The currency is likely to revive in the second half of 2023 to close the year at 80 to the dollar and rise further to 78 by the end 2024, according to estimates by Capital Economics

The rupee seems to be set for a period of extreme volatility – from deep into the red of 85 to a dollar by the middle of next year to a peak of 78 by the end of 2024 as the greenback wriggles out of a correction and the Indian economy gathers momentum.

“The dollar has stabilised over the past month after its sharp fall in November, and we continue to think that a slowing global economy and worsening risk sentiment will lead to another (possibly final) leg-up in the dollar over the first half of 2023,” Jonas Goltermann, Senior Markets Economist at Capital Economics, said in a note.

The dollar will strengthen further against most other currencies over the coming quarters as global growth slows, and risk appetite remains fragile, he said.

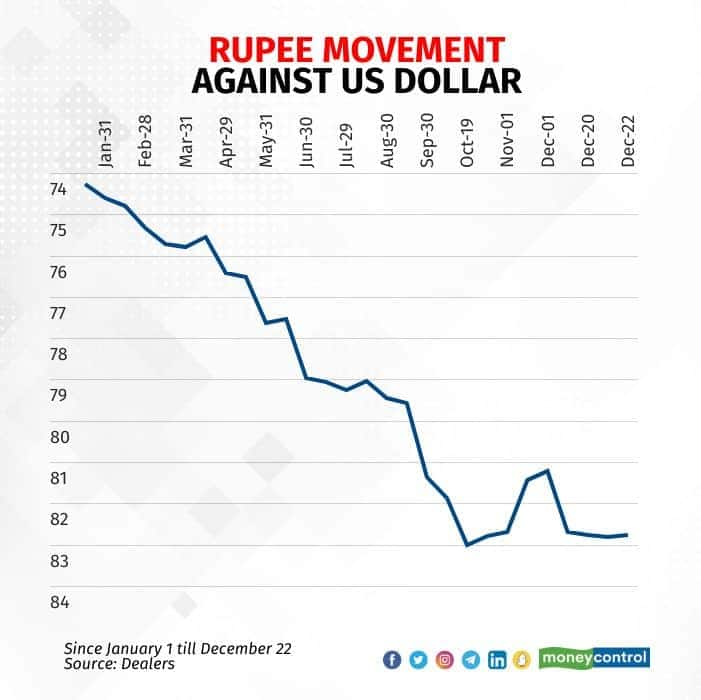

The research house pegs the rupee to trade at 83 to the dollar at end of this month and slip further to 84 at the end of March 2023 and then to 85 by June-end. The currency is likely to revive in the second half of 2023 to close the year at 80 to the dollar and rise further to 78 by the end 2024, according to estimates by Capital Economics.

The rupee has been buffeted by financial tightening in the US and financial market volatility that has battered most developed market and emerging market currencies.

The unit has fallen to fresh record lows of 83 to a dollar this year but has done better than most of its peers. Still, slowing global growth and a widening current account deficit could hurt the currency.

So far this year, the central bank has kept the volatility in check by selling dollars in the market. The government and the Reserve Bank of India have also brought in a raft of measures to boost the rupee, including the facilitation of trade in rupees with certain countries.

“The story of the Indian rupee is one of resilience and stability and we will continue to act with excessive volatility of exchange rate and orderly evolution of exchange rate,” RBI Governor Shaktikanta Das said earlier in December.

The sanctions on Russia earlier this year had included exclusion of its key banks from the global interbank payments systems. Meanwhile, Indian imports of crude oil from Russia surged as prices spiked.

Despite a widening trade deficit and the likely breach of the current account deficit threshold of three percent of GDP this fiscal year, India’s curreny is doing much better than in 2013 when the economy was seen as part of the fragile five in wake of the Federal Reserve’s taper tantrum.

`); } if (res.stay_updated) { $ (“.stay-updated-ajax”).html(res.stay_updated); } } catch (error) { console.log(‘Error in video’, error); } } }) }, 8000); })