Financial markets are supposed to follow a strict division of labour. The central bank sets the risk-free rate to stimulate or cool the overall economy, but it is “market-neutral”: it does not favour any asset over another. Private investors choose who to lend to and at what risk premium. Combine the two judgments, and the economy should have a set of interest rates that reflects economic conditions.

Your browser does not support the <audio> element.

Listen to this story

Save time by listening to our audio articles as you multitask

The European Central Bank (ecb), however, thinks markets are not doing their job—or at least not the way it wants. It is preparing to intervene in two novel ways: by limiting what it deems an acceptable difference (or spread) in rates between sovereign borrowers; and by greening its bond purchases and banking rules. In doing so it will abandon market neutrality and discriminate between assets.

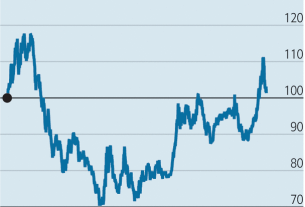

Start with sovereign spreads. On July 21st the ecb is expected to unveil a new tool meant to prevent borrowing costs among euro-zone governments from diverging too much. The aim is to ensure that monetary-policy decisions work similarly across the bloc. If rising rates, say, led to ballooning spreads, with the extra costs transmitted to private borrowers, some regions might feel a bigger squeeze than others.

The currency union has a history of such divergence. During the euro crisis, between 2011 and 2015, a bigger spread between sovereigns also meant tighter financial conditions for private firms and households. Yet some argue that the ecb’s mooted tool is not needed today. Europe has cleaned up its banks; the ecb has pledged to do whatever it takes to save the euro. In the private sector fragmentation is less of an issue: lending rates to firms in Italy are at the level they were before the euro crisis, relative to Germany’s, despite widening sovereign spreads.

Moreover, the policy looks tricky to implement. The ecb will need to define what counts as an “excessive” spread. That is hard, because economists do not know what the true, justified interest rate is for any given bond. The tool could encourage vulnerable countries to borrow at will, knowing the ecb is capping their spreads. So strings may have to be attached. And if it is deemed akin to monetary financing, which is barred under the Maastricht treaty, it may stumble in the courts.

Still, the ecb is likely to forge ahead. There is an emerging consensus that, in a diverse monetary union, managing sovereign spreads is part of monetary policy.

Increasingly the ecb also sees as its duty to curb the financial risks of climate change—its second break away from market neutrality. On July 4th the bank said it would “tilt” its corporate-bond buying towards issuers “with better climate performance”. The central bank is also making it harder to pledge carbon-intensive assets as collateral for loans from the central bank.

The ecb‘s neutrality was always a myth, says Pierre Monnin, an economist at the Council on Economic Policies, a think-tank in Zurich. Market-based estimates of risk are inevitably flawed when it comes to climate change, because no comprehensive system of carbon pricing exists. By failing to correct for unpriced “externalities”—harms imposed by borrowers on third parties—the ecb’s nominally neutral stance in fact reinforced such inefficiencies. Fossil-fuel firms also rely more on bond financing than renewables. But although these arguments are economically sound, it is not the traditional role of central banks to price externalities when the government has failed to act.

And are the ecb’s own risk assessments up to the task? One yardstick is the adequacy of its first climate-stress test, whose results were published on July 8th. These suggest that 41 of Europe’s biggest banks could together suffer about €70bn in credit and market losses over the next three years in the event of more frequent natural disasters and a disorderly energy transition. That is only around 4% of these banks’ aggregate capital, and far less than the €400bn of damage the ecb reckons might hit them in an economic downturn.

Yet the ecb itself admits the stress test is only a “learning exercise”, rather than an attempt to find out if the banks have a big-enough buffer to withstand climate chaos. Most banks do not have enough data to properly estimate climate losses; many lack the tools for incorporating climate risks into lending decisions. The ecb‘s first stab at totting up the potential costs of a messy transition is most probably a gross underestimate. By dropping market neutrality, the central bank is taking a more political role. Whether its visible hand ends up bending markets in the right direction is another question. ?

For more expert analysis of the biggest stories in economics, business and markets, sign up to Money Talks, our weekly newsletter.