China flag (File photo)

A gulf has opened up between Chinese stocks and the rest of emerging-market equities in recent weeks as pandemic recoveries have diverged. That parting of ways is likely to be short-lived, fund managers say.

Chinese equities are seen making up lost ground as the extreme pessimism toward its economy recedes and authorities take further steps to revive stuttering growth. At the same time, the gathering enthusiasm over other developing-nation equities could peter out amid a global slowdown, causing their correlation with China to reassert itself.

“I’ve seen this decoupling story many times in the last two plus decades, it never pans out,” said Zhikai Chen, head of Asian and global emerging market equities at BNP Paribas Asset Management, which oversaw the equivalent of $ 504 billion globally at the end of June. “From a trade flows perspective, and how big the Chinese economy is for commodity demand, it seems a heroic assumption.”

The MSCI China Index has dropped about 6% over the past month, whereas a similar MSCI gauge tracking the rest of emerging markets has jumped 7% in the same period. The same disparity has also emerged in bond markets with Chinese debt eking out a gain of under 1%, compared with a 4% return for emerging markets as a whole.

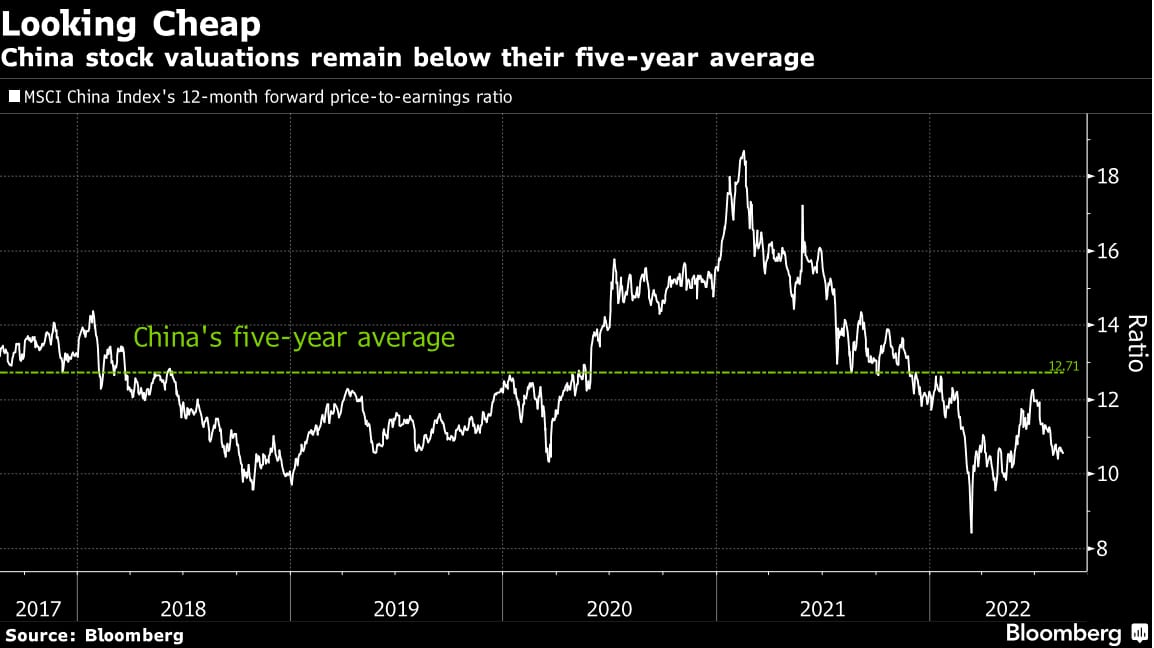

Valuations have become so depressed for Chinese shares that there’s plenty of room for a rebound if sentiment stabilizes. Authorities signaled their intention to bolster growth last week, with the central bank unexpectedly cutting a key policy rate. The government may unleash more pro-growth measures ahead of the National Party Congress expected to take place later this year, as President Xi Jinping seeks a third term.

Meanwhile, increasing doubts are arising over the rest of emerging markets.

The dollar has started to strengthen again from a low set earlier this month, slowing foreign fund inflows into developing nations as a whole. Financial conditions are also tightening globally as central banks raise interest rates to rein in inflation, weighing on the growth outlook for many emerging economies. Close links to the slowing US economy are also set to drag down performance.

Emerging markets outside China have held up “mostly because of perhaps over-optimism that the US economy is not going to slow as much as previously expected and that the Fed won’t have to tighten monetary policy that much,” said David Chao, a global market strategist in Hong Kong at Invesco, which oversaw $ 1.45 trillion as of July. “I’m not sure I buy that.”

In Asia, South Korea and Taiwan look particularly vulnerable as pullbacks in spending by their largest customers such as Apple Inc. underscore a slowdown in demand for chips, manufacturers of which are index heavyweights.

That said, some sectors in EM outside China may continue to outperform, with Indonesia and Brazil supported by energy shares and India by financials, which are prospering amid a revival in domestic demand.

Reasons to Recouple

The divergence between China and other emerging markets will also start to close as the slowdown in the world’s second-biggest economy spreads out to its closest trading partners, such as Korea and Malaysia.

“In the long-term, whether emerging markets can ‘decouple’ from a slowing China to outperform depends on their starting valuations and whether they have growth drivers outside of exporting commodities to build Chinese houses and infrastructure,” said Ian Samson, a fund manager at Fidelity International in Hong Kong.