If you’re hoping to mingle with multimillionaires this summer, you can skip the Hamptons and Lake Como.

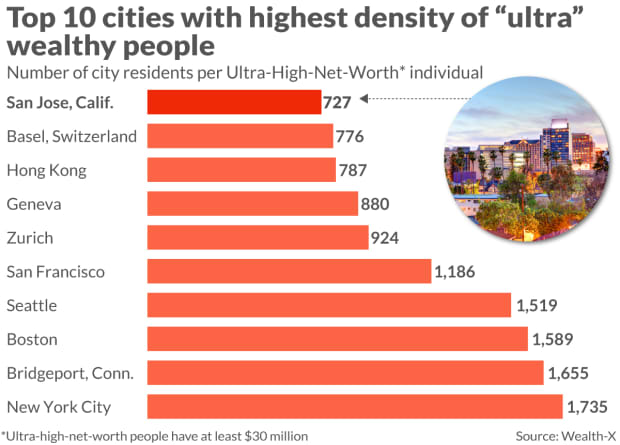

Where you’re most likely to bump into an “ultra-high-net-worth” person, someone who’s worth more than $ 30 million, is San Jose, Calif., according to the latest Wealth-X World Ultra Wealth Report.

San Jose, some 90 minutes by commuter rail south of San Francisco, tops the list of cities around the globe with the highest concentrations of ultrawealthy residents. One in every 727 people in San Jose, the de facto capital of Silicon Valley, is a member of this elite club.

One important caveat to Wealth-X’s findings: the report defined cities “on the basis of urban agglomerations and metropolitan (metro) areas, which include the built-up areas outside the administrative core.” The report didn’t specify which areas around San Jose were included in the analysis, but the city is near many affluent smaller towns and suburbs such as Cupertino, Los Gatos, Mountain View, Palo Alto and Saratoga.

Cities with the highest density of ultrawealthy people tend to be moderately-sized towns where technology or financial services dominate, according to Wealth-X. San Jose is home to such well-known companies as Cisco Systems CSCO, +0.90%, Hewlett-Packard HPE, +1.96%, Adobe ADBE, -0.24% and PayPal PYPL, +1.75%. Its population was just over 1 million in 2020, making it California’s third biggest city after Los Angeles and San Diego.

The 10 cities with the highest raw number of ultrawealthy residents in 2020 were New York, with 11,475 ultrawealthy people; Hong Kong; Tokyo; Los Angeles; Chicago; San Francisco; Paris, Washington, D.C.; Osaka, Japan; and Dallas.

The ranks of monied folks swelled unevenly around the world in 2020, with North America and Asia clocking the strongest gains, while Europe, the Pacific region and the Middle East saw declines. Africa “fared relatively better than some of its larger peers, with the number of ultrawealthy individuals declining by ‘only’ 1.5% and total net worth holding steady at $ 312 billion, equivalent to a 0.9% global share,” according to the Wealth-X report.

How the pandemic has affected the ultrawealthy

The very rich are getting richer, even during a pandemic. Amid the global health crisis and its attendant economic upheaval, the worldwide population of ultra-high-net-worth people grew by 1.7% in 2020 from 2019 to a total of 295,450 people, according to Wealth-X.

These superaffluent folks made up 1.2% of the world’s high-net-worth population — comprising anyone with at least $ 1 million — but they hold 34% of that group’s wealth, amounting to $ 35.5 trillion.

Wealth-X’s report noted that the expanding numbers of ultrawealthy people during “intense economic turmoil, widespread unemployment and falling incomes for many nonwealthy individuals underlined the polarizing effects of the pandemic across society.”

The authors added, “The extent to which the ultrawealthy were able to weather the storm (and, in some cases, significantly expand their fortunes) in one sense augers well for future wealth-creation prospects. However, it will also raise more questions over widening wealth inequality and could spur more concerted redistributive policy efforts in areas such as tax and regulation.”