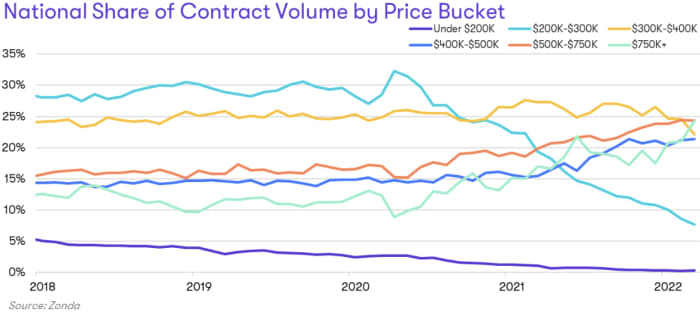

Homeownership became out of reach for millions of Americans following the recent boom in home prices. Lower-income families have been hit especially hard, with the share of new homes selling for under $ 300,000 plummeting to 10% from 35% in just two years.

A number of factors, including more than a decade of limited homebuilding, a sudden and sharp rise in demand related to demographics, seriously low mortgage interest rates, and lifestyle changes, and surging homebuilding costs caused by pandemic disruptions are all partly to blame.

There are also four key structural issues related to land, labor, regulation, and NIMBYism that make it increasingly difficult to get entry-level homes built today, exacerbating the issue of affordability.

Land prices are up

Land is a finite resource. Over time, the availability of land in desirable areas goes down, which pushes prices up. This is critical as land makes up between 20% and 30% of home prices in more affordable and development-friendly markets and 40% to 50% in land-constrained and coastal markets.

Over the past two years, land prices have spiked in response to increased demand. For-sale homebuilders that were rushing to secure land were competing with other buyers also in hurry.

In response, builders expanded their search radius to less-central locations, but it is not a surefire plan for creating housing at more affordable prices. Not only have those plots gone up in price, but in some cases, the land lacks entitlements (the legal approval needed for development) and/or infrastructure (water, sewers, roads and the like), both of which are time-consuming and expensive to add.

Land prices can adjust down during a protracted housing market correction or recession. The finite nature of the resource, though, means pricing will remain a hurdle when trying to build lower-priced homes in the future.

Labor is scarce

There were over a million residential construction workers during the mid-2000s housing boom. Total employment dropped to just 550,000 in 2011 during the housing bust as the industry struggled with weak demand and limited job opportunities. Many skilled workers left the housing industry permanently as they reskilled and found jobs in other industries perceived to be more stable.

Employment in residential construction has gradually improved to today’s roughly 900,000, but 62% of homebuilders report that they are still facing a labor shortage, per Zonda data. Retirements and alternative employment opportunities at places like Amazon also play a role.

Skilled workers within the construction industry have enjoyed a decade of rising wages, with June earnings up 5.6% compared to last year. Higher wages are good for employees but also contribute to higher homebuilding costs. Less labor-intensive building options exist, like 3D printing of homes, modular construction and other alternative building methods, but none have reached sufficient scale in the marketplace.

Regulation adds time and costs

State and local governments play a big role in the homebuilding industry by setting rules and regulations related to labor, the environment, community integrity, building codes, and more. The National Association of Homebuilders estimates that regulations imposed by governments at all levels account for roughly 24% of the final price of a new single-family home.

Pandemic-induced disruptions only made matters worse. The most prominent one is a labor shortage, similar to that experienced in the construction industry. Local municipalities found themselves understaffed resulting increased timelines for entitlements, permitting, inspections and other government services. This, in turn, increased costs for builders and developers. These issues have yet to abate.

Resistance from local NIMBYs

NIMBY or “not in my backyard” represents resistance to new development over fear of increased traffic, a strain on local resources like schools, pollution, and discomfort around who the new residents might be. The prevalence of local NIMBYism suppresses new construction as existing residents look to preserve the quality of life they have grown accustomed to. Without more construction, today’s large buyer pool is left competing for limited attainable housing supply.

More opinion: Restrictive zoning is the main factor squeezing the supply of housing

Moving forward

Home prices have generally trended up over the past 50 years barring a few exceptions during slower economic times. Both the development community and policymakers are acutely aware of the need for more lower-priced housing, but the market conditions and structural factors laid out pose challenges.

Many builders are trying to adjust with denser communities, smaller homes, and infill developments, though many solutions are met by pushback from residents and local leaders.

Consumers need to reconsider their expectations as well. Homeownership allows for stability and wealth building, but the desired bells and whistles liked upgraded countertops and high ceilings have become increasingly limited in entry-level homes.

To achieve true attainable housing going forward, everyone will need to do their part. Consumers should plan for tradeoffs, builders should continue to seek innovative ways to provide more affordable housing, governmental bodies should drive for improved efficiencies, and NIMBY advocates should consider the negative impacts of constrained housing inventory.

Ali Wolf is the chief economist for Zonda, the largest new construction database in North America.