Warren Buffett. (Image: Reuters)

Lending your hard-earned cash to a company for free, sounds like a bad deal (for you) — particularly when it can park the money at a bank and pocket the interest itself. But, in fact, customers do this willingly all the time when they pay in advance for goods and services or entrust their money to a financial intermediary.

As interest rates have risen, business-software companies, online brokerages, fintechs and travel groups that have business models designed to harvest so-called “float income” – interest earned on client funds — are pocketing a financial windfall that’s cushioning them from the economic slowdown the Federal Reserve is trying to engineer to crush inflation.

Banks and insurers are well known winners of rising rates — Warren Buffett’s fondness for the insurance industry stems from its ability to invest customer premiums well in advance of paying out for insured losses. But insurers aren’t the only ones able to pull this trick.

Payroll-processing companies like Automatic Data Processing Inc., Paychex Inc, Paycom Software Inc. and Paylocity Holding Corp are trusted with billions of dollars of client money prior to them transferring it to the client’s employees and the tax authorities. During that interlude, the money gets put in a bank account, invested in commercial paper, government bonds or similar safe assets.

Until recently, this cash earned a pittance, but thanks to the Fed raising rates to a range of 4.5 percent to 4.75 percent, float income has become increasingly lucrative.

Paylocity earned $ 24.5 million on its roughly $ 3 billion of client funds in the six months to December, accounting for nearly all of its pretax profit in that period.

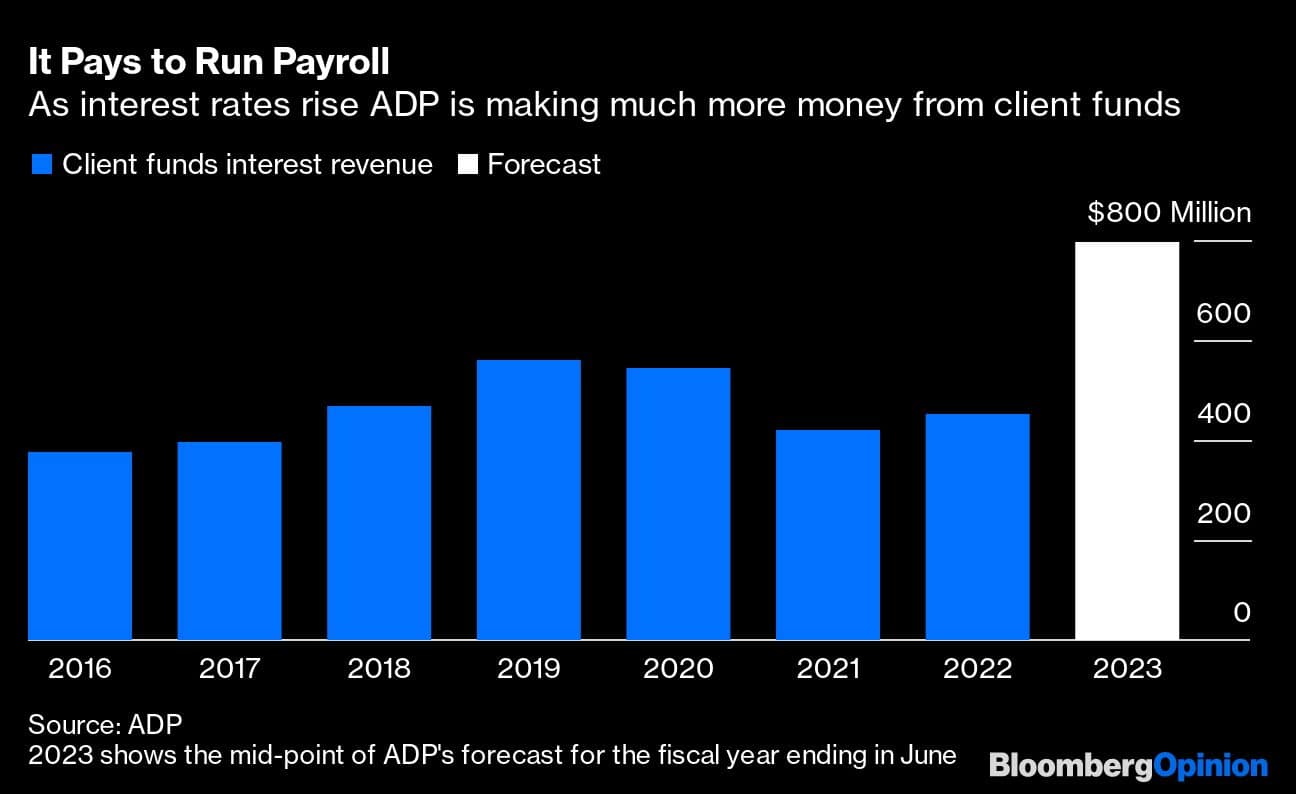

ADP, a much larger rival, holds $ 33 billion in client funds, and the interest earned on that increased 77 percent to $ 187 million in the October to December quarter. The group forecasts around $ 800 million of float interest income in fiscal 2023, equivalent to around 18 percent of anticipated pretax profit.

Rising rates could yet have a downside for payroll processors if their clients lay off staff, while further rate hikes might cause the value of debt securities they’ve invested in to decline. But for now they’re in a comfortable position.

“We’re getting this big tailwind from interest rates, and it doesn’t feel like that’s going to change again in the near-term,” ADP’s chairman Carlos Rodriguez, who was then chief executive officer, told investors in October.

It’s a similar story for fintechs, which hold billions of dollars of customer cash when the client is preparing to invest or transfer money.

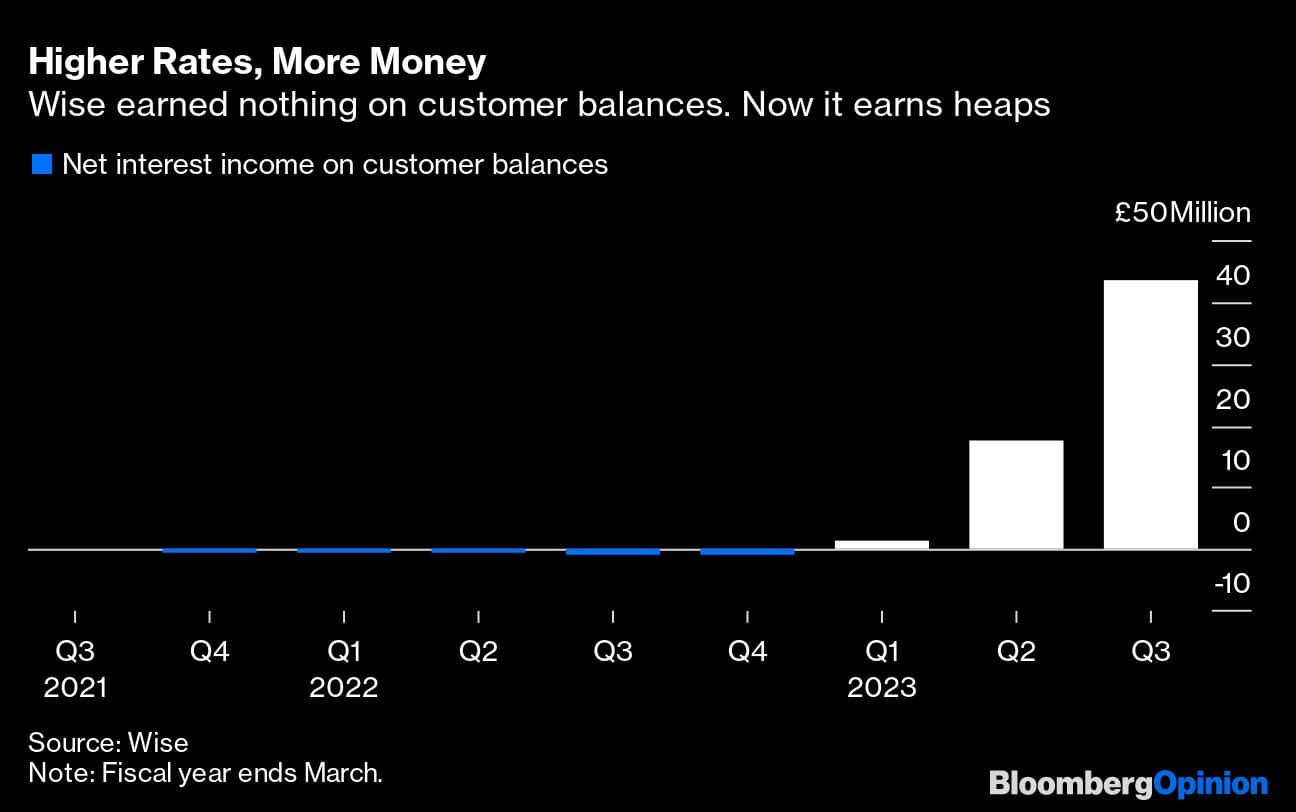

Interest on customer balances drove a 26 percent increase in PayPal Holdings Inc.’s “other value added services” (OVAS) revenue in the fourth quarter, which was five times the pace of transaction-revenue growth. London-based Wise Plc reported £43.5 million ($ 52.6 million) of net interest income on customer balances in the October to December quarter, or 16 percent of total revenue. In the same period a year ago, it reported negative net interest income on those balances.

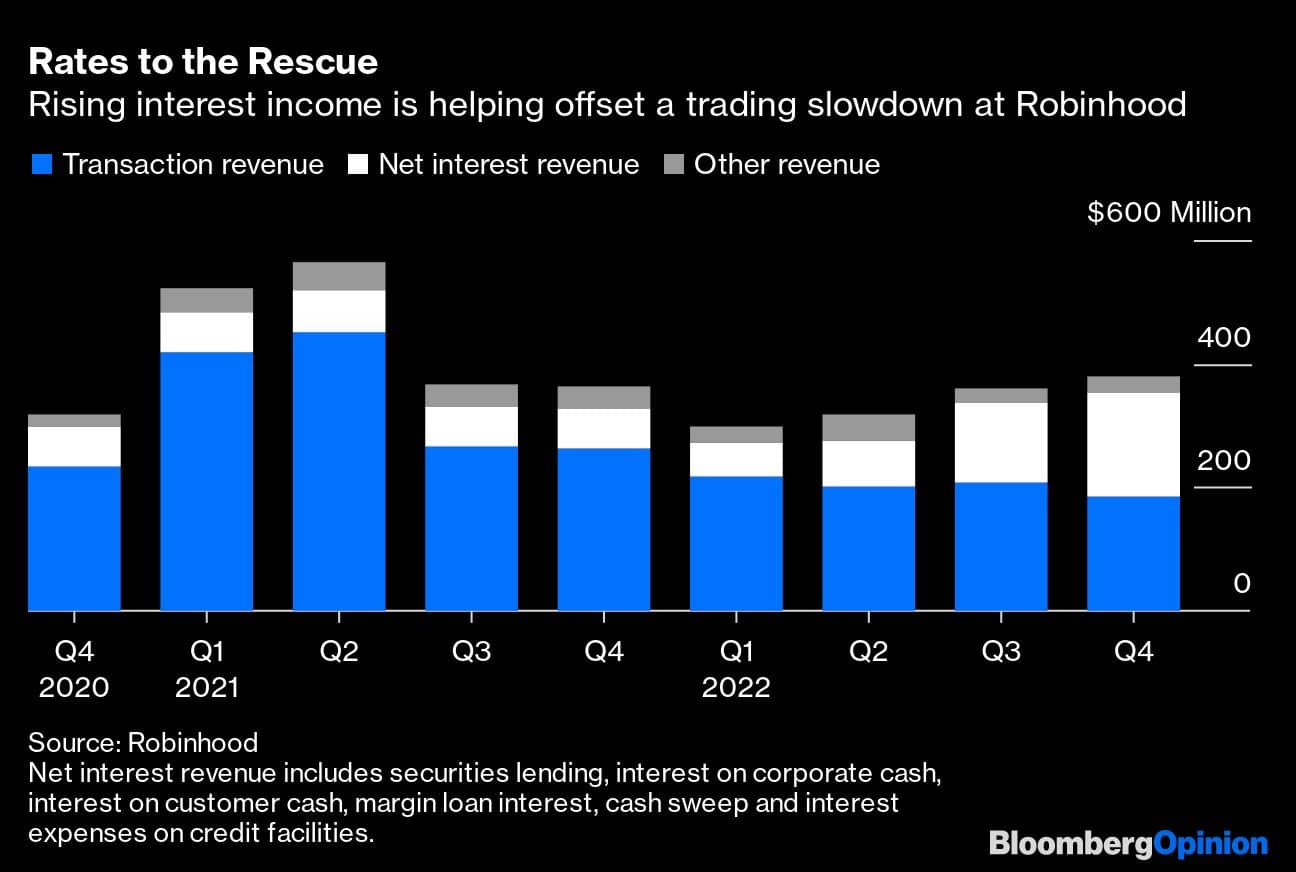

Net interest income contributed 44 percent of Robinhood Markets Inc.’s total revenue in the fourth quarter — well over double the contribution in the same period a year ago. While a big chunk of that relates to securities lending, interest paid by customers on their margin balances and interest on the company’s own cash, Robinhood’s $ 18.5 billion of interest earnings assets are helping counter a decline in retail trading. Its $ 166 million fourth-quarter net loss was its lowest as a public company. Net interest income at the much larger Interactive Brokers Group Inc. almost doubled in the fourth quarter and contributed more than half of total revenue. Its shares this month touched a record high.

Lately, some of these companies have emphasized how they’re sharing the financial benefit of rising rates with customers, which will in turn cap their financial upside.

Wise, which doesn’t have a banking license, in December launched a product that lets customers invest their balances in interest-bearing funds that hold government securities (on which it then earns a fee). Robinhood has increased the interest rate paid on the uninvested cash of customers who pay for its gold premium subscription to 4.15 percent, compared to 1.5 percent for regular accounts. Unused client money is swept up and parked at interest-paying banks, with Robinhood collecting a fee. Interactive Brokers passes through all rate hikes above the first 50 basis points on customers’ cash (providing their balance is sufficiently large).

Travel companies and airlines also hold billions of dollars of client cash because they are often paid for trips months in advance. However, cruise-ship companies and airlines were forced to take on lots of expensive or floating rate debt to survive the pandemic, and hence any positive impact from rising interest income has often been counteracted by much higher interest expenses.

Carnival Corp. held around $ 5 billion of customer deposits at the end of November, which together with its own cash resulted in $ 74 million of interest income for its fiscal 2022 financial year, which is nice to have. However interest expenses totalled $ 1.6 billion. Not good.

Airbnb Inc. is a notable exception to travel industry debt woes. It reported $ 58.5 million of interest income in the third quarter on its $ 14.4 billion cash and securities pile, which includes almost $ 5 billion of customer cash that’s paid to hosts only once guests check in. That’s far in excess of the $ 5.6 million quarterly interest expense, and equates to almost 5 percent of pretax profit. (The company reports fourth-quarter results Tuesday after the market close.) It’s worth remembering Airbnb guests can usually opt to pay only 50 percent of the total upfront and thus retain more of their cash until the time of the booking.

Interest income is not a panacea: Higher rates boost yields at cash-rich firms like Apple Inc, but hurt stock market valuations. While Tesla’s $ 22 billion cash pile is now earning a “ridiculous return,” in the words of CEO Elon Musk, higher rates also make it harder for consumers to afford vehicles.

Even so, with interest rates set to remain elevated for a while, investors should keep a lookout for businesses that generate float revenue. Meanwhile, their customers should pay more attention to ensure they’re not losing out.

Chris Bryant is a Bloomberg Opinion columnist covering industrial companies in Europe.

Credit: Bloomberg