Shubham Agarwal

Bearish momentum continues as the Nifty broke down below 16,500 and crashed vertically to a low of 15,733 and it closed the week on negative note around 15784.50 with the significantly loss of around 4 percent.

During the week, Nifty gyrated between 16417—15733. On the OI (open interest) front, long unwinding witnessed in Nifty over the week gone as there is decrease in OI.

On the other hand, Bank Nifty moved in line with Nifty as it closed week on the significant loss of more than 4 percent and closed around 33083.

Bank Nifty future gyrated between 34817 to 33025 the last week. Overall, Bank Nifty ended the week with loss of more than 1500 points and witnessed short buildup on OI front.

Further diving into the Nifty, upcoming weekly expiry CE option writers showing aggression. Nifty immediate and vital resistance stands at 16000 levels where nearly 42L shares has been added respectively. On the lower side immediate support level is at 15500 where it nearly 23L shares has been added followed by 15000 where nearly 31L share has been added.

Looking at the Bank Nifty upcoming weekly expiry data, on the upside, immediate and vital resistance is at 34000 where nearly 21L shares has been added whereas, on the lower side immediate support is at 33000 where 9L shares has been added followed by vital support stand at 32500 where nearly 12L shares has been added.

India VIX, fear gauge, increased significantly by 11% from 12.25 to 23.71 over the week. India VIX is trading above 20. Jump in the IV has increased fear in market. Further, any uptick in India VIX can push the downward momentum in Nifty.

Bank Nifty OIPCR over the week decreased from 0.645 to 0.544 compared to last Friday. Overall data indicates CE writers are more aggressive than PE writers in Nifty.

Moving further to the weekly contribution of sectors to Nifty. Most of the sectors are contribution on the negative side except Power. Private Bank, OIL and NBFC has contributed the most on the negative side in the Nifty by 180.35, 108.82, 74.66 points respectively, while only Power contributed positively to Nifty by 4.42 points.

Looking towards the top gainer & loser stocks of the week in the F&O segment. Gujarat Gas topped by gaining over 11.3 percent, followed by IGL 7 percent, Godrej Consumer Properties 4.4 percent. Whereas GNFC has lost over -26 percent, Indiabulls Housing Finance -21.8 percent, Vedanta -21.7 percent over the week.

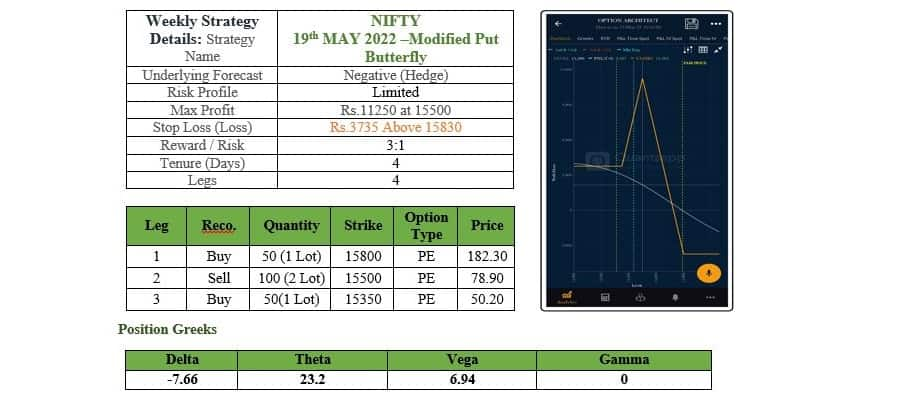

Considering the negative momentum along, upcoming week can be approach with a low-risk strategy like Modified Put Butterfly in Nifty.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Download your money calendar for 2022-23 here and keep your dates with your moneybox, investments, taxes