Considering the positive placement of ‘RSI-Smoothened’ oscillator, we expect Wipro to convincing surpass immediate hurdles. One can look to buy for a near term target of Rs 498.

Sameet Chavan

June 06, 2022 / 06:47 AM IST

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

Sameet Chavan, Chief Analyst-Technical and Derivatives at Angel One

Late recovery in our market last week seemed to have anticipated some relief on the global front. In-line with this, we witnessed some pleasant environment across the globe last Monday, which resulted in a gap-up opening in domestic markets to kick-start the week on a cheerful note. The benchmark index Nifty opened with nearly 200 points bump up to set the tone for the entire week.

However, the market once again failed to keep up the momentum in the following sessions. We saw the market struggling around 16,700 in the first half of the week; led to some stock specific correction. Fortunately, 16,400 provided a decent support on weekly expiry day which pulled the markets higher at the close and then influenced the positive start last Friday too. However, after the opening, the market looked nervous throughout the session to eventually end with marginal cuts below 16,600.

On a weekly basis, we may see the Nifty gaining nearly one and half-a-percent but if we dive deep into the intra-week activity, we can clearly see that there was no conviction for the major part of the week (especially at the higher end).

Now from a technical perspective, the Nifty has finally managed to surpass the recent sturdy wall of 16,400; but it struggled as we approached the next barrier around 16,700 – 16,800. In fact, the way overall things panned out on Friday, it’s a reflection of how traders are a bit wary and are skeptical of carrying positions over the weekend. Because globally although we witnessed some relief, we are still not completely out of the woods.

For the coming week, one needs to keep a close tab on global developments and price-wise, 16,400 is the level to watch out for. Till the time we remain above it, we can continue with a ‘buy’ on decline strategy. However, the higher side is till capped where 16,800 is to be seen as immediate hurdle after which 17,000 is to be considered as key psychological level.

Some of the heavyweight spaces did well this week but they were unable to lift the overall sentiments in the latter half. Hence, traders are advised not to trade aggressively and should ideally be very selective in stock specific trades also.

Here are two buy calls for current week:

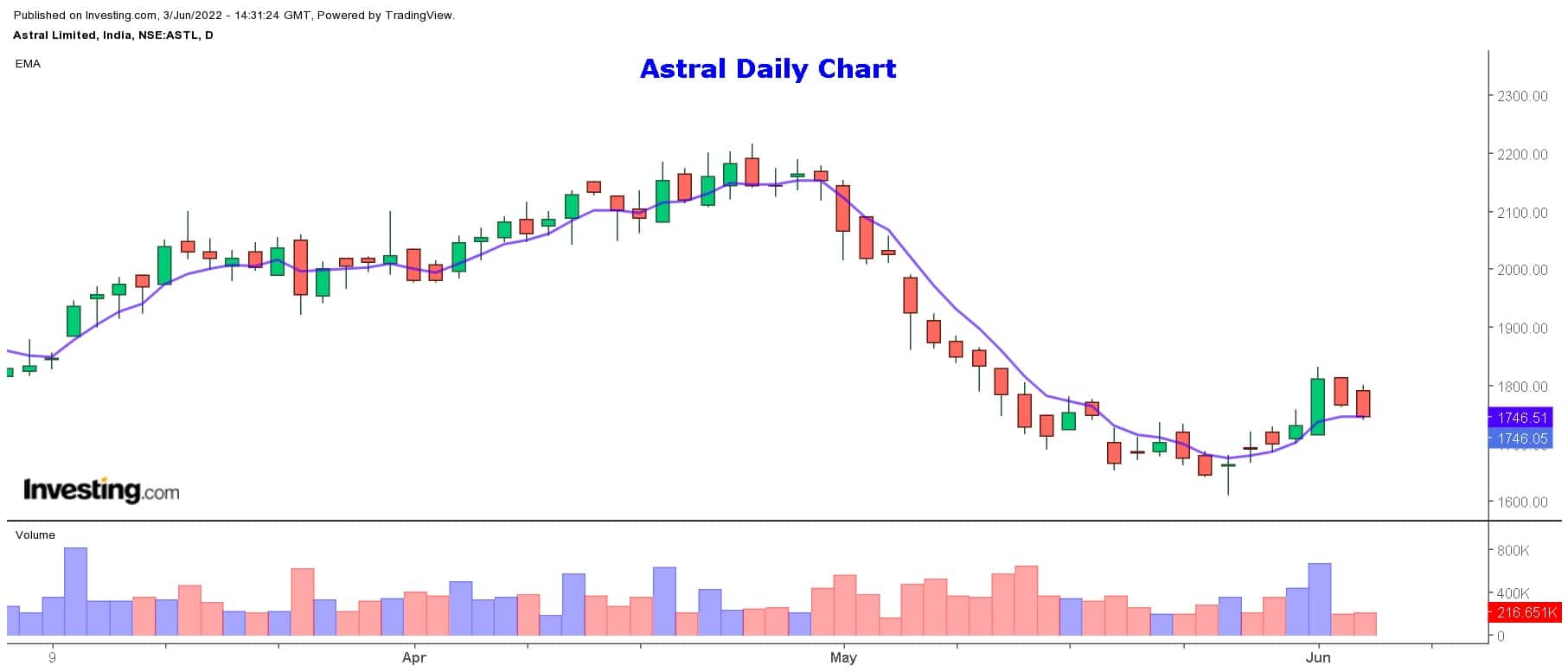

Astral: Buy | LTP: Rs 1,746 | Stop-Loss: Rs 1,683 | Target: Rs 1,870 | Return: 7 percent

In entire May month, the stock prices remained under severe pressure and in the course of action, we witnessed a massive price-correction of more than 25 percent in such a short span. Fortunately, this hammering halted around Rs 1,600 and then prices consolidated for nearly a week.

During the mid-week, we observed huge single day upsurge in stock prices to traverse the ‘5-day EMA’ (exponential moving average) convincingly. The volumes were sizable to support the price behaviour.

Hence, although in the following two sessions, stock cooled off a bit, we recommend buying this for a trading target of Rs 1,870. The stop-loss can be placed at Rs 1,683.

Wipro: Buy | LTP: Rs 475.50 | Stop-Loss: Rs 464 | Target: Rs 498 | Return: 5 percent

The IT space finally had some sigh of relief this week as it turned out to be one of the leading performers to pull the market from recent lows. As far as Wipro is concerned, we can see previous week’s ‘Dragonfly Doji’ pattern getting confirmed.

On the slightly lower frame chart, stock prices are showing early signs of strength as it’s challenging the ’20-day EMA’ placed around Rs 478.

Considering the positive placement of ‘RSI-Smoothened’ oscillator, we expect the stock to convincing surpass immediate hurdles. One can look to buy for a near term target of Rs 498. The strict stop-loss needs to be placed at Rs 464.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.