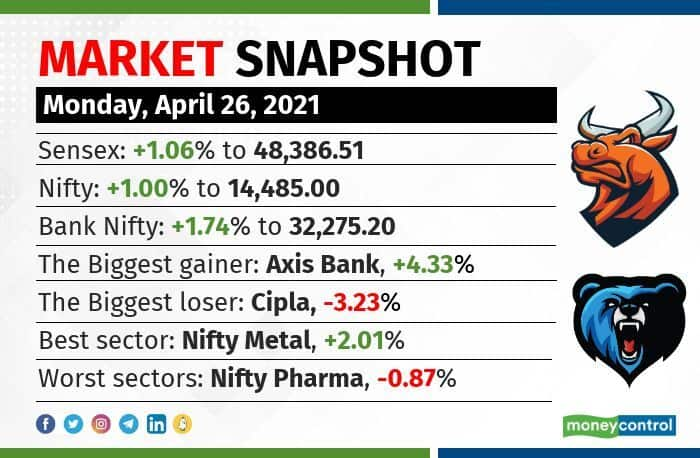

Benchmark indices started the week on a positive note with Nifty closing near the 14,500 amid positive global and buying in metal, bank and realty stocks. At close, the Sensex was up 508.06 points or 1.06 percent at 48386.51, and the Nifty was up 143.60 points or 1.00 percent at 14485.

Except for pharma, all other sectoral indices ended in the green. BSE Midcap and Smallcap indices rose 0.6 and 0.9 percent, respectively.

“Nifty was unable to cross the resistance of 14500-14700. If we are able to do so, the trend will turn bullish and we can scale higher to achieve 15000. On the flip side, if it resists, then we will go down to test the recent lows of 14150-14200,” said Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments.

Axis Bank, UltraTech Cement, ICICI Bank, JSW Steel and Grasim Industries were among top gainers on the Nifty, while losers included Cipla, Britannia Industries, HCL Technologies, BPCL and HDFC Bank.

Stocks & sectors

On the BSE, the realty index jumped 3.7 percent, while metal and bank indices rose 2 percent each.

Among individual stocks, a volume spike of more than 100 percent was seen in SAIL, Sun TV Network and MphasiS.

Long buildup was seen in SAIL, Page Industries and Gujarat Gas, while a short buildup was seen in Havells India, Marico and Dabur India.

More than 150 stocks, including Zydus Wellness, Tata Steel, JSPL and JSW Steel hit a fresh 52-week high on the BSE

Technical View

Nifty formed a bullish candle on the daily scale and has been forming higher highs – higher lows since the last two sessions.

“Nifty has to continue to hold above 14,400 zones to witness an up move towards 14,600 and 14,700 zones, while on the downside, support exists at 14,300 and 14,150 zones,” said Chandan Taparia of Motilal Oswal Financial Services.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.