Mutual funds (MFs), which manage investments of their equity scheme investors, have been net sellers in the equity market in 2021 so far.

They have also been consistently buying in these 78 stocks in every quarter of the current financial year (FY).

MFs have net sold Rs 1.25 lakh crore of shares during the year, while the market has clocked 70 percent gains, hitting fresh record highs. The fund houses might have used rallies to book profits, given the high valuations supported by global liquidity.

In the same period, foreign institutional investors (FIIs) have made a net buying of Rs 2.78 lakh crore worth of shares.

The better-than-expected earnings growth, improved economic data points and a slew of measures announced by the government and the Reserve Bank of India along with low credit cost, have lifted market sentiment.

Despite a spike in COVID-19 infections in the second half of February, experts are not unduly worried, given the vaccination drive, increase in tests to control cases and precautionary measures taken by state governments.

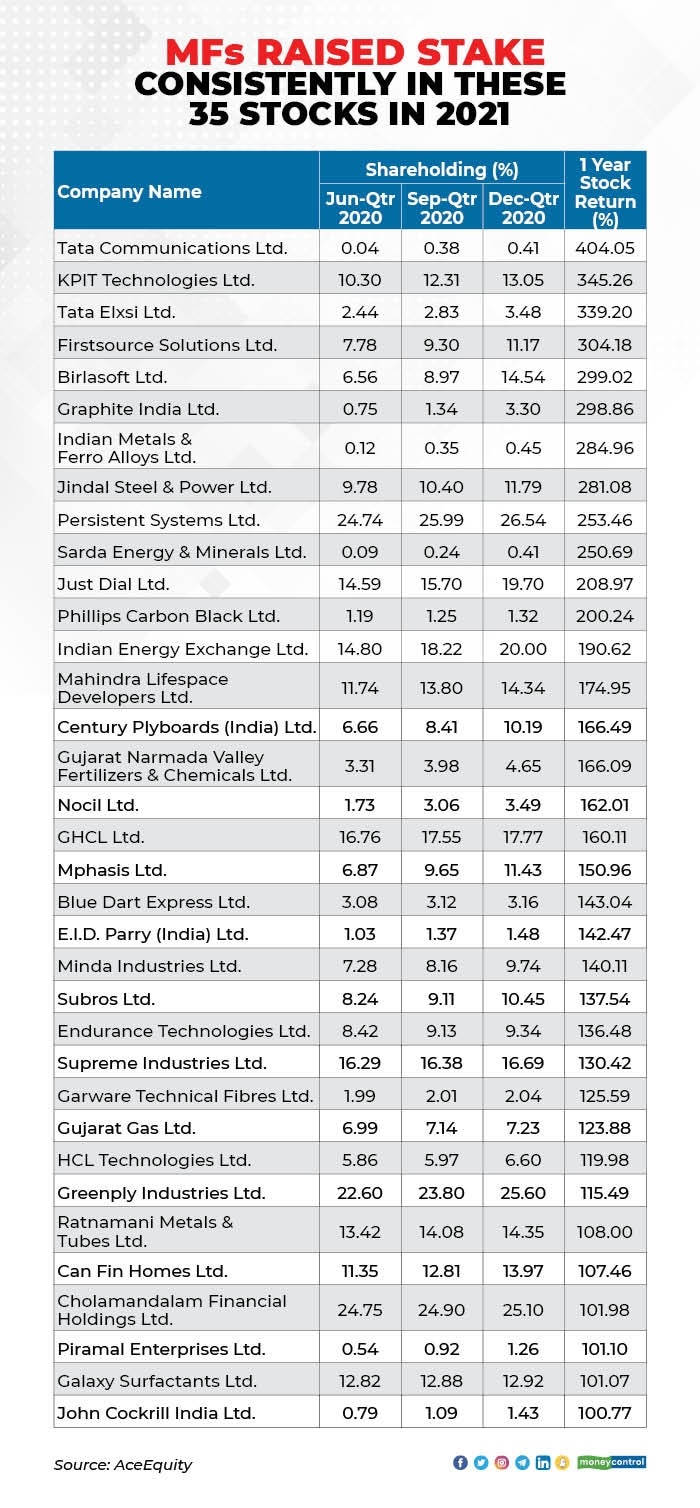

The shareholding data of every quarter in financial year 2020-2021 indicated that mutual funds bought heavily from these 78 stocks; of them the top 35 stocks have given a return of at least 100 percent since as long as April 1, 2020.

Among them, top stocks including Tata Communications, KPIT Technologies, Tata Elxsi, Firstsource Solutions, Birlasoft, Graphite India, Indian Metals and Ferro Alloys, Jindal Steel and Power, Persistent Systems, Sarda Energy and Minerals and Just Dial shot up 200-400 percent, since the beginning of June quarter 2020.

The others which gained over 100 to 199 percent during the same period include Phillips Carbon Black, Indian Energy Exchange, Mahindra Lifespace Developers, Century Plyboards (India), Nocil, GHCL, Mphasis, Minda Industries, Endurance Technologies, Supreme Industries, Gujarat Gas, HCL Technologies, Can Fin Homes and Piramal Enterprises.

The next 26 stocks, which include Radico Khaitan, V-Mart Retail, Greenlam Industries, Brigade Enterprises, Bharat Dynamics, BASF India, Lux Industries, Lupin, Page Industries, Maruti Suzuki, REC, ICRA, Bosch, Jyothy Labs, Sunteck Realty and Fortis Healthcare, registered more than 50 percent return.

The above data indicates that most of these companies belong to IT or ITES, pharmaceuticals, fertilizers, auto and steel industries.

A look at the one-year returns of these sector-specific indices reveals that the Nifty Metal index had given the highest return at 144 percent, followed by Nifty Auto 114 percent, Nifty IT 104 percent, and Nifty Pharma at 65 percent.

Gaurav Garg, Head of Research at CapitalVia Global Research told Moneycontrol: “It is evident that MFs selected the sectors that had offered the strongest returns in the past one year. In the second quarter of FY21, pharma, chemicals, and information technology sectors outperformed during the lockdown. Following that, investors diverted their funds into the financial and auto sectors in the third quarter, which rallied in the last two months of the third quarter.”

In addition, many stocks belonged to the Mid cap and Small cap categories. The Nifty Midcap 100 and Small cap 100 indices delivered 102 percent and 128 percent returns respectively from the start of FY21, outpacing the benchmark Nifty 50 that gained 71 percent in the same period.

“As most of these stocks belong to Mid and Small cap, the fund manager may have invested at discount prices as putting money in the Mid and Small caps come with higher risk-reward ratio. So, when the stocks are at discounted prices, the MFs may have taken the advantage of it,” added Garg.

Experts believe that technology and pharma stocks could remain in the limelight for a longer period, given the current environment created by COVID-19 with respect to automation, digitalisation and healthcare, while the rally in steel stocks was attributed to rising commodity prices and expected recovery in demand.

Agriculture boosted fertiliser and the auto segment, while increasing government spending on infrastructure and the expected demand recovery, supported the auto business.

Garg’s prediction is that “If major economies put increased significance on renewable energy, technology and pharmaceuticals, these sectors will become more relevant to the MFs, ” adding it to be a “strong indicator that investment managers are switching away from cyclical industries in search of greater portfolio consistency and efficiency.”

He is careful to caution that this list can be used by investors as a guide when making investments, but should not be followed without doing their own research.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.