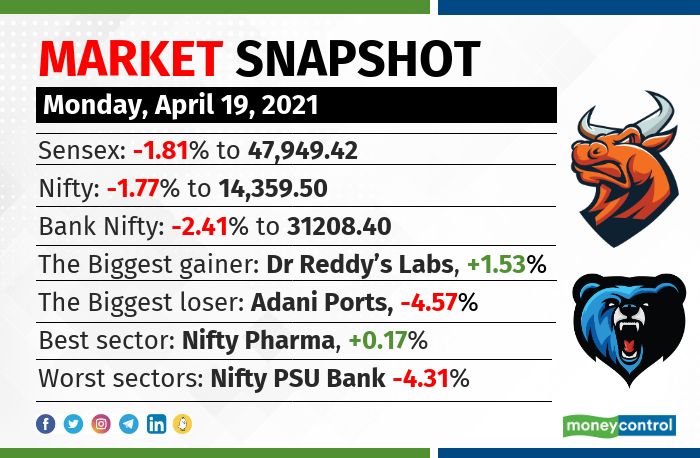

The unabated record surge in coronavirus cases dragged the market down by more than 1.5 percent on April 19 despite positive global markets. At close, the Sensex was down 882.61 points, or 1.81 percent, at 47949.42, and the Nifty was down 258.40 points, or 1.77 percent, at 14,359.50.

Most of the Asian indices ended higher tracking record closing from the US markets on April 16.

The market capitalisation of BSE listed company’s fell Rs 3,53,420.76 crore to Rs 2,01,77,325.24 crore on April 19.

The Nifty PSU Bank shed more than 4 percent, while auto, infra, metal and energy indices slipped 1-2 percent. BSE Midcap and Smallcap indices shed 1.5-2 percent.

“We did not break 14,200-14,250 on a closing basis and hence the onset of a bear market cannot be confirmed. This patch is a good support for the Nifty and if we disrespect this, we can drift to 13,800-13,900,” said Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments.

“Since the upside is capped at 15,000, a view on the long side can be only be taken post that level. Until then, the index will remain sideways with a downward bias,” Hathiramani added.

Adani Ports, Power Grid Corp, ONGC, Hero MotoCorp and Bajaj Finserv were among the major losers on the Nifty. Gainers included Dr Reddy’s Laboratories, Cipla, Britannia Industries, Wipro and Infosys.

Stocks & sectors

On the BSE, the realty index slipped 4 percent and the capital goods index fell 3 percent. However, oil & gas, power, FMCG, bank and auto indices shed 1-3 percent.

Among individual stocks, a volume spike of more than 100 percent was seen in Apollo Hospitals, Bata India and Mindtree.

Long buildup was seen in Pfizer, Lupin and Apollo Hospitals, while a short buildup was seen in AU Small Finance Bank, Bajaj Finance and Ashok Leyland.

More than 100 stocks, including Cipla, Cadila Healthcare, Subex and Caplin Point Laboratories, hit a fresh 52-week high on the BSE.

Technical View

The Nifty formed a bullish hammer candle on the daily scale as it closed higher than its opening zone, which indicates that declines are being bought.

“The Nifty has to cross and hold above 14,400 zones to witness a bounce towards 14,600 and 14,700 zones, while on the downside, support exists at 14,250 and 14,200 zones,” said Chandan Taparia of Motilal Oswal Financial Services.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.