U.S. stock futures were steady early Monday, holding their latest rally ahead of testimony from Federal Reserve Chair Jerome Powell and crucial jobs data later in the week.

How are stock-index futures trading

- S&P 500 futures ES00, +0.01% dipped 1 point, or less than 0.1%, to 4049

- Dow Jones Industrial Average futures YM00, -0.03% fell 16 points, or 0.1%, to 33398

- Nasdaq 100 futures NQ00, +0.02% rose 8 points, or 0.1%, to 12320

On Friday, the Dow Jones Industrial Average DJIA, +1.17% rose 387 points, or 1.17%, to 33391, the S&P 500 SPX, +1.61% increased 64 points, or 1.61%, to 4046, and the Nasdaq Composite COMP, +1.97% gained 226 points, or 1.97%, to 11689.

What’s driving markets

Stock futures are pausing for breath following a two-day bounce that broke a three-week losing streak.

The S&P 500 has recovered the 4,000 mark as investors welcomed the sight of benchmark bond yields dipping back below 4%, despite a report on Friday showing the U.S. services sector remains in robust health.

“U.S. markets ended the week in positive territory, for the moment looking through the implications of more recent data which suggest that the Federal Reserve still has work to do in taming inflation by raising interest rates further,” said Richard Hunter, head of markets at Interactive Investor.

“There was some relief following comments from a Fed member, which cemented the likelihood that the next rate rise will be 0.25%, suggesting at least that the velocity of rate rises could have peaked,” he added. Last week, Atlanta Fed President Raphael Bostic said he was “very firmly” in the quarter-point move camp.

The 10-year Treasury yield TMUBMUSD10Y, 3.918%, which hit 4.081% last Thursday, is down another 2.6 basis points to 3.933%.

Investors’ attention will now turn to Powell’s semi-annual congressional testimony on Tuesday and Wednesday, then on Friday the nonfarm payrolls report will show whether wage growth is being contained, an important consideration for the central bank.

“[Powell] will certainly reiterate that the Fed is not yet done with its fight against inflation, that the labor market remains particularly strong, that a soft landing is possible, yet the Fed won’t hesitate to sacrifice growth to abate inflation as soon as possible,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

“Looking at the latest set of data, the U-turn of easing inflation and last month’s blowout jobs figures, we don’t expect to hear anything less than hawkish from Mr. Powell. But it’s always possible that a word like ‘disinflation’ slips out of his mouth, and that we get a boost on risk,” she added.

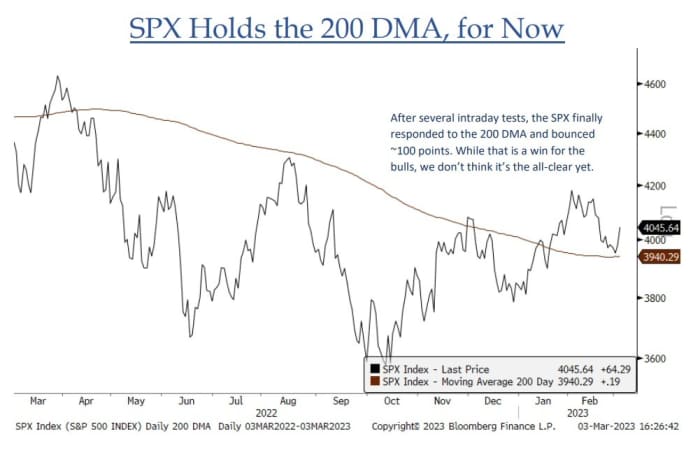

Some analysts remained skeptical of the latest rally’s longevity.

Source: BTIG

“We think the counter-trend rally can carry a bit further, but expect the 4060-4080 zone on [the S&P 500] to represent firm resistance based on retesting the broken uptrend, horizontal resistance from the mid-Feb. breakdown, and the falling 20 da moving average,” said Jonathan Krinsky, chief technical strategist at BTIG.

“Above that, the high volume zone of 4125-4150 should act as more important resistance,” he added.