Shubham Agarwal

A bullish momentum continued in the broader market with the Nifty touching a fresh high of 18,320 in the last four weeks and closing around 18,282.70. The index is just 300 points short of its fresh all-time high.

The Nifty Futures during this week ranged from 18,320 to 17,905, ending the week with around 2.40 percent gain. The Nifty witnessed a long built-up on the OI (open interest) front in the week gone by.

The Bank Nifty, on the other hand, underperformed the Nifty as if gained only 1.5 percent over the last week. The Bank Nifty traded in a broader range of 38,957-38,000.

The Bank Nifty gained more than 588 points last week and witnessed long built-up on the OI front.

Further diving into the Nifty upcoming weekly expiry PE writers showed aggression by building more positions compared to CE writers. The Nifty immediate resistance stands at the 18,300 levels, where nearly 36 lakh shares were added, followed by 19,500 levels with 70 lakh shares.

On the lower side, the immediate support level is at 18,200 where nearly 50 lakh shares were added, followed by 18,000 with an addition of 46 lakh shares.

Looking at the Bank Nifty upcoming weekly expiry data, immediate and vital resistance stands at 38,500 (15 lakh share). Whereas, on the downside, immediate support level stands at 38,500 (18 lakh shares) followed by 37,500 (11 lakh shares).

India VIX, fear gauge, decreased by 6 percent from 17.60 to 16.48 over the week. India VIX is trading near the lowest level of pre-COVID crash. A cool-off in the IV has given relaxation to the market. Further, any downticks in India VIX can push the upward momentum in the Nifty.

Looking at the sentimental indicator, Nifty OIPCR for the week has increased from 1.258 to 1.28. The Bank Nifty OIPCR over the week increased from 0.834 to 0.89 compared to last Friday. Overall data indicates more of PE writers over CE writers in the Nifty.

Let’s move into the weekly contribution of sectors to the Nifty. Most of the sectoral indices have contributed positively such as IT, NBFC and OIL have collectively contributed nearly 250+ in the Nifty’s 429 points gain. FMCG alone contributed on the negative side.

Let’s look at the top gainer and loser stocks of the month in the F&O segment. RBL Bank topped with over 15.3 percent gain, followed by PVR at 13.9 percent and Indian Hotels at 13.5 percent. Motherson Sumi led the losing squad with over 21.9 percent loss, followed by Idea at 15.8 percent and Wipro at 9.9 percent, over the week.

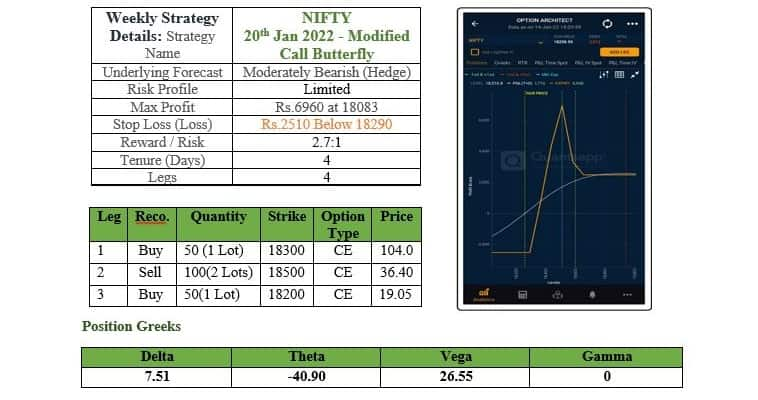

Considering the bullish momentum along, the upcoming week can be approached with a low-risk strategy like modified call butterfly in the Nifty.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions