A pre-owned Rolex wristwatch is arranged for a photograph at the head office of Eco Style, a retailer dealing in pre-used luxury goods, in Tokyo, Japan, on Tuesday, May 19, 2020. The world?s third-largest economy shrank an annualized 3.4% in the three months through March from the previous quarter as exports slid and social distancing crimped consumer spending, official figures showed May 18, confirming the second-straight quarterly contraction.

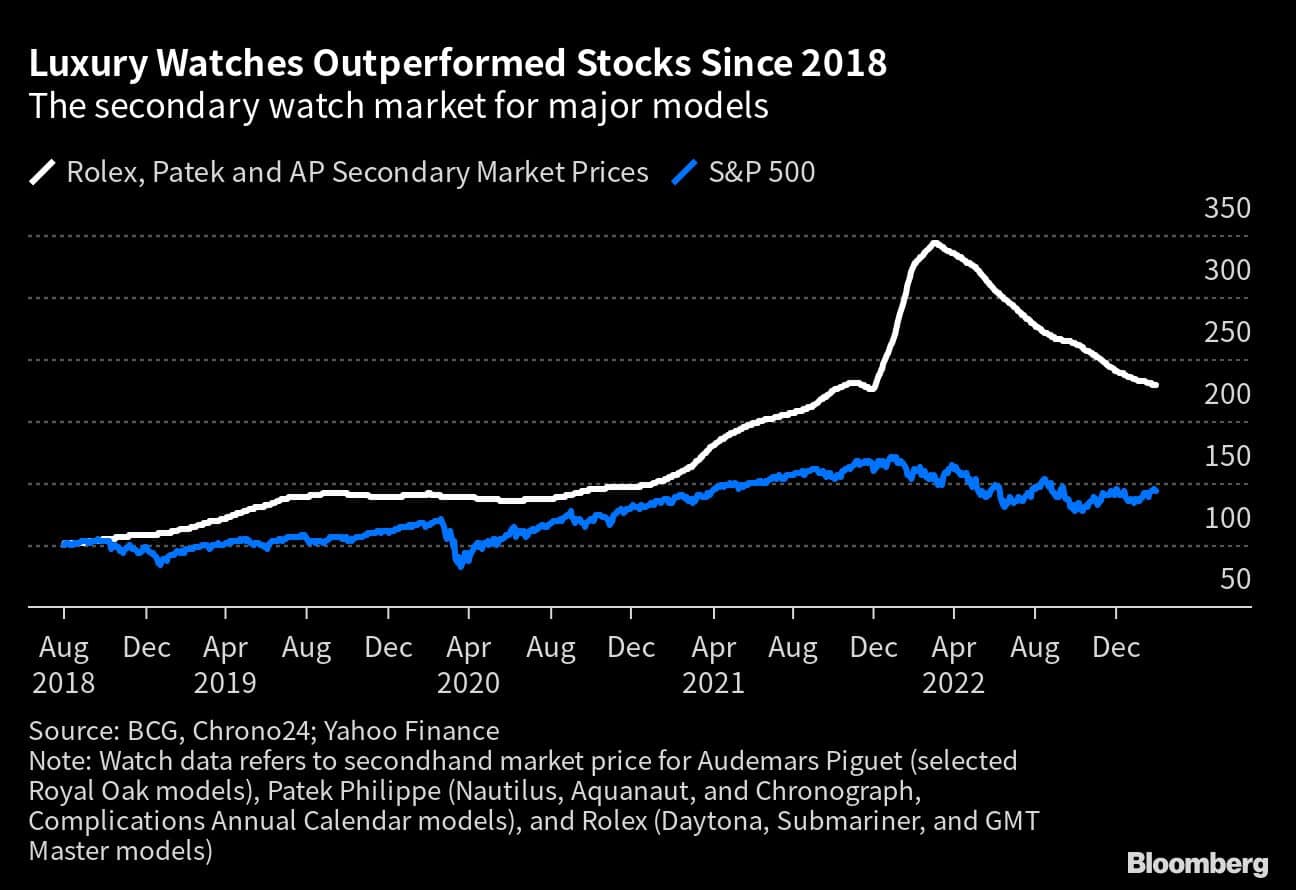

Prices for Rolex, Patek Philippe and Audemars Piguet watches appreciated by an average of 20% a year since mid-2018, outpacing the S&P 500 Index, as values for pre-owned luxury timepieces surged, a new report shows.

The S&P 500 stock index averaged annual returns of 8% from August 2018 to January 2023 while a basket of pre-owned watch models from top Swiss brands grew at more than twice the pace, the report from Boston Consulting Group Inc. and secondary market dealer WatchBox said.

That’s despite prices of some pre-owned models, including Rolex Daytonas, Patek Nautilus and AP Royal Oaks, declining by as much as a third since the market peaked in the first quarter of 2022.

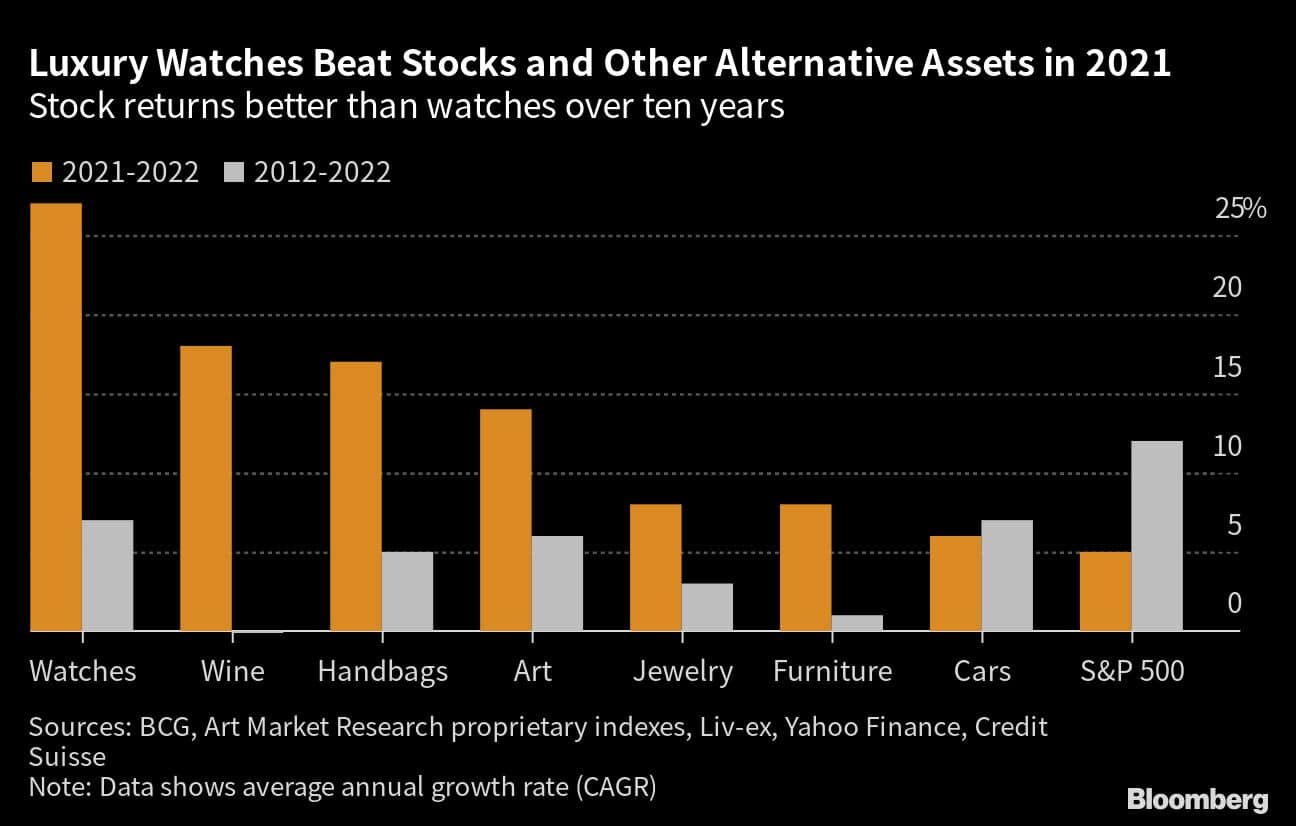

Prices for a basket of so-called independent brand watches including FP Journe, H. Moser & Cie and De Bethune — a small Swiss producer which is majority owned by WatchBox — returned 15% over the same period. The report touts luxury watches as an alternative asset class to stocks, bonds, art and wine.

Over a longer period, stocks outperformed watches as an investment asset. The S&P 500 had a compound annual growth rate of 12% between 2012 and 2022, while Rolex, Patek and AP watches averaged 7%.

Secondary-market watch price increases accelerated sharply during the pandemic as Millennial and Generation Z consumers, cash-flush and stuck at home, discovered a pricey new hobby collecting Swiss watches. The rise and fall of cryptocurrency values has also correlated with used watch prices.

“Value and transparency are the drivers of the secondary market and that has been a driver of liquidity,” Sarah Willersdorf, a managing director and partner at BCG in New York, said in an interview.

More than 60% of transactions were online compared to 15% for new purchases. While men still make up the majority of buyers, the number of female and younger collectors is growing rapidly, she added.

Philadelphia-based WatchBox is one of the top sellers of pre-owned watches in the world with operations in the US, Switzerland and Hong Kong and backers including former NBA great Michael Jordan and activist investor Bill Ackman.

Boston Consulting Group and WatchBox co-funded the consumer research conducted for the report.

The secondary luxury watch market grew to $ 24 billion in 2022 compared to the primary retail market which was worth $ 55 billion. The pre-owned market is expected to grow by 9% a year to $ 35 billion by 2026 as prices rise and more people begin collecting watches, according to a BCG forecast.

LuxeConsult, an independent Swiss analyst and consulting firm, recently forecast that used luxury watch sales would overtake the primary retail market by 2033 with sales surging to $ 85 billion.

Often dubbed the “grey market,” the secondary luxury watch sector was boosted in December when Swiss giant Rolex SA said it would start authenticating pre-owned watches for resale through its network of authorized dealers.