The Dow Jones Transportation Average’s relative weakness may be a warning that there could be more to worry about than just a temporary freight-specific slowdown.

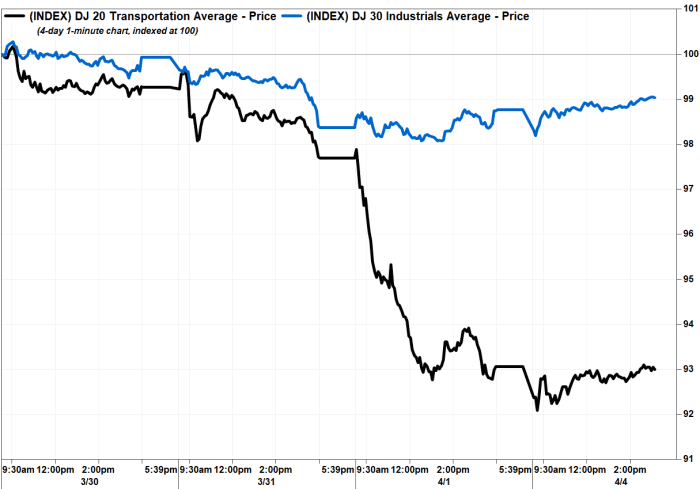

The Dow transports DJT, -0.04% fell 0.1% in afternoon trading, putting them on track for a fourth straight loss. The decline follows a 4.7% tumble on Friday, the biggest one-day drop since June 11, 2020, even through its more widely followed sister index, the Dow Jones Industrial Average DJIA, +0.24%, rose 0.4% on Friday.

That divergence comes between two indexes that have a correlation of 0.95% over the past five years, according to a MarketWatch analysis of FactSet data.

During the Dow transports’ (DJT) four-day losing streak, it has dropped 7.3%. Meanwhile, the Dow industrials (DJIA) are headed for a second straight gain, and have slipped just 1.1% the past four days.

FactSet, MarketWatch

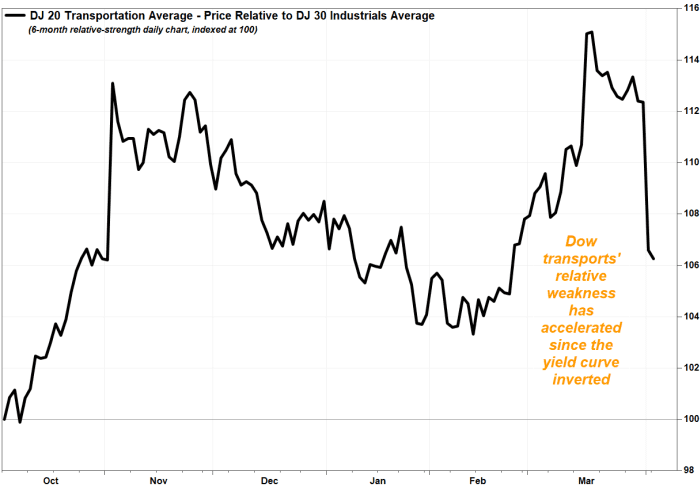

The DJT’s relative weakness that past several days coincides with the first inversion of the yield curve, in which the yield of the 10-year Treasury note closed below the 2-year Treasury yield, for the first time in nearly three years. And that’s not just a coincidence. Read MarketWatch’s “Bond Report” column to follow the yield curve inversion.

“It remains our belief that investors historically look toward transportation stocks as leaders in the stock market as a barometer of economic activity,” wrote UBS analyst Thomas Wadewitz in a note to clients.

That supports the notion that the yield curve inversion is depicting fears of an economic slowdown, if not an outright recession, rather than a technical market blip in the wake of a Federal Reserve interest rate hike.

Don’t miss: Risks tilt toward a deeper yield curve inversion as some investors discount its recession-signaling power.

FactSet, MarketWatch

The idea that the DJT helps foreshadow the economic trajectory is more than a century old. One of the six basic tenets of the Dow Theory of market analysis, which has remained relevant on Wall Street for more than 100 years, is that the DJT and DJIA had to confirm each others’ trends. The idea being, the economy can’t be strong if transportation companies aren’t taking what industrial companies are making. Read more about the Dow Theory.

So far this year, the DJT has lost 5.9% while the DJIA has slipped 4.0%.