SPIC showed tremendous resilience in the recent broader market destruction and now when things have started to stabilize a bit, this counter showed its dominance by giving a massive upsurge to come of its congestion zone.

Sameet Chavan

March 21, 2022 / 06:16 AM IST

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

Sameet Chavan, Chief Analyst-Technical and Derivatives at Angel One

The previous week’s smart recovery was followed by a positive start on Monday. We managed to extend gains towards 16,900 on the same day itself. However, due to some nervousness at higher levels, we witnessed a sharp profit-booking on the subsequent day to snap all gains. Fortunately, it was merely a reality check which didn’t last too long.

In fact, the geopolitical concerns with respect to Russia and Ukraine started to fade away, which lifted the overall sentiment. Due to two back-to-back bump-up sessions, the Nifty eventually went on to close convincingly beyond 17,000 as the bulls pocketed almost 4 percent gains last week.

Despite being a truncated week, it was not at all short of action by any means. The bulls took it from where they left last week and, in fact, as the global uncertainty kept easing off, markets reacted strongly in the upward direction to compensate for all the bashing they had couple of weeks back.

If we refer to our recent commentaries, we fortunately started participating in the journey just at the right time and last week too managed to ride it successfully. Technically, the way ‘RSI-smoothened’ was placed last week, it was clearly an indication of continuation of the upward trajectory. Now with last Thursday’s spectacular move, bulls have conquered the sturdy wall of 16,800 – 17,000, which now should act as an immediate support for the index.

On the flipside, 17,500 followed by 17,650 are the next levels to watch out for. But in our sense, the index may not have the similar sort of swift move that we witnessed in last 5 – 6 trading sessions.

We may see some consolidation or in between small bout of profit-booking in the current week.

However, we strongly believe that the stock-specific adjustments are likely to continue and hence the pragmatic approach would be to keep focusing on thematic plays and importantly identifying the potential movers within the same is the key.

Also, the banking index plays a vital role going ahead as its approaching its crucial juncture of 36,700–37,000.

Let’s see how this high-beta index behaves in the first half of the current week. Since the Russia-Ukraine war is yet to completely come to an end, it would be important to keep a regular tab of this development as well.

Here are two buy calls for next 2-3 weeks:

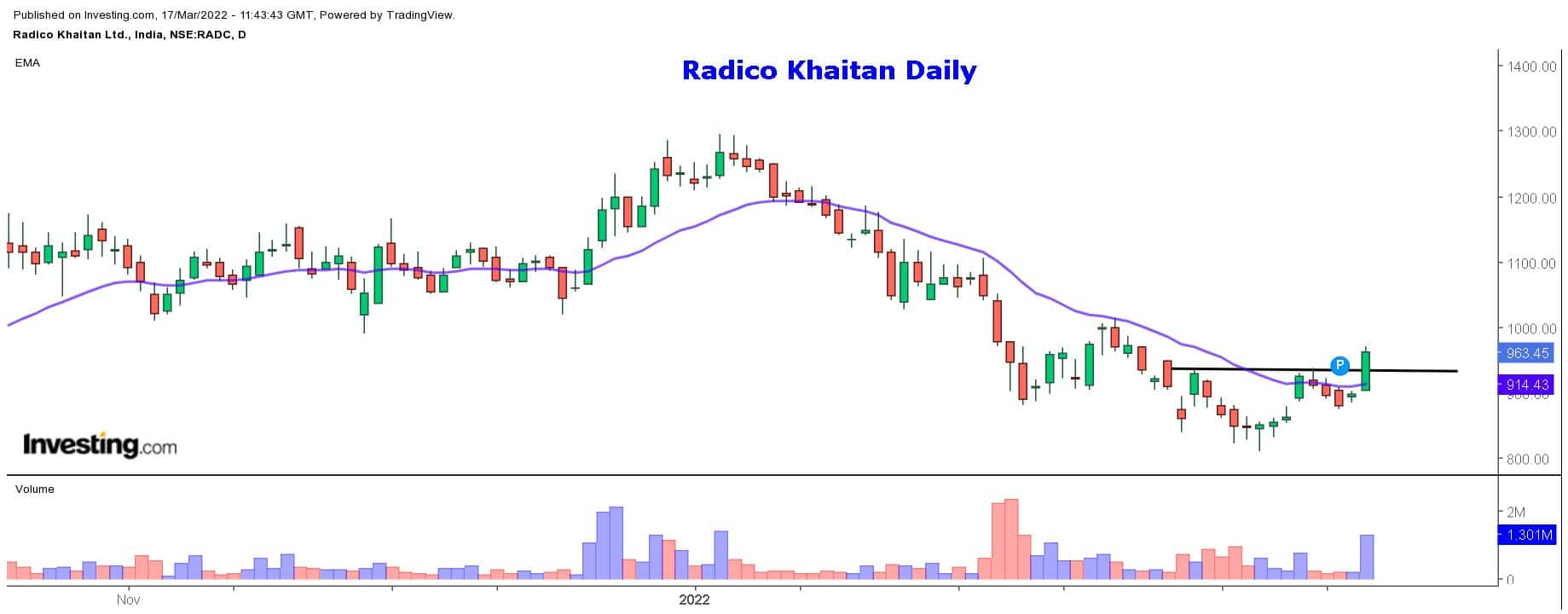

Radico Khaitan: Buy | LTP: Rs 963.45 | Stop-Loss: Rs 912 | Target: Rs 1,020 | Return: 6 percent

A lot of mid and small cap counters have taken a U-turn after recent hammering. This stock completed its higher degree retracement around Rs 800 and after forming its base for nearly three weeks, the stock prices finally took off on last Thursday.

This price breakout is accompanied with huge volumes, indicating renewed buying interest in the stock. In addition, the relative strength index ‘(RSI)-Smoothened’ has started moving northwards to confirm its strength.

We recommend buying this stock in a range of Rs 955 – 950 for a trading target of Rs 1,020. The stop-loss can be placed at Rs 912.

SPIC: Buy | LTP: Rs 63.15 | Stop-Loss: Rs 59 | Target: Rs 70 | Return: 11 percent

In the week gone by, we saw lot of thematic moves playing out well and on Friday, all of a sudden, the fertilizer pack seems to have come into a limelight. Southern Petrochemicals Industries Corporation (SPIC) has been one of the outperforming stocks in this space since last couple of years.

In fact, it showed tremendous resilience in the recent broader market destruction and now when things have started to stabilize a bit, this counter showed its dominance by giving a massive upsurge to come of its congestion zone.

Traders can look to buy for a near term target of Rs 70. The stop-loss can be placed at Rs 59.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.