Hi! This week’s ETF Wrap looks at the jump in options contracts tied to exchange-traded funds such as the SPDR S&P 500 ETF Trust.

Please send feedback and tips to christine.idzelis@marketwatch.com. You can also follow me on Twitter at @cidzelis and find me on LinkedIn.

Sign up here for our weekly ETF Wrap.

Options activity surrounding exchange-traded funds has jumped, as the ETF market evolves to increasingly attract investors engaging in short-term trading strategies or to express their views on stocks and bonds, according to research from Citigroup.

“I feel like the macro is driving a lot of this,” said Drew Pettit, director of ETF analysis and strategy in Citigroup’s research business, in a phone interview. “Macro” drivers might include economic data on inflation as well as statements from the Federal Reserve, he said.

Activity in options contracts tied to ETFs picked up in 2020 amid the market volatility and uncertainty during the earlier stages of the pandemic and has continued to surge since then, according to Pettit. He said the SPDR S&P 500 ETF Trust SPY, -1.38% and Invesco QQQ Trust QQQ, -1.88% are popular among institutional investors for options trading, while the ARK Innovation ETF ARKK, -2.78% also shows up a lot in the most-active options being traded.

“Now, we’re seeing a lot more people talk about fixed income ETF options,” Pettit said. “Those are growing in popularity.”

Read: QQQ is bleeding assets, but are ETF investors ‘finally bailing’ on growth stocks just as tech stocks jump in 2023?

Options contracts give investors the right but not the obligation to buy or sell a security at a stated price before a certain date. Institutional investors are using options contracts linked to an ETF to express a positive or negative view on the assets underlying the fund’s investment strategy or to hedge their books, according to Pettit.

Citi equity strategist Scott Chronert said Feb. 6 during a panel at the Exchange conference in Miami Beach, Florida that he saw “tremendous growth” in options activity tied to ETFs last year. He said that options trading around exchange-traded funds is part of the “next wave of innovation” in the ETF market.

Within fixed income, Pettit said the iShares iBoxx $ High Yield Corporate Bond ETF HYG, -0.80%, iShares 20+ Year Treasury Bond ETF TLT, -1.42% and iShares iBoxx $ Investment Grade Corporate Bond ETF LQD, -0.80% are popular ETFs with institutional investors, as well as the Invesco Senior Loan ETF BKLN, -0.05%.

Citi’s institutional clients include investors such as pension funds, hedge funds, actively-managed mutual funds, larger endowments or insurance companies’ “tactical sleeves,” according to Pettit.

While equity ETFs “SPY” and “QQQ” have attracted daily options trading, with contracts expiring that same day, investors tend to use weekly options for other areas of the exchange-traded-fund market, such as fixed-income ETFs, or say, “ARKK” and the KraneShares CSI China Internet ETF KWEB, +0.68%, according to Pettit.

On some days, bullish or bearish options trading around ETFs can move the needle on stock-market prices, particularly with “shorter expiry options,” said Pettit. “When everyone switches on a dime and starts putting on the same trade in options, then you see a little bit more of a pull.”

In a research report early this month, Citi strategists including Pettit and Chronert said that ETFs are “increasingly mainstream for fast money.”

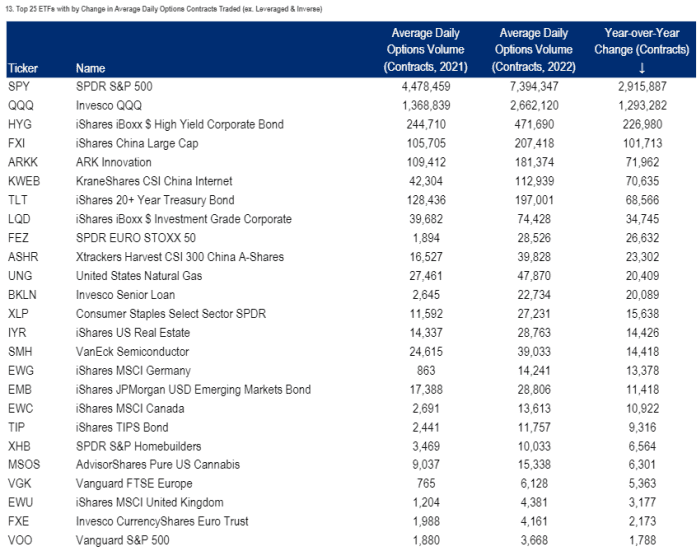

A chart in their report included the top 25 ETFs by “year-over-year change in average daily options contract volume.” See below.

CITI RESEARCH NOTE DATED FEB. 2, 2023

“We expect more funds to take on liquidity characteristics of ETFs that are heavily used for institutional trading purposes,” the Citi strategists said in the report, pointing to “rapid repositioning, risk management and hedging use cases.” They said to expect more ETFs “with narrower exposures, think sector, industry, single factor, single country and even thematic, to have increasingly tactical use.”

Read: Another ‘Volmageddon’? JPMorgan becomes the latest to warn about an increasingly popular short-term options strategy.

Also see: A potential stock-market catastrophe in the making: The popularity of these risky option bets has Wall Street on edge

As usual, here’s your look at the top- and bottom-performing ETFs over the past week through Wednesday, according to FactSet data.

The good…

| Top Performers | %Performance |

| ARK Next Generation Internet ETF ARKW, -2.80% | 9.1 |

| ARK Fintech Innovation ETF ARKF, -4.23% | 7.5 |

| ARK Innovation ETF ARKK, -2.78% | 6.7 |

| ALPS Clean Energy ETF ACES, -2.96% | 5.5 |

| WisdomTree Cloud Computing Fund WCLD, -4.07% | 5.4 |

| Source: FactSet data through Wednesday, Feb. 15, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $ 500 million or greater |

…and the bad

| Bottom Performers | %Performance |

| abrdn Physical Platinum Shares ETF PPLT, +0.48% | -3.8 |

| WisdomTree China ex-State-Owned Enterprises Fund CXSE, -0.32% | -3.5 |

| iShares Asia 50 ETF AIA, +0.32% | -3.4 |

| VanEck Junior Gold Miners ETF GDXJ, -0.40% | -3.3 |

| VanEck Gold Miners ETF GDX, -0.42% | -3.3 |

| Source: FactSet data |