 35,000 with 13 lakh shares, followed by 35,500 with 9 lakh shares.

On the downside, 34,500 with 8 lakh shares stand as the immediate support level, followed by 34,000 with 7 lakh shares.

India VIX, the fear gauge, increased nearly 7 percent from 11.76 to 12.69 over the week. India VIX is trading near the lowest level of the pre-covid crash. Cool off in the VIX has given relief to the market.

Any downtick in India VIX can push the upwards momentum in Nifty.

Looking at the sentimental indicator, Nifty OI PCR for the week has decreased from 1.146 to 1.082. Bank Nifty OIPCR over the week decreased from 0.933 to 0.793 compared to last Friday. Overall data indicates more of Call writers over put writers in Nifty and vice-versa in Bank Nifty.

Sectoral conurbation was mixed last week. Metals, IT and pharma have positively contributed nearly 43.52,38.81 and 24.47 points to the Nifty. On the other hand, oil, FMCG and power have negatively contributed 90.17, 40.85 and 32.64, respectively, to the Nifty loss of 82.19.

Nifty monthly rollover stands at 81.64 percent versus 84 percent in June series expiry while Bank Nifty rollover stands at 80.79 percent versus 84 percent in June series expiry.

JSW Steel has the highest stock-wise rollover of 92.3 percent, followed by L&T and Pidilite Industries with rollover standing at 90 percent each.

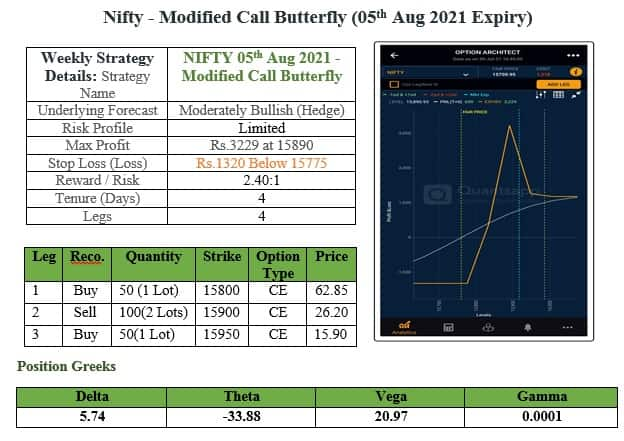

Conclusion: Considering the consolidation, this week can be approached with a low-risk strategy like Modified Call Butterfly in Nifty.

Rationale

>>Nifty witnessed Long Unwinding in OI Over the week, respectively.

>>India VIX increased to 12.69 from 11.76.

>>Nifty OIPCR decreased to 1.082 from 1.146.

>>Metals and auto sectors contributed the most to Nifty.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.