Shubham Agarwal

For the second consecutive week, Nifty fell approximately 3 percent in the five trading sessions ended last Friday after falling to 16,850 levels and seems to settling at 17,000 levels. The Nifty futures during the week ranged from 17,602 to 16,850. IT and NBFC contributed the most for this fall, while the Nifty witnessed a short built-up on the OI (open interest) front in the week gone by.

The Bank Nifty on the other hand was much more volatile as it gyrated between 39,225 to 36,400 the last week. Overall, the Bank Nifty ended the week with a marginal gain of 200 points last week. It also witnessed Long Buildup on the OI front in the week gone by.

Further diving into the Nifty upcoming Weekly expiry CE writers showing aggressions by building more position compared to PE writers. The Nifty immediate Support stands at the 16,500 levels where nearly 22 lakh shares were added, followed by 16,000 levels with 20 lakh shares.

On the higher side, immediate resistance level is at 17,500, where nearly 25 lakh shares were added, followed by a vital resistance at 18,000 with the addition of 38 lakh shares.

Let’s take a look at the Bank Nifty upcoming weekly expiry data. On the upper side, the Bank Nifty immediate and vital resistance stands at 38,000 where nearly 10 lakh shares have been added, whereas, on the downside, the immediate support level stands at 37,000 where nearly 7 lakh have been added followed by 36,500 levels with the addition of 7 lakh shares.

India VIX breaking out in its upper regime. India VIX increased by 9 percent from 18.89 to 20.73 over the week. A spike in the India VIX has created a fear in the market. Further spikes in India VIX can lead to more fear.

Looking at the sentimental indicator, the Nifty OI PCR for the week has increased from 0.873 to 0.925. The Bank Nifty OIPCR over the week decreased from 0.746 to 0.64, compared to last Friday. Overall data indicates more of PE writers over CE writers in the Nifty.

Let’s move further to the weekly contribution of sectors to the Nifty. Most of the sectoral indices have negatively contributed such as IT, OIL and NBFC has collectively contributed nearly 400 in the Nifty 494 points loss. Whereas PSUB, Telecom contributed on the marginally on positive side.

The Nifty rollover stands at 73 percent as against 78 percent (January Expiry Day), Bank Nifty rollover stands at 84 percent versus 84 percent (January Expiry Day). Bosch, Grasim & Torrent Power are the stocks with highest Rollover of around 96.73 percent, 94.7 percent and 92.16 percent, respectively. ONGC witnessed least rollover at 45.62 percent, followed by Escort 46.02 percent and Motherson Sumi with rollovers of around 49.53 percent.

Let’s check out the top gainer and loser stocks of the week in the F&O segment. Bank of Baroda topped by gaining over 11.5 percent, followed by Canara Bank 10.9 percent, LIC Housing Finance 9.9 percent. Whereas, IndiaMart has lost over 20.8 percent, Torrent Pharma 17.3 percent, and Trent 14.40 percent over the week.

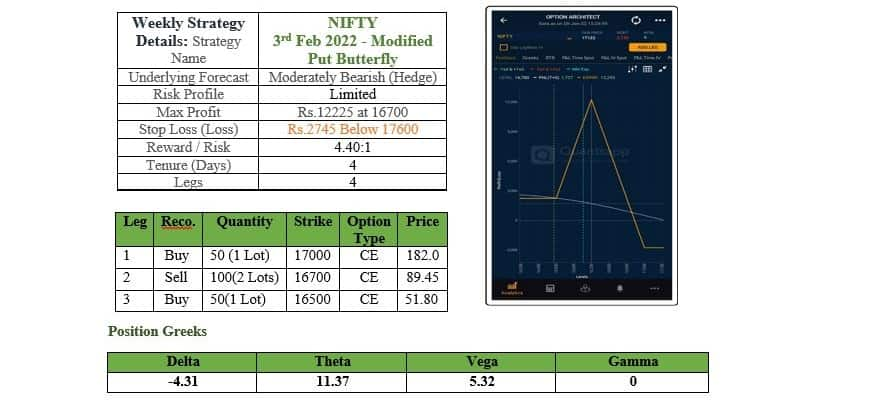

Considering the Bearish momentum along, upcoming week can be approach with a low-risk strategy like Modified Put Butterfly in the Nifty.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.