The Nifty50 index is now more than 18 percent up from its June lows and is gradually gathering steam to reclaim 18,000 mark with crucial support at 17,500, experts said.

Sunil Shankar Matkar

September 12, 2022 / 08:28 AM IST

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] < 0){ // $ (‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”); // $ (‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); //} if(resData[stkKey][‘percentchange’] >= 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] < 0){ $ (‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”); //$ (‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); $ (‘#gainlosstxt_’+articleId).find(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); } $ (‘#volumetxt_’+articleId).show(); $ (‘#vlmtxt_’+articleId).show(); $ (‘#stkvol_’+articleId).text(resData[stkKey][‘volume’]); $ (‘#td-low_’+articleId).text(resData[stkKey][‘daylow’]); $ (‘#td-high_’+articleId).text(resData[stkKey][‘dayhigh’]); $ (‘#rightcol_’+articleId).show(); }else{ $ (‘#volumetxt_’+articleId).hide(); $ (‘#vlmtxt_’+articleId).hide(); $ (‘#stkvol_’+articleId).text(”); $ (‘#td-low_’+articleId).text(”); $ (‘#td-high_’+articleId).text(”); $ (‘#rightcol_’+articleId).hide(); } $ (‘#stk-graph_’+articleId).attr(‘src’,’//appfeeds.moneycontrol.com/jsonapi/stocks/graph&format=json&watch_app=true&range=1d&type=area&ex=’+stockType+’&sc_id=’+stockId+’&width=157&height=100&source=web’); } } } }); } $ (‘.bseliveselectbox’).click(function(){ $ (‘.bselivelist’).show(); }); function bindClicksForDropdown(articleId){ $ (‘ul#stockwidgettabs_’+articleId+’ li’).click(function(){ stkId = jQuery.trim($ (this).find(‘a’).attr(‘stkid’)); $ (‘ul#stockwidgettabs_’+articleId+’ li’).find(‘a’).removeClass(‘active’); $ (this).find(‘a’).addClass(‘active’); stockWidget(‘N’,stkId,articleId); }); $ (‘#stk-b-‘+articleId).click(function(){ stkId = jQuery.trim($ (this).attr(‘stkId’)); stockWidget(‘B’,stkId,articleId); $ (‘.bselivelist’).hide(); }); $ (‘#stk-n-‘+articleId).click(function(){ stkId = jQuery.trim($ (this).attr(‘stkId’)); stockWidget(‘N’,stkId,articleId); $ (‘.bselivelist’).hide(); }); } $ (“.bselivelist”).focusout(function(){ $ (“.bselivelist”).hide(); //hide the results }); function bindMenuClicks(articleId){ $ (‘#watchlist-‘+articleId).click(function(){ var stkId = $ (this).attr(‘stkId’); overlayPopupWatchlist(0,2,1,stkId); }); $ (‘#portfolio-‘+articleId).click(function(){ var dispId = $ (this).attr(‘dispId’); pcSavePort(0,1,dispId); }); } $ (‘.mc-modal-close’).on(‘click’,function(){ $ (‘.mc-modal-wrap’).css(‘display’,’none’); $ (‘.mc-modal’).removeClass(‘success’); $ (‘.mc-modal’).removeClass(‘error’); }); function overlayPopupWatchlist(e, t, n,stkId) { $ (‘.srch_bx’).css(‘z-index’,’999′); typparam1 = n; if(readCookie(‘nnmc’)) { var lastRsrs =new Array(); lastRsrs[e]= stkId; if(lastRsrs.length > 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); }); function redirectToTradeOpenDematAccountOnline(){ if (stock_isinid && stock_tradeType) { window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=$ {stock_isinid}&ex=$ {stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’); } }

The market rebounded with the Nifty50 closing above the recent consolidation range rising 1.68 percent in the week ended September 9 following correction in the previous two weeks. The index is now more than 18 percent up from its June lows and is gradually gathering steam to reclaim the 18,000 mark with crucial support at 17,500, experts said.

The index rallied nearly 300 points to close above 17,800, while there was a bit of outperformance by the broader space as the Nifty Midcap 100 and Smallcap 100 indices gained 2 percent and 3.3 percent during the week.

Last week’s rally was driven largely by IT, infrastructure, banks and metals, which gained 2-3.5 percent.

“Whenever financial counters contribute to the rally, it is construed as a healthy rally. Moreover, the most laggard heavyweight basket, IT, showed some encouraging signs towards the fag end of the week. This provided credence to the move and conviction to retest the recent psychological level of 18,000 in the week beginning September 12,” Sameet Chavan, Chief Analyst-Technical and Derivatives at Angel One, said.

He advised traders to continue with their recent ‘buy on declines’ strategy and use decline towards the support zone of 17,675 – 17,500 to add fresh longs.

Also, the broader end of the spectrum is clearly on a roll and hence, one should keep focusing on potential movers from the cash segment, which are likely to fetch higher returns, Sameet said.

Let’s take a look at the top 10 trading ideas by experts for the next three-four weeks. Returns are based on the September 9 closing prices:

Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities

Creditaccess Grameen: Buy | LTP: Rs 1,030 | Stop-Loss: Rs 940 | Target: Rs 1,154 | Return: 12 percent

The stock is forming a symmetrical triangle on the daily chart. This is a bullish consolidation as it is consolidating above the break-out level of Rs 1,000.

Based on that, on dismissal of the trading range, the stock may go up to Rs 1,300 in the long run with a minor hurdle at Rs 1,154. Here’s a buy at current levels and more on the decline around Rs 980-990 and. The stop-loss should be at Rs 940.

Firstsource Solutions: Buy | LTP: Rs 116.5 | Stop-Loss: Rs 110 | Target: Rs 130 | Return: 12 percent

On a weekly basis, the stock is trending positively, indicating a break and reversal in the prevailing trend. The prevailing trend of the stock is negative, however, for the past 3 days, it is showing signs of pausing weakness on daily basis and has crossed the upper barrier at Rs 114.

The strategy should be to accumulate on every dip with a final stop-loss at Rs 110. On the upside, it has a resistance of Rs 130 and Rs 145.

Godrej Consumer Products: Buy | LTP: Rs 938 | Stop-Loss: Rs 880 | Target: Rs 1,050 | Return: 12 percent

The stock is in pull back mode from the level of Rs 694. Currently, it is at Rs 938. It has the scope to move beyond Rs 1,000 to hit-retest the level of Rs 1,050.

In the best-case scenario, it may even jump to the previous high which is at Rs 1,138. Buying is advisable between Rs 940 and Rs 930 and keep a stop-loss at Rs 880 for the same.

Nandish Shah, Senior Derivative & Technical Analyst at HDFC Securities

Kansai Nerolac Paints: Buy | LTP: Rs 513 | Stop-Loss: Rs 485 | Target: Rs 570 | Return: 11 percent

The stock price has broken out on the weekly chart to close at highest level since February 2022. Primary and intermediate trend of the stock is positive as it is trading above its 100 and 200 weeks EMA (exponential moving average).

Momentum Oscillators – RSI (relative strength index – 11) and MFI (money flow index – 10) have placed above 60 on the weekly chart and sloping upwards, indicating strength in the current uptrend of the stock.

Plus DI (directional indicator) is trading above minus DI while ADX (average directional index) line is placed above 25, indicating stock price is likely to gather momentum in the current uptrend. One can buy the stock in the range of Rs 513-500.

Central Bank of India: Buy | LTP: Rs 20.5 | Stop-Loss: Rs 18.5 | Target: Rs 24.5 | Return: 20 percent

The stock price has broken out on the weekly chart from the downward sloping trendline, adjoining the highs of July 2, 2021 and April 8, 2022. Short term trend of the stock turned positive as stock price is trading above its 5 and 20 weeks EMA.

Momentum Oscillators – RSI (11) and MFI (10) have placed above 60 on the weekly chart and sloping upwards, indicating strength in the current uptrend of the stock. One can buy the stock in the range of Rs 20.5-19.5.

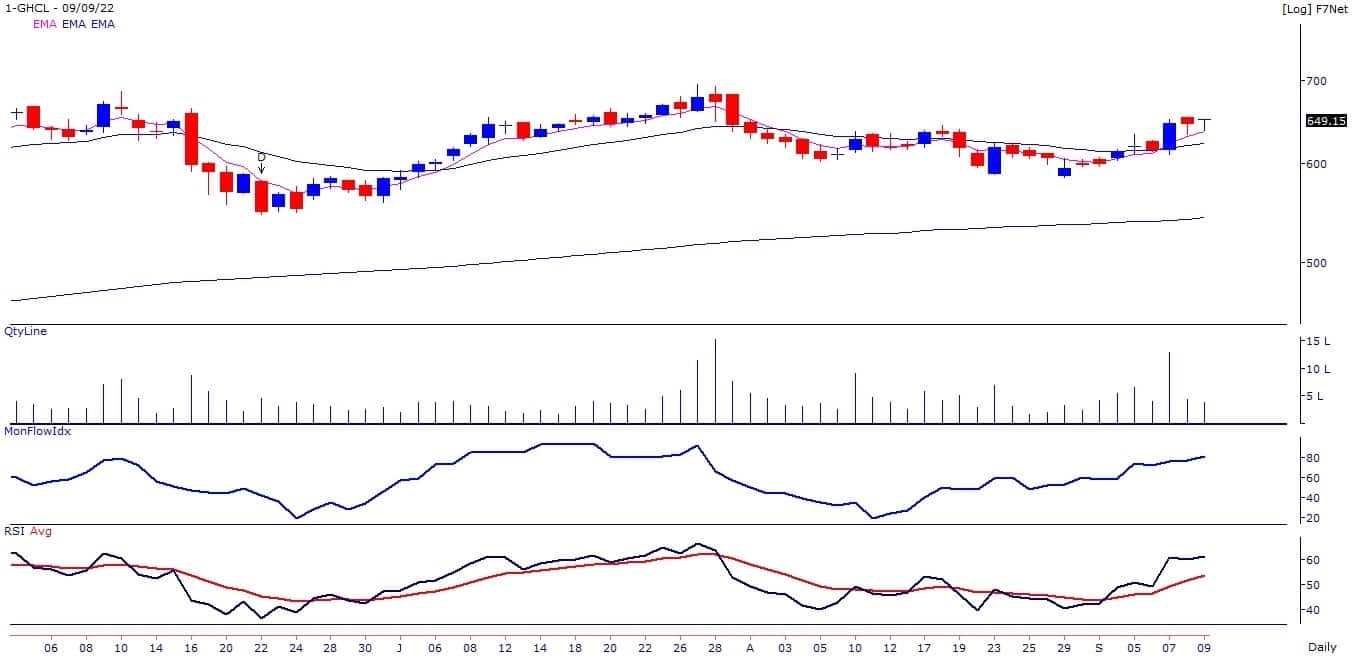

Gujarat Heavy Chemicals: Buy | LTP: Rs 649.15 | Stop-Loss: Rs 610 | Target: Rs 720 | Return: 11 percent

The stock price has broken out on the daily chart where it closed at highest level since July 28, 2022. Primary trend of the stock is positive as it is trading above 100 and 200 days exponential moving averages.

Oscillators like RSI and MFI are placed above 50 and rising upwards, indicating strength in the current uptrend. Stock price is forming higher top higher bottom candlestick pattern on the weekly charts. One can buy the stock in the range of Rs 649-630.

Vidnyan Sawant, AVP – Technical Research at GEPL Capital

State Bank of India: Buy | LTP: Rs 553.35 | Stop-Loss: Rs 508 | Target: Rs 625 | Return: 13 percent

SBI is making a fresh life time highs now a days and sustaining at higher levels which shows strong positive undertone of the stock for the medium to longer term.

On the weekly time frames, the stock is giving breakout of Bullish Flag pattern with volume confirmation in the latest week which strengthen the bullish characteristic of the stock.

On the smaller time frames like daily as well the stock is giving breakout of Cup & Handle pattern with volume confirmation in the latest trading session which is in line with the overall bullish structure of the stock.

The momentum indicator, RSI plotted on weekly and daily timeframes have sustained above 65 mark which tells that the prices are in strong positive momentum.

We recommend to buy this stock for the target of Rs 625 with stop-loss at the level of Rs 508 on the closing basis.

Tech Mahindra: Buy | LTP: Rs 1,126.65 | Stop-Loss: Rs 1,040 | Target: Rs 1,290 | Return: 14 percent

Tech Mahindra has given a strong rally from Rs 471 – Rs 1,838 since March 2020 to December 2021. After that it corrected and formed a base at Rs 990 to Rs 940 zone which is a 61.8 percent Fibonacci retracement levels of the previous advance from Rs 471 to Rs 1,838.

Now the stock is respecting that support level and started moving up and sustaining at previous 3 month’s high which shows initial positive current of the stock.

On the Weekly timeframe, the stock is forming higher top higher bottom formation and sustaining above its 20 Week SMA (Rs 1,0090) for the first time since January 2022 indicated beginning of trend on the upside after the correction.

We witnessed a rise in volume at every up move indicating developing bullish interest in the stocks at lower levels.

RSI plotted on the daily and weekly time frames is moving up with the prices which confirms the strong positive momentum in the counter.

Going ahead we expect the prices to go higher till Rs 1,290 followed by Rs 1,570 mark and the stop-loss must be placed at Rs 1,040 on the closing basis.

Carborundum Universal: Buy | LTP: Rs 879 | Stop-Loss: Rs 790 | Target: Rs 1,035 | Return: 18 percent

Carborundum Universal rallied from Rs 178 – Rs 1035 since March 2020 to January 2022. After that it has corrected till Rs 652 levels and took strong support of 20 months SMA and started moving up and currently the stock is sustaining at its previous 7 months high which shows that the stock is once again ready to move up after a shallow retracement.

On the weekly charts, the stock is maintaining its higher top higher bottom formation and formed CIP (Change in Polarity) pattern near Rs 800 mark which is a bullish structure for the stock for medium to longer term.

The stock has given a breakout of Cup & Handle pattern on the daily charts which confirms the bullish nature of the stock for the short term as well.

RSI plotted on the Weekly timeframe is maintaining higher top higher bottom formation which shows a strong positive momentum in the prices.

We recommend to buy this stock for the target of Rs 1,035 with stop-loss at the level of Rs 790 on the closing basis.

Ruchit Jain, Lead Research at 5paisa

Max Healthcare Institute: Buy | LTP: Rs 413.3 | Stop-Loss: Rs 388 | Target: Rs 454 | Return: 10 percent

The stock has consolidated within a range in last few months which has led to formation of ‘Symmetrical Triangle’ pattern on the daily chart. The prices have now given a breakout from the pattern with good volumes.

The ‘RSI Smoothed’ oscillator has also given a positive crossover and is indicating a positive momentum. Hence, we expect further upmove in the stock in the short term.

So traders can look to buy the stock around current market price of Rs 413 and look to add on dips towards Rs 400 for potential short term targets of Rs 432 and Rs 454. The stop-loss on long positions should be placed below the support of Rs 388.

Glenmark Pharma: Buy | LTP: Rs 389 | Stop-Loss: Rs 366 | Target: Rs 427 | Return: 10 percent

In last few months, the stock has seen a corrective phase from its swing highs of Rs 687 which was seen in the month of July 2021. The stock has retraced the previous uptrend by 61.8 percent and is trading near the support since last few weeks.

The volumes on the daily chart have started increasing indicating a buying interest in the stock. The RSI oscillator is also indicating a positive momentum and hence, we expect a pullback move in the stock in the near term.

Hence, traders can look to buy the stock in the range of Rs 388-385 for potential short term targets of Rs 405 and Rs 427. The stop-loss on long positions should be placed below the support of Rs 366.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.