The stock market has more diverse offerings than the crypto market, but the opposite is true when it comes to the people investing in them.

Some 13% of Americans have bought or sold a cryptocurrency such as bitcoin, ether, or dogecoin in the past year, according to a report based on a survey of more than 1,000 people published Thursday at the National Opinion Research Center at the University of Chicago, an independent non-partisan research institute.

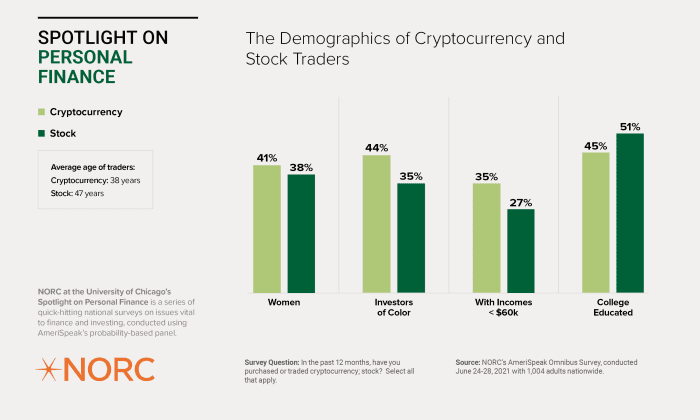

Of these investors, some 41% are women, 44% are people of color, 35% earn less than $ 60,000 a year, and 45% are college educated, according to the survey that was conducted between June 24 and June 28.

Meanwhile, some 24% of Americans bought or sold stocks during the same one-year period. Of these investors, 38% are women, 35% are people of color, 27% earn less than $ 60,000 a year, and 51% are college educated.

Crypto investors are also younger than stock market investors — the average age of a crypto investor is 38, compared to 47 for stock market investors.

“Cryptocurrencies are opening up investing opportunities for more diverse investors, which is a very good thing,” said Angela Fontes, a vice president in the economics, justice and society department at NORC.

“It will be important that these investors have access to sound information as they make decisions related to these often more volatile investments,” she added.

“ The average age of a crypto investor is 38, compared to 47 for stock market investors. ”

Case in point: Over the past month, bitcoin BTCUSD, +17.11%, the most traded cryptocurrency, went from above $ 36,000 to below $ 30,000, around a 20% change. Two months prior, bitcoin was hovering around $ 60,000. While the Dow Jones Industrial Average DJIA, +0.21% went from a one-month high of nearly 35,000 to a one-month low of nearly 34,000, around a 3% change.

(Crypto and stocks aren’t correlated but sometimes strategists view the assets as measures of risk appetite on Wall Street.)

Crypto is trading lower as investors are becoming increasingly concerned about the spread of the COVID-19 delta variant and growing tensions between China and the U.S. On top of that, the Chinese government continues to crack down on crypto trading. In May, it banned banks and other financial third parties from offering it to customers.

“Recently, crypto currency prices have skyrocketed and plummeted, and speculative trading of cryptocurrency has rebounded, seriously infringing on the safety of people’s property and disrupting the normal economic and financial order,” three Chinese financial regulatory branches said in a joint statement obtained by Reuters.

Most crypto investors rely on information they read on crypto trading platforms like Coinbase COIN, +10.45%, general trading platforms like Fidelity FIS, -0.38% or Robinhood and on social media. Only 2% of crypto investors get guidance from a broker or financial adviser, according to the University of Chicago report.