Source: Reuters

Asian powerhouses China and India have fared very differently against COVID-19 since the pandemic spread across the world, with China recovering from last April, while India remained mired in the outbreak until December, as reflected by their respective demand for crude oil.

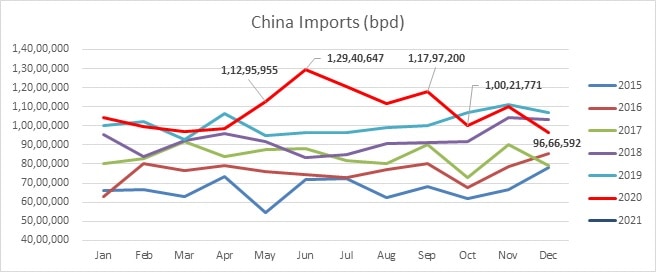

China has imported above-average volumes of crude for eight of the past 10 months (since April 2020, till January 2021) including record-breaking arrivals for three of those months, with imports for January expected at above-average levels of over 11 million barrels-per-day (bpd), assessments by Refinitiv Oil Research showed. This is despite a recent resurgence of the outbreak that has led to the lockdown of two cities containing 22 million people.

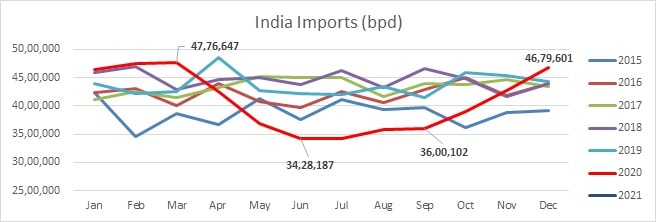

In contrast, India’s crude only rebounded above-average levels from December, at 4.68 million bpd for the month, recovering from July’s all-time low of 3.42 million bpd, and below-average volumes of under 4 million bpd from May to October.

China – Recovered from last April

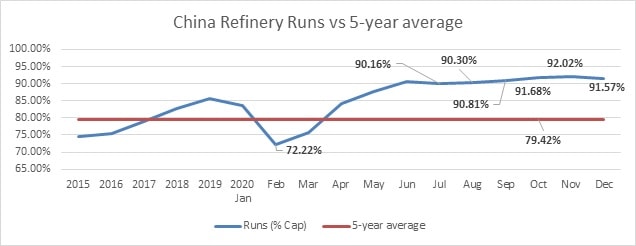

China was the first country to be struck by the coronavirus in January, and suffered the worst of the pandemic in February, forcing widespread lockdowns across the world’s most populous country. This resulted in a sharp fall for the demand of transportation and industrial fuels, and saw refinery runs plunging to a record low of 72.1 percent of its 15.5 million bpd capacity.

However, within a month of strict movement restrictions, the country was well on its way to recovery by March. At the same time, the coronavirus was beginning its spread across the world with lockdowns appearing everywhere, curbing oil demand.

At the time, oil giants Saudi Arabia and Russia were negotiating to extend an output-cut agreement as part of the OPEC+ grouping to support fast-falling prices. They failed to reach an agreement, and this led to both sides maximizing output for April, which saw prices plunging to multi-year low levels – front-month Brent hit a 20-year low of under $ 20 per barrel, while the US WTI benchmark closed unprecedented negative levels.

By April, China was near full recovery in terms of its oil demand, with refinery runs at 84.1 percent, just under the 2019 average of 85.9 percent. Its refiners took full advantage of the situation and bought large volumes of crude from April-lifting barrels onwards.

This resulted in record-high volumes from May to September, with May arrivals hitting a historical high of 11.3 million bpd, followed by another record for June at 12.94 million bpd, and staying high at above 10 million bpd until September.

These huge arrivals resulted in massive congestions at its ports from May-end, with vessels having to wait for weeks before being able to discharge at its worst, until H1 October. The buying frenzy also led to Chinese importers exhausting their annual government-allotted crude import quotas well before the end of the year, forcing them to turn to alternative feedstocks, leading to below-average arrivals of around 9.5 million bpd in October and December.

These massive imports have also led to refinery runs surging above 90 percent from June, and averaging at 91 percent up till December, the longest sustained period that China’s runs are at such levels, well above the 2015-2019 average of 79.4 percent.

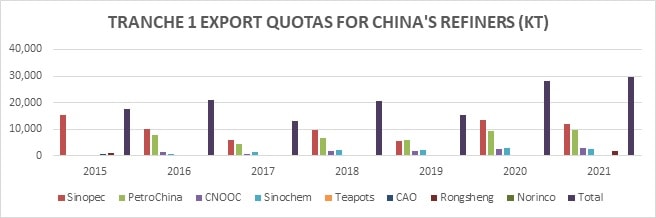

However, the high refinery runs did not result in a glut of exports refined products such as gasoline, diesel and jet-kero, of which China is one of the world’s largest exporters, as most of its destination markets both in Asia and the rest of the world remains impacted by COVID-19.

Reflecting this, China’s major exporters, which operate under a government-mandated export quota, only managed to meet 74.7 percent of their allowed 59.03 million mt quota, the lowest since the quota system was introduced in 2015 and well below the above 94 percent levels seen in 2016-2019.

Going forward, we expect China’s crude imports to remain robust, as reflected by the above-average inflows of above 11 million bpd expected for January, barring any major wave of COVID-19 infections, albeit not at the frenzied levels seen in 2020.

Similarly, we expect that exports of diesel, gasoline and jet-kero to go closer to quota levels, though whether it would revert to normal above 94 percent levels remains to be seen, with much of the world still suffering from the pandemic. Also, the quota is expected to be higher this year, as evidenced by the higher Tranche 1 of quotas issued by the government, at 29.47 million mt, versus last year’s 28 million mt.

India – On the way to recovery?

In contrast, India suffered the worst of the pandemic in April, right after its refiners volunteered for more barrels in the face of the Saudi-Russia price war. Its entire 1.3 billion population was literally locked down overnight, leading to a sharp fall in demand for transportation and industrial fuels, forcing some refineries to close or severely cut capacity, and some to resell crude cargoes at discounted prices in the spot market.

Worse, the refiners bought larger than usual volumes of crude in Jan-March, averaging at 4.72 million bpd, and at 4.25 million bpd for April, versus the 2019 average of 4.37 million bpd. The surplus crude had to be stored in the government’s strategic tanks, filling its entire 5.33 million mt capacity, with another 8.5-9.0 million mt being stored in tankers floating in the Middle East.

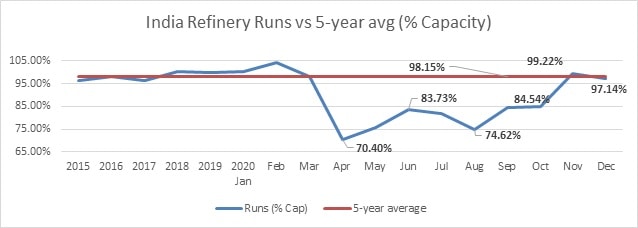

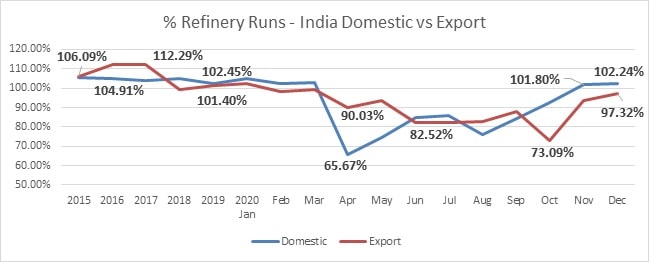

Refinery runs plunged to a record low of 70.4 percent of its 5.1 million bpd capacity in April, well below the 2015-2019 average of 98 percent, staying under 85 percent until October. The run cuts were led by its state-owned refiners, which slashed runs to a record-low 65.7 percent of its 16.27 million mt/month capacity, staying under 85 percent till October.

The run cuts were led by the country’s largest refiner, Indian Oil Corporation (IOC), at 52.8 percent of its 5.77 million mt/month capacity for April, but its export-oriented refiners – Reliance and Nayara – managed to keep runs at above 80 percent throughout the April-October period, with the exception of October, when Nayara shut most of its 1.67 million mt/month capacity for maintenance.

However, runs returned strongly from November, rising close 100 percent for the two months till December, led by recovering domestic demand for transportation fuels as lockdown eases, with state-owned refiners leading the way as runs cross above the 100 percent mark, while that for the export-oriented refiners hit a post-pandemic high of 97.3 percent in December.

This was also reflected by crude imports hitting consecutive post-pandemic highs of 4.27 million bpd for November and 4.68 million bpd for December, with January inflows set to close at an all-time high, with 4.81 million mt assessed by Refinitiv Oil Research as landing the country so far.

I believe that this record-high volume is, in part, driven by a price call, as the cargoes are typically purchased at least two months in advance, and prices have risen since, to above $ 55 a barrel, versus November’s $ 40-45 a barrel.

Refinitiv Oil Research believes that the uptick is also helped by improving international margins for diesel and jet-kero as a colder-than-usual winter in the Northern Hemisphere resulted in stronger demand for the fuels.

Margins for diesel and jet-kero, as represented by their front-month price spreads to Dubai crude, for December were at multi-month highs for December, respectively averaging at $ 6.13 per barrel and $ 4.65 per barrel, according to Refinitiv Oil Research forward curve assessments.

It remains to be seen, however, if this improvement is sustainable beyond the winter, with air-travel still severely limited, and the pandemic still prevalent in many countries across the world, forcing second- and third-wave lockdowns.

Already, margins for both products are lower in January, with diesel averaging at $ 5.72 per barrel and jet-kero at $ 3.30 per barrel.

(M1 Diesel/Dubai) (M1 Jet-kero/Dubai)

(M1 Jet-kero/Dubai)

In India, infections remain high, at the 10.74 million, the world’s second-largest, after the United States. On top of that, retail diesel prices are at record-highs in both Delhi and Mumbai, at Rs 76.48 per litre and Rs 83.30 per litre respectively, as the government continues to maintain high excise duties on road fuels. Tax, duty, and dealer commissions comprise some 60-65 percent of petrol and diesel prices in the country.

Conclusion – China ahead in recovery

In final conclusion, I believe that both countries are on the way to recovery, with China being well ahead as its economy has more or less returned to normal and with a comparatively low number of COVID-19 infections at just under 90,000 cases, despite its recent lockdown of 22 million people.

The challenge facing India is its vast population and fractured politics that will make it difficult to roll out an effective country-wide vaccination program. It remains to be seen if its refiners have reason to regret its record-high crude imports for January.

(Yaw Yan Chong is the Director at Refinitiv Oil Research (Asia), an LSEG business.)

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.