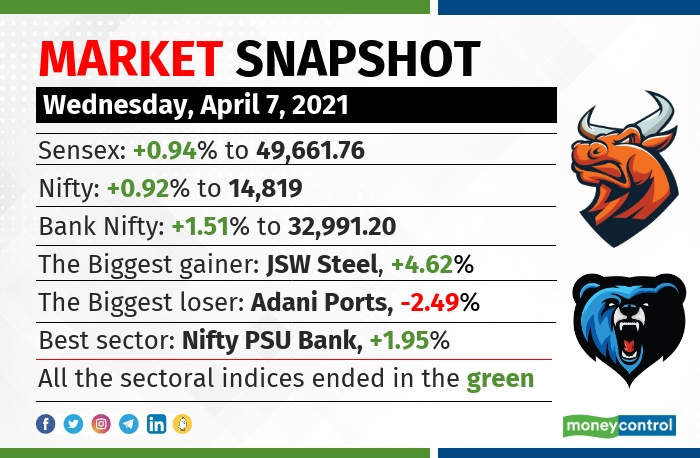

Indian market ended in the green for the second straight session on April 7 after the Reserve Bank of India (RBI) kept key policy rates unchanged and maintained its accommodative stance. Sensex rose 460.37 points or 0.94% to close at 49,661.76, while Nifty was up 135.50 points or 0.92% to end at 14,819.

“Indian market is invigorated by RBI’s long-term dovish stance to maintain an easy money policy till the economy reverts to normalcy. A big cheer is the GSec buying program of Rs 1 lakh crore to ensure liquidity and flatten the long-term yields curve,” said Vinod Nair, Head of Research at Geojit Financial Services:

“RBI’s decision to maintain its high GDP growth forecast also helped the market to calm down its fears which had increased post the second wave of infection and stringent lockdowns,” he added.

RBI’s monetary policy committee (MPC), as expected, left the repo rate unchanged at 4 percent and reverse repo rate at 3.35 percent.

The central bank’s assurance of continuing with the accommodative stance led to a sharp vertical up move on Dalal Street even as concerns grow over the more aggressive second coronavirus wave.

Also, the MPC maintained its Gross Domestic Product (GDP) growth forecast at 10.5 percent for FY22.

“While a status quo in terms of policy rates was factored in, the big positive has come in terms of the transparency of the OMO calendar through the G-sec acquisition programme (GSAP), which is likely to support and stabilize long term yields,” said Nitin Shanbhag, Head – Investment Products, Motilal Oswal Private Wealth Management.

“In this regard, RBI has announced GSAP of Rs 1 lakh crore in 1QFY22, of which Rs 25,000 crore would be conducted on 15 April 2021. This has provided some relief to the 10-year G-Sec yield,” Shanbhag added.

JSW Steel, Wipro, Britannia Industries, SBI Life Insurance and SBI were among top gainers on the Nifty, while losers included Adani Ports, Tata Consumer Products, UPL, NTPC and Titan Company.

Stocks & sectors

Except power, all other BSE sectoral indices ended on a positive note with realty, IT, auto, bank, oil & gas and metal indices adding 1 percent each.

Among individual stocks, a volume spike of more than 100 percent was seen in City Union Bank, Gail and PI Industries.

Long buildup was seen in the PI Industries, Vedanta and Cholamandalam Financial, while a short buildup was seen in Mphasis, Amara Raja Batteries and LIC Housing Finance.

More than 150 stocks, including JSW Steel, Sobha, Vedanta, hit a fresh 52-week high on the BSE.

Technical View

The Nifty formed a Bullish candle along with long shadow on daily scale and continues its formation of higher lows from the last two sessions.

“The Nifty has to cross and hold above 14,880 zone to witness a range breakout and an up move towards 15,000 zones, while on the downside support exists at 14,650 and 14,550 levels,” said Chandan Taparia of Motilal Oswal Financial Services.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.