U.S. stocks have been hanging around record highs recently amid broader participation by individual investors, but now cracks are starting to form in the foundation of the bull market, according to technical analysts at SentimenTrader.

The biggest breakdowns in the positive trend for markets tend to come when fewer stocks are helping to drag benchmarks toward fresh records, the analysts say

“The biggest issues have come when underlying momentum wanes and we see cracks under the surface,” wrote Jason Goepfert, head of SentimentTrader and founder of independent investment research firm Sundial Capital Research, in a research note published Tuesday.

“That’s what’s happening now,” he wrote.

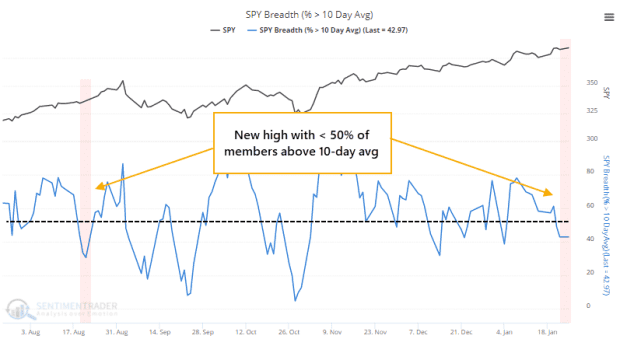

Notable says the SentimenTrader researcher is that fewer stocks are managing to end above their short-term moving averages even as the S&P 500 index SPX, +0.12% has managed to eke out record closing highs as it did on Monday along with the Nasdaq Composite Index COMP, +0.21%.

Goepfert noted that the S&P 500 closed at another record high on Monday, “and yet fewer than 45% of its stocks managed to close above their 10-day moving averages.”

“That’s a lot of short-term downtrends on a day the index closed at a high,” he said.

SentimenTrader

A breakdown in breadth may seem insignificant but SentimenTrader notes that the last time it occurred was in August last year near a period in September where markets momentarily turned lower.

“The reason why relatively few stocks are above their 10-day averages is that relatively few have been rising on days the S&P showed a gain,” the researcher wrote.

And it isn’t just the relatively short-term 10-day moving averages where breadth is starting to tighten.

On Monday, roughly 68% of S&P 500 stocks traded above their 50-day MA, representing the lowest such level since Nov. 6. That’s below 2021’s average level at 74.5%, according to Dow Jones Market Data.

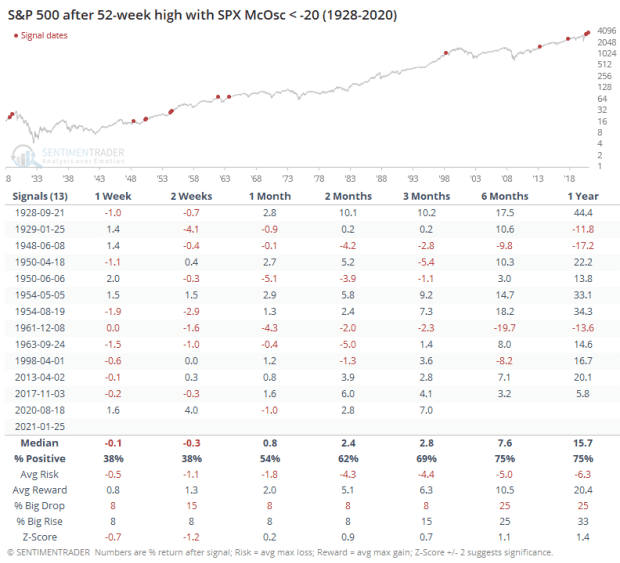

Even if the market doesn’t see a breakdown or correction in price, Goepfert makes the case that when breadth starts to narrow, or fewer stocks are making new highs, returns for the market overall tend to be middling to poor, referencing the McClellan Oscillator‘s subzero breadth reading.

“We can see from the chart that the S&P’s annualized return since 1928 when its Oscillator was below zero is an abysmal -3.2%,” he said.

SentimenTrader

The Sundial Capital researcher says that it probably isn’t a coincidence that readings of breadth are narrowing amid a period of growing speculation from individual investors using options to express their bullish views.

“The only time in 20 years that speculation neared the current level was in the latter half of last August,” he wrote. “It’s probably not a coincidence that that was also when we started to see initial signs of deterioration in stocks underlying the major indexes like we are now,” Goepfert added.

Indeed, massive betting on companies using options, including in companies like GameStop Corp. GME, +60.02%, AMC Entertainment Holdings AMC, +5.20% and others, has been raising concerns on Wall Street, with some market participants worried that the current fervor for investing hews too closely to the dot-com bubble paradigm.

Read: Is GameStop’s wild ride due to market manipulation by social-media users—or are they exercising free speech?

Check out: How you could lose everything by short selling stocks, whether it’s betting against GameStop or Tesla

U.S. stock indexes on Tuesday were bouncing around, with the S&P 500 index and the Nasdaq Composite struggling to hold on to record highs, while the Dow Jones Industrial Averag DJIA, +0.15% e was being buoyed by gains in Johnson & Johnson JNJ, +2.94% and 3M Co. MMM, +3.48%, which both reported earnings.