In the first few trading sessions of the calendar year 2022, the benchmark Nifty has gained close to 5%. This rather sharp up move has surprised many market participants, considering that macro conditions have deteriorated in the past two weeks. The inflation has increased. The global energy prices have risen sharply. The US Fed commentary has become particularly hawkish. The NSO (National Statistical Office) has moderated the GDP growth estimates, forecasting it to be lower than the recent RBI estimates. The RBI has announced OMOs aimed at draining more liquidity from the market. The Corona cases have grown exponentially in the past two weeks, leading to stricter mobility restrictions. The latest IIP data has pointed to deceleration in economic growth momentum. Politically also, the ruling BJP may have lost some popularity points in the five states going to election from next month.

This less expected strong performance of the markets has evoked mixed reactions from the market participants.

One section of the market participants has grown extra cautious, fearing that this strong start to the year may fizzle out soon as the economic realities begin to hit harder and investors caught at higher levels may have to bear greater pain.

On the other hand, the other section finds the strong start to the year a good omen for the rest of the year. The experts in this section believe that strong domestic flows will continue to drive the markets in 2022. They feel that the global markets shall adjust to the new monetary policy in the next couple of months and USD may begin to flow towards emerging markets like India.

Yet another section believes that the Indian market may spend most of the year 2022 consolidating their position, moving in a broader range. It is felt that presently we may be at the midpoint of the range and hence the market offers a balanced risk-reward equation at this point in time.

Personally, I am not a fan of market level forecasting and like to work on individual business where I would like to invest my money. Trading in equity market is a highly specialized skill that requires strong technical skills, understanding of short-term business cycles, high risk appetite and good liquidity position. Incidentally, I possess none of these prerequisites to the successful trading enterprise.

Regardless, to satisfy my curiosity I did some star gazing, and noticed the following trends that may interest the short-term market traders.

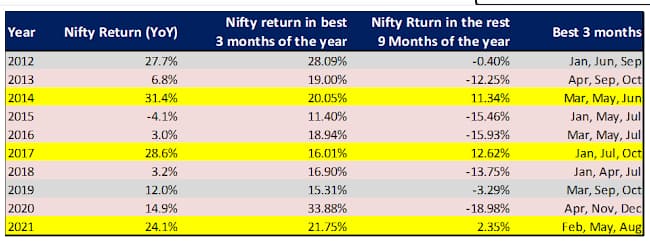

1. In the past 10 years (2012 to 2021), Nifty has given a positive return in 9 years. Only in 2015 Nifty yielded a negative return of -4.1%. The annual positive return has ranged between 3% (2016) and 28.6% (2017).

2. In 7 out of the past ten years, the sum of the returns in the best 3 months was higher than the annual Nifty returns. This implies that in these 7 years, the sum of returns in the rest 9 months was negative.

3. January has appeared 4 times in the best three months of the year in 10 years. Two of these years (2012 and 2017) were amongst the best 3 years of the decade. However, the other two years (2015 and 2018) were amongst the worst 3 years of the decade.

4 February and August have appeared only once in the best 3 months of the year (2021). This was one of the best 4 years of the decade.

5. Whenever January appeared in the list of best 3 months of the year, February and March were not in that list.

6. July has appeared 4 times in the list of 3 best months. On three of these four occasions (2015, 2016, 2018), Nifty peaked in July and August and the annual returns were lowest in the decade, ranging between -4.1% to 3%.

If the current rally sustains for the month of January and the past is any guide to the future, then there are 75% chances that the year 2022 may yield a low single digit return and the months of February and March may not be great months in terms of stock returns.

Do you believe in this data jugglery? Well I do not. The basic idea of sharing this statistics is to show that it means literally nothing.