For the coming week, Ruchit Jain of 5paisa.com says 17,500 will now be seen as the important support while a move above 17,700 could again lead to a buying interest amongst market participants and take the index towards 17,900-18,000

Sunil Shankar Matkar

January 24, 2022 / 10:10 AM IST

Top 10 Trading Ideas

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

After a significant rally of 10 percent, the market, for first time, saw some meaningful correction in the week ended January 21 as the benchmark indices fell 3.5 percent amid inflation concerns, rising oil prices, spiking US bond yields and FII selling. Traders also seem cautious ahead of the Union Budget.

The Nifty50 fell more than 600 points during the week to settle at 17,617, as selling pressure was seen across sectors barring energy, forming large bearish candle on the daily charts. It was down seven-tenth of a percent and formed Doji kind of pattern on the daily charts, indicating indecisiveness among bulls and bears.

The index defended the 17,500 level which is going to act as a crucial support next week as breaking the same can drag the index towards 17,300 levels, while the 17,700 mark would be a crucial hurdle, experts feel.

“Before this corrective phase, we had seen a sharp surge, too, wherein the index had rallied from 16,410 to 18,300 without any meaningful correction and thus, this down move could be seen as a corrective phase within the uptrend,” says Ruchit Jain, Lead Research at 5paisa.com.

He further says the index has retraced 38.2 percent of the previous rally and has formed a ‘Doji’ candlestick pattern on the daily chart. “This pattern near the support indicates indecision and thus a follow up move in the coming week is likely to dictate the near term direction.”

For the coming week, Ruchit Jain says 17,500 will be seen as an important support while a move above 17,700 could again lead to a buying interest among market participants and take the index towards 17,900-18,000.

This week’s correction is just a short-term corrective phase and the market should now resume the uptrend to mark a pre-budget rally, says Jain.

Here are top 10 trading ideas by experts for the next 3-4 weeks. Returns are based on the January 21 closing prices:

Expert: Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities

Tech Mahindra: Buy | LTP: Rs 1,593.55 | Stop-Loss: Rs 1,480 | Target: Rs 1,690-1,770 | Return: 6-11 percent

On Friday, the stock completed a corrective pattern between the Rs 1,610-1,600 levels. It was at Rs 1,838 in December 2021 and currently it is available at Rs 1,600, which is a decent correction from the high level but it is still in the trading range of the previous up-move, which was between Rs 1,480 and Rs 1,838.

Buy at the current levels, add more if the stock falls to Rs 1,540. Make the final stop-loss near Rs 1,480. On the upside, there would be resistance at Rs 1,690 and Rs 1,770.

Tata Power: Buy | LTP: Rs 241.95 | Stop-Loss: Rs 225 | Target: Rs 268-287 | Return: 11-19 percent

Last month, the stock was consolidating into an ascending triangle, which was transformed into a breakout formation above the Rs 230 level.

It is pursuing a breakout formation that allows the stock to reach Rs 268, which was its previous highest level. Buy at current levels for a target of a minimum of Rs 268 and a maximum of Rs 287 over the next few months. For that, keep the stop-loss at Rs 225.

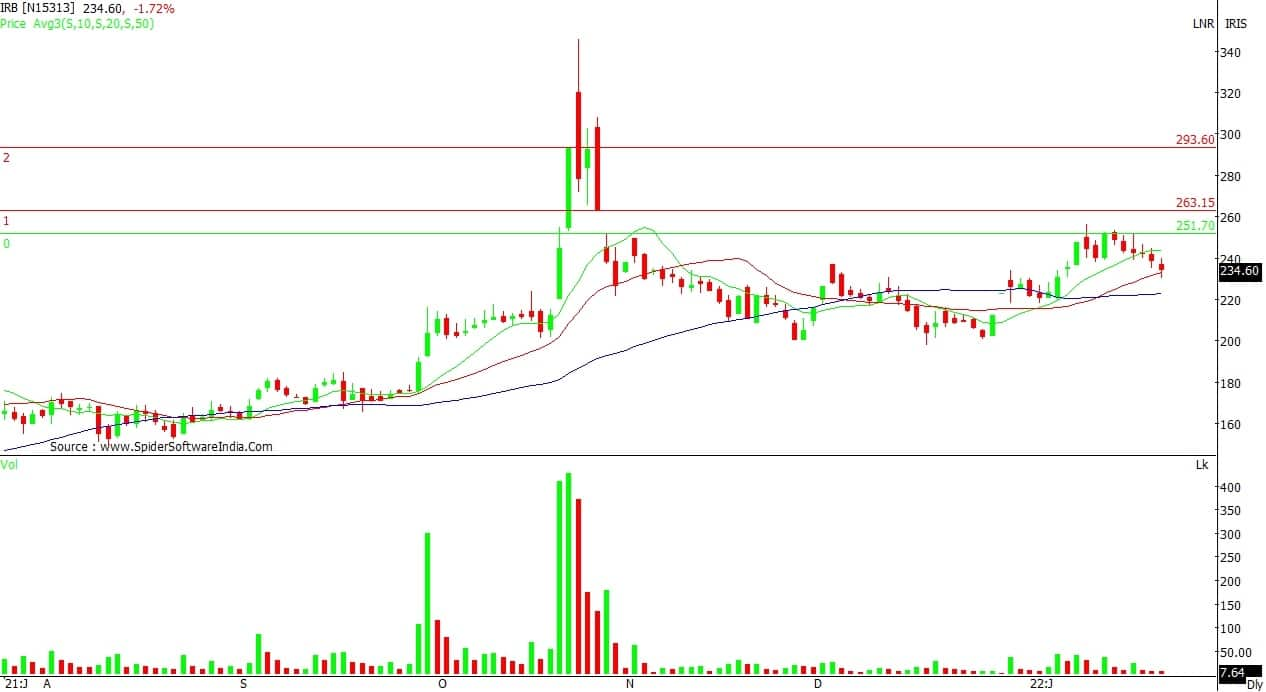

IRB Infrastructure: Buy | LTP: Rs 232.60 | Stop-Loss: Rs 210 | Target: Rs 263-290 | Return: 13-25 percent

After hitting the support at Rs 200, it is forming a rounding bottom. It has taken almost a month, which is positive for the stock and may help the stock to move upwards.

It is advisable to buy between the Rs 240 and Rs 230 levels for the target of Rs 263, where the stock has left the bearish gap and the next target would be Rs 290. For that, keep a stop-loss at Rs 210.

Expert: Nagaraj Shetti, Technical Research Analyst at HDFC Securities

Linde India: Buy | LTP: Rs 2,774.35 | Stop-Loss: Rs 2,630 | Target: Rs 3,065 | Return: 10 percent

After showing a rangebound action in the last few weeks, the stock price (Linde India) has witnessed a sharp upside breakout in this week amid a volatile broader market. The stock price has moved above the crucial resistance of the consolidation at Rs 2,535 levels on Friday and closed higher. Hence, there is a higher possibility of further extension of upside momentum in the coming week.

Volume has started to expand during upside breakout in the stock price and weekly 14 period relative strength index (RSI) shows positive indication. Hence, one may expect further strengthening of upside momentum in the stock price ahead.

Buying can be initiated in Linde India at CMP, add more on dips down to Rs 2,700, wait for the upside target of Rs 3,065 in the next 3-4 weeks. Place a stop-loss of Rs 2,630.

CCL Products India: Buy | LTP: Rs 460.9 | Stop-Loss: Rs 430 | Target: Rs 515 | Return: 12 percent

After showing minor weakness within a narrow range in the last two weeks, the stock price has witnessed a decisive upside bounce of the range movement at Rs 440 levels in this week and closed higher. The weekly candle pattern indicate a decisive upside breakout of the larger consolidation pattern.

The larger positive sequence like higher tops and bottoms is intact as per weekly timeframe chart. Volume has expanded on Friday during upside breakout and the weekly 14 period RSI shows positive indication.

One may look to buy CCL Products at CMP, add more on dips down to Rs 445 and wait for the upside target of Rs 515 in the next 3-4 weeks. Place a stop-loss of Rs 430.

Biocon: Buy | LTP: Rs 377.1 | Stop-Loss: Rs 350 | Target: Rs 417 | Return: 11 percent

The down trend of the last many months seems to have completed in this stock (Biocon). The stock price is now making an attempt to stage upside breakout of the consolidation movement (type of triangle pattern) at Rs 385 levels.

After showing a larger downward trend in the last many months, the stock price seems to have halted its down trend and recently showed an accumulation type pattern at the lows. This bullish action could consider as an attempt of decisive change in trend in the stock price towards upside.

The volume has started to expand and weekly 14 period RSI and weekly ADX/DMI (average directional index/direction movement index) signal chances of further strengthening of upside momentum for the stock price ahead.

One may look to buy Biocon at CMP, add more on dips down to Rs 360 and wait for the upside target of Rs 417 in the next 3-4 weeks. Place a stop-loss of Rs 350.

Expert: Ruchit Jain, Lead Research at 5paisa.com

Hindustan Unilever: Buy | LTP: 2,325.4 | Stop-Loss: Rs 2,250 | Target: Rs 2,440 | Return: 5 percent

This stock has gone through a corrective phase in last four months and prices have corrected from its high of Rs 2,850 to Rs 2,200. Historically, the ’20-EMA’ (exponential moving average) on the monthly charts have acted as a support during price corrections from where we again usually witness buying interest in this stock.

After this recent correction, the stock is trading near its long-term moving average support and now even on the daily chart, we witnessed some buying interest in the stock on Friday. This up move during the day was supported by good volumes while a combination of short covering and long formation was seen in the derivatives segment. Hence, we expect a pullback move in the stock in the near term.

Thus, short-term traders can look to trade with a positive bias and buy in the range of Rs 2,320-2,300 for a potential target of Rs 2,440 in next 2-3 weeks. One can place a stop-loss below Rs 2,250 on long positions.

Bharat Dynamics: Buy | LTP: Rs 459.1 | Stop-Loss: Rs 435 | Target: Rs 500 | Return: 9 percent

In the recent corrective phases, the stock has managed to find support around its ‘200 EMA’ on the daily chart and in this month, we have witnessed a decent buying interest in the stock. Prices have seen an up move supported by good volumes while the stock has also given a breakout from its resistance.

The weekly and monthly momentum readings are indicating a positive structure and hence, we expect the stock prices to continue its up move in the short term.

Hence, traders can look to trade with a positive bias and buy in the range of Rs 460-450 for a potential target of Rs 500 in next 3-4 weeks. One can place a stop-loss below Rs 435 on long positions.

Hitachi Energy India: Buy | LTP: Rs 3,030.75 | Stop-Loss: Rs 2,750 | Target: Rs 3,450 | Return: 14 percent

The stock has been forming a ‘Higher Top Higher Bottom’ structure on the weekly charts and is thus in an uptrend. In last couple of months, the stock went through a time-wise correction and prices have given a breakout from this consolidation during this week.

The price up move on Friday was supported by good volumes which indicate that the stock has resumed its broader uptrend. The breakout zone of Rs 2,850-2,800 should now become a support on any declines and hence, short term traders can adopt a strategy to buy the stock at current levels and add on dips towards the mentioned support.

Thus, traders can look to trade with a positive bias and buy around Rs 3,000 for a potential target of Rs 3,450 in next 3-4 weeks. One can place a stop-loss below Rs 2,750 on long positions.

Expert: Sameet Chavan, Chief Analyst-Technical and Derivatives at Angel One

Time Technoplast: Buy | LTP: Rs 86.20 | Stop-Loss: Rs 77.90 | Target: Rs 102 | Return: 18.3 percent

Although the entire market corrected sharply this week, there were few handful of stocks who did extremely well and this stock is clearly one of them.

On Friday, despite stock prices falling sharply on the back of profit booking, the weekly structure still looks quite sturdy. We can see it traversing weekly ‘200-SMA’ with some authority along with sizable volumes, indicating tremendous strength in the counter.

The momentum oscillators on daily charts are pointing northwards, which indicates momentum to continue in the upward direction. We recommend buying for a medium term target of Rs 102. The stop loss can be placed at Rs 77.90.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.