Investors scrambled for reasons to explain a sharp stock-market surge Tuesday that saw the Dow Jones Industrial Average jump nearly 500 points as major indexes turned in their best performance in a month. A look at the calendar may offer the best explanation, argued Fundstrat co-founder Tom Lee.

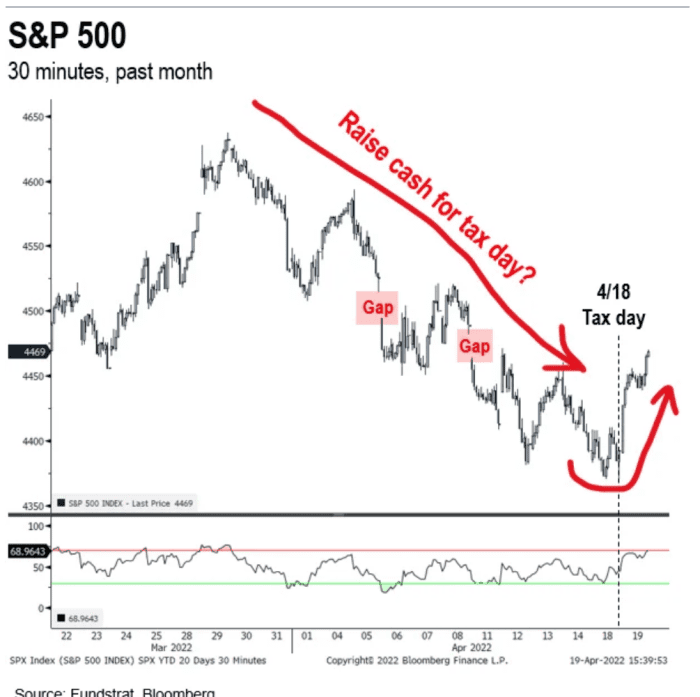

“Equities have fallen in a straight line since late March (13 trading sessions) and the decline continued into April 18th,” the deadline for filing federal income tax returns, Lee said in a Tuesday note.

The note highlighted research that shows stocks have tended to suffer in the runup to “Tax Day,” as investors raise cash to pay Uncle Sam, often followed by a sustained bounce in years when investors face hefty tax bills (see chart below).

Fundstrat

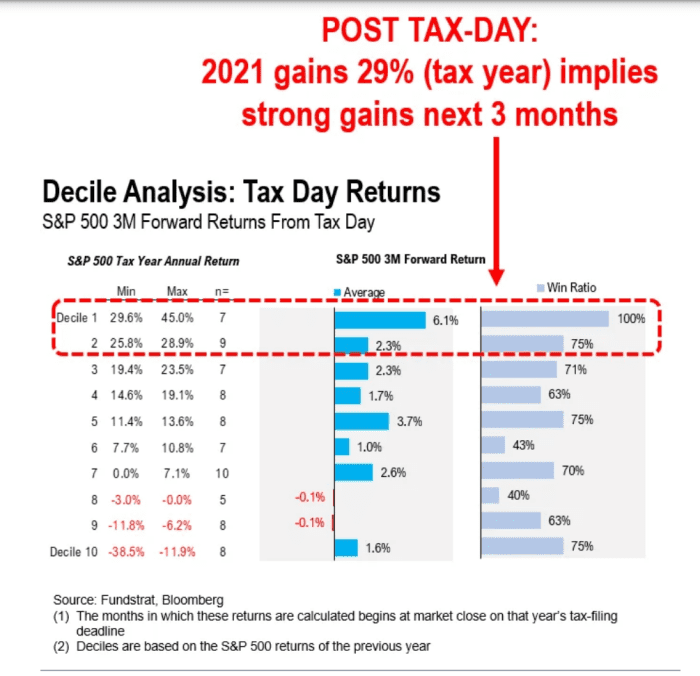

They faced a doozy after another big year of gains for equities in 2021, Fundstrat has estimated, putting total capital-gains taxes on equities at a record of more than $ 800 billion, along with another $ 150 billion or more for crypto-related capital gains.

Fundstrat found that since 1945, post-Tax Day returns have been strongest following a big up year for the S&P 500, defined as in the top two deciles. The 29% advance for the S&P 500 last year was just shy of the cutoff for the top decile at 29.6% (see chart below).

The Dow DJIA, +1.45% jumped 499.51 points, or 1.5%, Tuesday to close at 34,911.20, while the S&P 500 SPX, +1.61% rose 1.6% and the Nasdaq Composite COMP, +2.15% advanced 2.2% — the biggest percentage gains for all three indexes since March 16, according to Dow Jones Market Data.