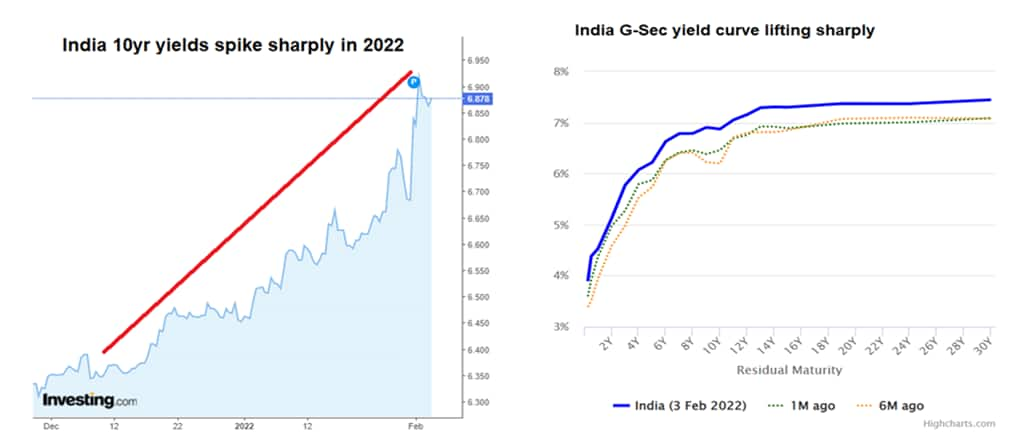

YTD 2022, the benchmark 10yr yield has seen a sharp surge, rising over 55bps. With this the benchmark yields are higher by 100bps from 2020 lows. The higher yields have however not transmitted to the lending rates.

While the equity markets have generally welcomed the Union Budget for FY23, the bond market seems to be majorly disappointed. It may be pertinent to note that the government bond yields had started rising in December 2021 itself, even though the April-October 2021 deficit numbers were very encouraging; and the RBI had categorically assured that the policy stance will continue to be “growth supportive” irrespective of the rising price pressures.

YTD 2022, the benchmark 10yr yield has seen a sharp surge, rising over 55bps. With this the benchmark yields are higher by 100bps from 2020 lows. The higher yields have however not transmitted to the lending rates.

Perfect storm in the bond street

A perfect storm seems to be developing in the Indian bond market.

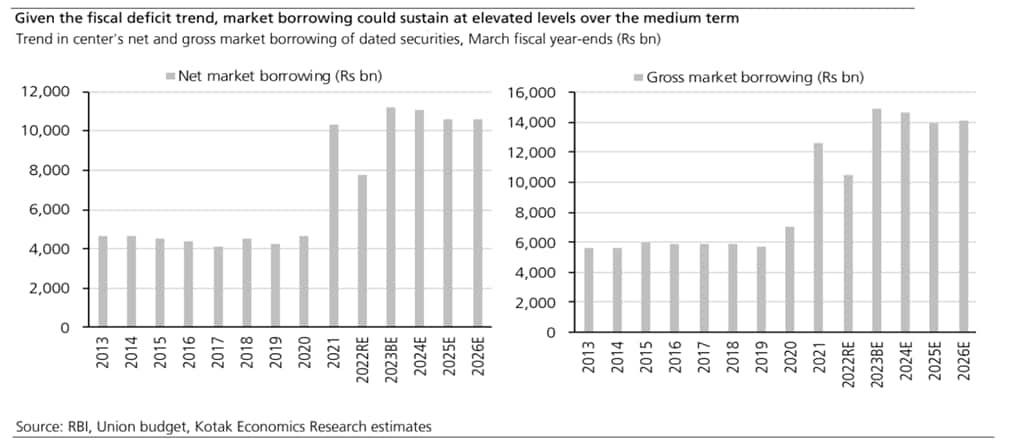

- The net government market borrowings are most likely to stay elevated in the midterm as fiscal consolidation is expected to take longer than previously estimated.

- The inflation is persistently hitting the upper bound of the RBI tolerance range. The Monetary Policy Committee (MPC) of the RBI is widely expected to yield to the pressure of staying close to the curve and begin hiking the rates.

- The US Fed has already announced the pathway to normalize the near zero interest rates. Besides, the US fed has also announced termination of Covid related quantitative easing (QE) program by March 2022. This could impact the global demand for emerging market bonds

- The domestic household savings are continuing to slow down, forcing the government to reduce its reliance on small savings funds for deficit financing.

- The banks are anticipating acceleration in credit growth, shrinking the pool available for bond buying.

- The RBI has already started unwinding the excess liquidity infused in the system to complement the government’s Covid relief measures.

The ambitious capital expenditure plan of the government would need to be evaluated against a rising rate environment; especially when it largely hinges on the private sector participation in capacity building.

Historically, bond yields had a good negative correlation with the equity returns. The correlation has been much stronger in case of broader markets. It would be interesting to see how things unfold in the coming months.

`); } if (res.stay_updated) { $ (“.stay-updated-ajax”).html(res.stay_updated); } } catch (error) { console.log(‘Error in video’, error); } } }) }, 8000); })