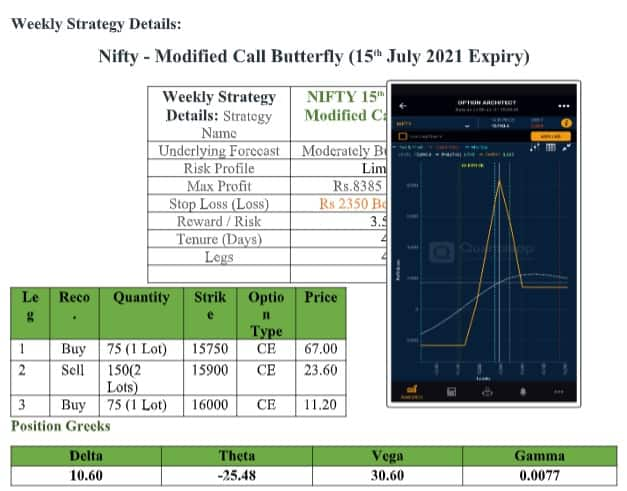

India VIX, the fear gauge, rose nearly 7 percent from 12.09 to 12.96 over the week gone by. India VIX is trading near the lowest level of the pre-COVID crash. Considering the consolidation in Nifty and in India VIX, this week can be approached with a low-risk strategy

Shubham Agarwal

July 19, 2021 / 07:32 AM IST

Consolidation continues in Nifty. It has been trading in a broader range of 15,900-15,500 for five weeks now.

Many gap ups and gap downs with high volatile sessions have been witnessed in the week ended July 16. Still, the index failed to make any directional move.

The upcoming weekly expiry Call writers are showing aggression by building more positions compared to Put writers. Immediate and vital resistance stands at a 15,800, followed by 16,000.

On the lower side, 15,000 stands as the vital support level while 15,700 will work as immediate support.

For the Bank Nifty, immediate resistance stands at 35,500, followed by 36,000, whereas on the downside, 35,000 stands as the immediate support, followed by 34,500.

India VIX, the fear gauge, rose nearly 7 percent from 12.09 to 12.96 over the week gone by. India VIX is trading near the lowest level of the pre-COVID crash.

Cool-off in the VIX has relaxed the market. Further, any downticks in India VIX can push the upward momentum in Nifty.

Nifty OI PCR for the week gone by decreased from 1.092 to 0.94. Bank Nifty OI PCR over the week decreased from 0.83 to 0.789.

Overall, F&O data indicates more of Put writers over Call writers in Nifty and Bank Nifty.

Conclusion: Considering the consolidation in Nifty and in India VIX, this week can be approached with a low-risk strategy like Modified Call Butterfly in Nifty.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.