The carnage playing out in the U.S. stock market on Wednesday is likely an amuse-bouche compared with the devastation on the menu for the bulls in the coming months and years, Guggenheim Partners Global Chief Investment Officer Scott Minerd told MarketWatch in an interview.

The prominent CIO on Wednesday said he envisioned the possibility of a dreadful summer and fall for stock-market investors — one in which the Nasdaq Composite Index COMP, -4.73% eventually unravels, plunging 75% from its Nov. 19, 2021, peak (currently it’s down around 28%) and the S&P 500 SPX, -4.04% tumbles 45% from its Jan. 3, 2022, peak (from which presently down 18%) as we head into July.

“That looks a lot like the collapse of the internet bubble,” Minerd said, referring to the implosion of technology stocks in 1999 and early 2000.

What’s driving Minerd’s pessimism? He fears that the Federal Reserve has made it abundantly clear that it is aiming to continue raising interest rates, despite the possibility that it could result in ruction in equity markets and elsewhere.

”What’s clear to me” is that “there is no market put, and I think we’re all waking up to that fact now,” Minerd said.

The CIO was alluding to the so-called Federal Reserve put option, which is shorthand for the belief the U.S. central bank will rush in to rescue tanking markets — an approach that has been denied by previous Fed chairs.

More on bear-market fears: Why are stocks falling? Inflation jitters killing fragile ‘bear market’ bounce.

On Tuesday, Fed Chairman Jerome Powell also appeared to be trying to disabuse investors of the notion that the bank should be relied upon to throw investors a buoy as monetary-policy makers attempt to combat an outsize dose of inflation.

“Restoring price stability is an unconditional need. It is something we have to do,” Powell said in an interview Tuesday during the Wall Street Journal’s Future of Everything festival. “There could be some pain involved,” Powell added.

Don’t miss: Fed’s Powell says a ‘softish landing’ for the U.S. economy is plausible

Minerd said that he believed the Fed will continue to raise rates “until they see a clear breaking of the inflation trend” and that “they are wiling to go above a neutral rate,” referring to a level of interest rates that neither stimulates nor restrains the economy.

Earlier this month, the Fed’s rate-setting committee raised the benchmark federal funds rate to a target ranging between 0.75% and 1%. It is expected to raise rates by at least 50 basis points at its June 14-15 gathering, as U.S. inflation stood at an 8.3% annual rate in April, according to the Labor Department, well above the Fed’s target rate of 2%.

The Guggenheim executive said that a May 13 gathering of former Federal Reserve policy makers and prominent economists, including John Taylor, John Cochrane and Michael D. Bordo, hosted by the Hoover Institution just after the Fed’s May meeting, caused him to take a more bearish stance on equities and the market as a whole.

Also read: Is it now or never for a stock rally? Fund managers’ cash pile is the biggest since 2001, says Bank of America.

He said attendees at that Hoover conference estimated that the Fed would need to take interest rates to 3.5% to 8% to hit neutral, which suggested to him that the central bank might need to dial up rates until something in the economy or markets, or both, breaks.

The Fed appears to have “very little concern about the continuation of what I think now is a bear market,” Minerd said. If that is the case, “we are probably going to have a pretty severe selloff,” he said. The investor said a severe downturn could give central bankers some pause, but any respite from hikes might not come until a lot of damage is already done.

So, as long as the selloff remains relatively orderly and we don’t get a sudden crash, the Fed is going to continue to raise higher than inflation an unemployment will justify by the time they get [to a neutral rate],” he explained.

Need to Know: Why this investor who paid $ 650,000 to lunch with Buffett isn’t buying or selling stocks right now

Some Wall Street pros, including Wells Fargo & Co. WFC, -3.66% Chief Executive Charlie Scharf, said that it will be hard to avoid a recession against that rate-hike backdrop, and Minerd agreed.

“When you start to line up all the data, a “summer of pain is what we’re heading for,” he noted, adding that by October, things may have reached a bottom.

In a draft of a research report, reviewed by MarketWatch, Minerd said:

With the passage of time as the Fed continues to hike, we will find ourselves experiencing the effects of increasingly restrictive monetary policy. Well before it reaches this terminal rate the Fed will increase the risk of overshooting, causing a financial accident, and starting a recession.

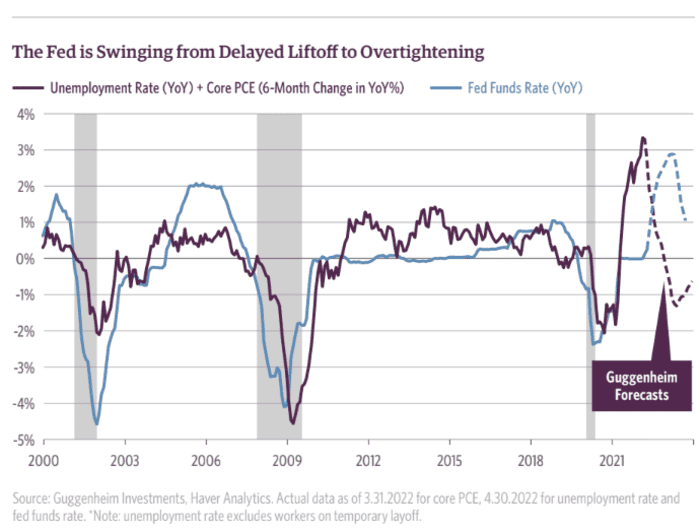

Minerd said that Fed is headed toward overtightening financial conditions just as employment show some softness.

Guggenheim Partners

At last check Wednesday, the S&P 500, the Nasdaq Composite and the Dow Jones Industrial Average DJIA, -3.57% were down by at least 3%, amid a withering selloff.