Naveen Kulkarni of Axis Securities

The sense on the Street is that India’s banking shares could be a big mover over the next 12 months, as all the positives start getting priced in. In conversation with Moneycontrol, Naveen Kulkarni, Chief Investment Officer at Axis Securities also believes that the picture for Indian IT sector ‘remains quite complex’ at this juncture. He advices investors to be selective, and also to wait for another quarter to understand the changing trends here.

Here’s the full interaction.

Do you think the new-age tech companies will delay their IPO plans, especially after already-listed new-age companies were hit quite badly in the recent turmoil and corrected more than others?

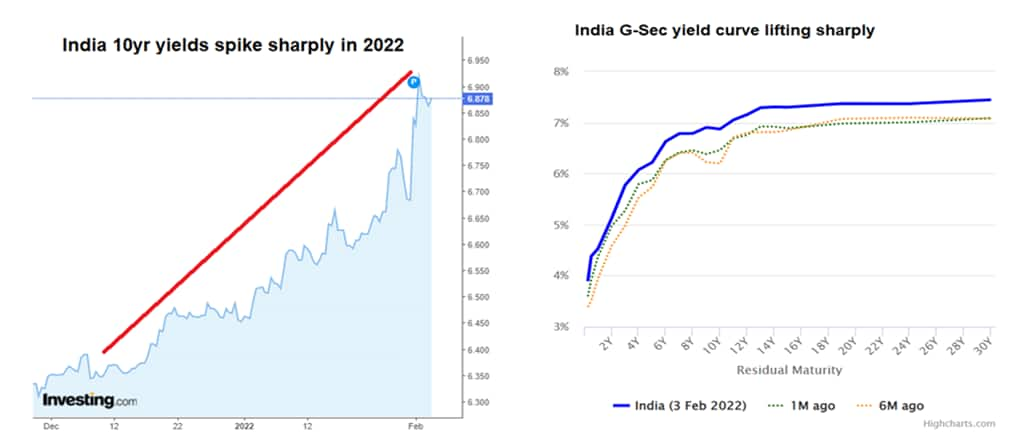

The market has changed for technology companies after the significant correction seen on the Nasdaq. As central bankers around the world try to manage the liquidity – which is fuelling global inflation – the cost of funds will continue to rise. This will have the most profound impact on new-age tech companies, which have inverted the basics of business.

As liquidity in the system eases, even the new-age tech companies will demonstrate a clear path to profitability and cash flows. Technology companies with strong business models and a path to cash flows will still tap the IPO market, albeit at lower valuations compared to the giddy levels of last year.

Thus, it can be assumed that many new-age companies are likely to delay their IPOs, and weaker companies may never become public. They could get merged with the stronger ones as the global liquidity taps dry up.

Indian markets have seen a correction in line with the global trend. Have you spotted any big investment themes in India?

Indian equity markets have seen a correction in-line with the global trend, but it is also important to note that India was one of the best performers last year. While the foreign institutional investors have been selling a significant sum of equity, it has been absorbed by the domestic institutional investors.

Almost 50 per cent of the selling has been in the banking sector, and that has been absorbed, with banking stocks starting to stabilize. This indicates the inherent strength of the sector. The Indian banking space, including the frontline PSU banks, has seen a significant improvement in RoE (return on equity) and profitability. The system NPAs (non-performing assets) have reduced significantly, and credit growth is picking up. While the cost of funds is also rising, this may not be a serious negative for the banks, as assets are repriced before liabilities. Thus, the Indian banking system could be a big mover over the next 12 months.

Apart from banks, the Automobile sector will also see benefits of cooling commodity prices like Steel and Aluminium. New steel contracts could get negotiated at a lower price which will help improve the margins. The chip shortage will also start to abate significantly in the forthcoming quarters, helping top OEMs raise production.

The IT sector, one of the biggest gainers since 2020, has been slaughtered in the current turmoil. Recession fear is one of the reasons behind this correction, though companies have major order books in hand. What are your thoughts and is it the right time to buy this space or should one be selective?

While recession will pose a serious challenge to the IT sector, the inflationary headwinds faced by the large corporations in the west will pose serious challenges to their business models. This could mean more outsourcing to Indian companies, but it might also result in delays in large transformational deals.

The picture for the Indian IT sector remains quite complex at this juncture. It will help to remain selective, but also wait for one more quarter to understand the changing trends in the IT sector.

As far as India is concerned, considering the global environment, are we done with the correction, or the worst is yet to be over?

The correlation of Indian equity markets with the global markets continues to remain quite high. However, the Indian market also has corrected less than many global markets. So, if global markets continue to fall, the Indian markets will also fall, but the intensity of the fall is likely to be much lower.

The FII selling has been wiping out entire flows of 2021 and mid of 2020. Thus, the selling pressures are likely to abate, and if foreign markets stabilize, Indian markets should see positive action.

Now the Street knows the inflation risk, recession fear, faster rate hikes by central banks, geopolitical tensions, earnings downgrades, FII selling, etc. Do you think the market is fully priced in all these risk factors? Also have you noticed any other risk factors that the market has not started pricing in yet?

The selling pressure from foreign institutional investors has been very intense. After almost two years, flows are closer to zero even as fundamentals of the Indian companies seem to be improving significantly. Thus, it can be assumed that the market has priced in the future challenges.

If we look at the top 500 stocks, more than 80 per cent of the stocks have corrected by more than 20 per cent and almost 60 per cent of the stocks have seen a correction of more than 30 per cent. The number of stocks trading above the 200-day moving average is just in the high teens, which is similar to a taper tantrum or demonetization.

Thus, it can be safe to assume that the market has priced in the challenges, but more corrections to the global markets cannot be ruled out. Nonetheless, it seems logical to assume a significant portion of the correction is over, and it’s time to make calibrated investments with a long-term view.

Disclaimer: The views and investment advice expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with their certified advisors before taking any investment decisions.