The Nifty 50 extended its gains over the past four weeks to 7.5 percent, which indicates a positive momentum. If the uptrend persists, a record high can’t be ruled out in the coming days, experts said.

Sunil Shankar Matkar

January 17, 2022 / 10:56 AM IST

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

The stock markets sustained their gains for the fourth consecutive week amid third-quarter corporate earnings and ahead of the Union Budget. The rise in Covid-19 cases appeared to be a less worrying factor because of the low rate of hospitalisation.

The Nifty 50 settled at 18,255 on January 14, advancing 2.5 percent and taking the gain over four weeks to 7.5 percent, which indicates a positive momentum. The formation of a bullish candle for the fourth straight week suggests the bulls aren’t tired at the moment and if the uptrend persists, a record high can’t be ruled out in the coming days, experts said.

All sectors, barring FMCG, participated in the rally last week, with energy, infrastructure, auto and metals the prominent gainers. The Nifty Midcap 100 and Smallcap 100 indices added 2.82 percent and 3.62 percent, respectively.

“Nifty on the weekly chart formed long bull candles for three consecutive weeks,” said Nagaraj Shetti, technical research analyst at HDFC Securities. “Though the Nifty placed at the highs, there is no sign of any tiredness or reversal at the highs as per smaller and larger time frame charts.”

Shetti said the near-term uptrend status of the Nifty remains intact and intraday weakness on January 14 hadn’t dampened the efforts of bulls.

“The emergence of sustainable buying from the dips and overall positive daily chart pattern signal an upside target of 18,600 levels by next week. Immediate support is placed at 18,100 levels,” said Shetti.

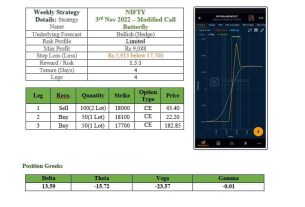

Here are top 10 trading ideas by experts for the next 3-4 weeks. Returns are based on January 14 closing prices:

Shrikant Chouhan, head of equity research (retail) at Kotak Securities

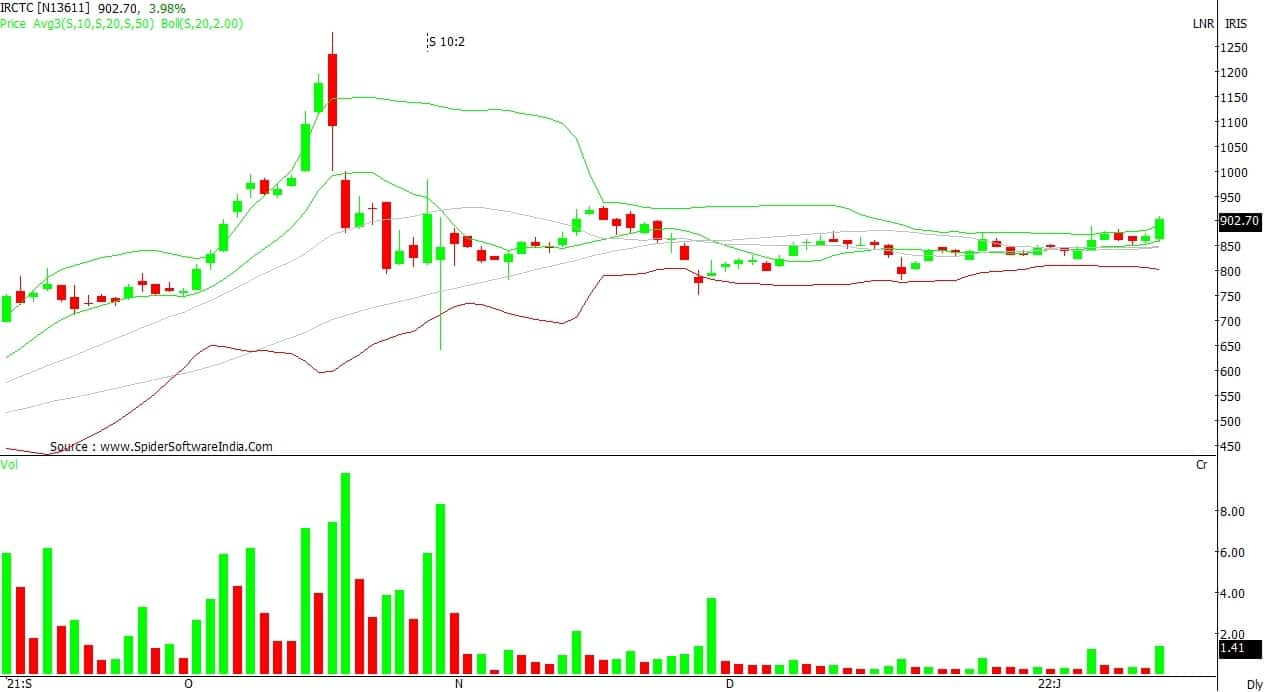

IRCTC: Buy | LTP: Rs 902.70 | Stop-Loss: Rs 845 | Target: Rs 1,000-1,040 | Return: 11-15 percent

The stock has spent a lot of time between the Rs 875 and Rs 775 levels. On January 14, it decisively broke the upper barrier and closed at the same level with a significant jump in volumes.

According to a Bollinger Band study, the stock’s closing is at the highest level of the upper band, which suggests a further upward trend in the near term.

Info Edge: Buy | LTP: Rs 5,696.25 | Stop-Loss: Rs 5,500 | Target: Rs 5,950-6,050 | Return: 4.5-6.2 percent

Info Edge completed a zigzag correction pattern between Rs 5,100 and Rs 5,080 and has gradually crossed the biggest hurdle, which was at Rs 5,695.

However, the stock tried to pull back on January 14 and closed at the highest point of the day. Traders should buy at current levels and more on dips.

Infosys: Buy | LTP: Rs 1929.35 | Stop-Loss: Rs 1,850 | Target: Rs 2,000-2,100 | Return: 3.6-8.8 percent

Following strong quarterly earnings, the stock closed above the all-time high. It will likely move to the next level based on the principle of expansion, which is at Rs 2,000 and Rs 2,100.

It is advisable to buy at current levels, buy more on dips, and keep a stop-loss at Rs 1,850 levels.

Subash Gangadharan, senior technical and derivative analyst at HDFC Securities

Jubilant Ingrevia: Buy | LTP: Rs 635.90 | Stop-Loss: Rs 580 | Target: Rs 750 | Return: 18 percent

Jubilant Ingrevia has been consolidating in a range between Rs 518 and Rs 626 for the past few weeks. The stock broke out of this range on January 14 on the back of huge volumes and the uptrend could continue.

Technical indicators signal that the stock is trading above the 20-day and 50-day simple moving average (SMA). Momentum readings like the 14-day relative strength index (RSI) are in rising mode and not overbought, which implies potential for further upsides.

With the intermediate technical setup also looking attractive, the stock may move up towards its current life high in the coming weeks. Buy between Rs 630 and Rs 640. Stop-loss is at Rs 580 while the target is Rs 750.

Jindal Steel & Power: Buy | LTP: Rs 418.65 | Stop-Loss: Rs 390 | Target: Rs 475 | Return: 13.5 percent

Jindal Steel & Power is in an intermediate uptrend as it has consistently made higher tops and higher bottoms for the past several months. Recently, the stock dropped from Rs 473 and found support near Rs 340.

Over the past few weeks, the stock consolidated in the Rs 340-411 range before breaking out on January 13 on the back of above-average volumes.

With the stock trading above key moving averages such as the 20- and 50-day SMA, the intermediate technical setup looking positive, and momentum readings like the 14-day RSI in rising mode and not extremely overbought, the uptrend is poised to continue.

We recommend a buy between Rs 414 and Rs 420. Stop-loss is at Rs 390 while the target is Rs 475.

Mastek: Buy | LTP: Rs 3,184.5 | Stop-Loss: Rs 3,000 | Target: Rs 3,600 | Return: 13 percent

Mastek bounced back recently from a low of Rs 2,412, which corresponds to the previous intermediate low that the stock tested in August 2021. This indicates that Rs 2,412 is a strong support level.

Over the past few weeks, the stock consolidated in a range of Rs 2,941-3,085 before breaking out on January 12 on the back of above-average volumes.

With the stock trading above the 20- and 50-day SMA, the intermediate technical setup looking positive, and the 14-day RSI in rising mode and not extremely overbought, the uptrend is likely to continue.

We recommend a buy at Rs 3,180-3,220 levels. Stop-loss is at Rs 3,000 while the target is Rs 3,600.

Ruchit Jain, lead research at 5paisa.com

Sobha: Buy | LTP: Rs 913.7 | Stop-Loss: Rs 865 | Target: Rs 988 | Return: 8 percent

The real estate space witnessed decent buying last year after a long period of underperformance. In the past couple of months, the sector has consolidated, which seems to be a time-wise correction, and now the momentum appears to be resuming.

Sobha has been forming a ‘higher top higher bottom’ structure for a few months and after some consolidation, the stock has broken out from a ‘cup and handle’ pattern, which indicates resumption of the uptrend. Volumes during the price up-moves were good, while during the corrective phase, volumes were low, which is a positive sign.

Short-term traders can buy the stock in the range of Rs 910-900 for a potential target of Rs 988 in the next 3-4 weeks. A stop-loss can be placed below Rs 865 on long positions.

Gujarat Narmada Valley Fertilizers & Chemicals: Buy | LTP: Rs 489.25 | Stop-Loss: Rs 461 | Target: Rs 530 | Return: 8 percent

After gains in September, the stock has seen some pricewise and timewise correction in the past two months. However, the stock resumed its up-move over the past few days, backed by rising volumes.

Last week, the stock broke a trendline resistance, backed by rising volumes, which is a positive sign. The short-term moving average crossed over medium-term averages, which is also a sign of positive momentum. We expect the stock to resume its broader uptrend and short-term traders can look for buying opportunities.

Traders can look to trade with a positive bias and buy in the range of Rs 490-485 for potential targets of Rs 530 and 545. One can place a stop-loss below Rs 461 on long positions.

Bharat Electronics: Buy | LTP: Rs 220.1 | Stop-Loss: Rs 208 | Target: Rs 240 | Return: 9 percent

The stock has been forming a ‘higher top higher bottom’ structure on the weekly charts and is thus in an uptrend. In the past few months, it has been observed that when prices enter a corrective phase, it levels up with its weekly ‘20 EMA’ (exponential moving average) and then continues its uptrend.

A similar pattern was observed this time, too, and the stock now appears to have resumed its broader uptrend. The RSI oscillator indicates a positive momentum that should support prices in the near term.

Traders can buy the stock at about the current price of Rs 220 for a potential target of Rs 240-242 in the next 3-4 weeks. One can place a stop-loss below Rs 208 on long positions.

Tata Consumer Products: Buy | LTP: Rs 762.5 | Stop-Loss: Rs 727 | Target: Rs 815 | Return: 7 percent

Over the past four months, the stock has dropped to sub-Rs 700 levels from Rs 889. The price consolidated over the past few sessions at about its 200 DMA and there was good buying interest on January 14.

The price up-move was supported by high volumes and this resulted in a breakout above its short-term resistance levels. The corrective phase for the stock is over and an up-move in the stock can be expected in the short term.

Traders can buy the stock in the range of Rs 760-755 for a potential target of Rs 815-820 in the next 3-4 weeks. One can place a stop-loss below Rs 727 on long positions.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management.