Here’s what Karan Pai of GEPL Capital, recommends investors should do with these stocks when the market resumes trading today

Sunil Shankar Matkar

December 28, 2021 / 07:22 AM IST

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

The market showed smart recovery from the day’s low in late morning deals and closed with half a percent gains amid low volumes on December 27, backed by select banking and financials, IT, pharma and auto stocks. Generally volumes remain low in the last week of a year due to the holiday season.

The BSE Sensex climbed nearly 300 points to close above 57,400 levels, and the Nifty50 jumped more than 80 points to close near 17,100 mark, while the broader markets underperformed frontline indices. The Nifty Midcap 100 and Smallcap 100 indices gained 0.44 percent and 0.2 percent.

Stocks that were in focus include Laurus Labs which rallied 3.51 percent to Rs 519.25, Glenmark Pharma which gained 2.88 percent at Rs 509.65, and Ashoka Buildcon which surged 10.02 percent to Rs 101.55.

Other stocks that were in action include Vakrangee which jumped 4.64 percent to Rs 43.95, and La Opala RG which was up 2.86 percent at Rs 430.10.

Here’s what Karan Pai of GEPL Capital, recommends investors should do with these stocks when the market resumes trading today:

Laurus Labs

Laurus Labs is placed below the 200-Day SMA (simple moving average) (Rs 553) since October 28, 2021. On the shorter time frame, the prices seem to have found near the Rs 450 mark and formed a bullish confirmation with the RSI (relative strength index).

The prices seem to be heading higher towards the 200-Day SMA (Rs 553), this up move was backed by volume build-up, indicating participation in the up move.

Going ahead, we expect the prices to move higher towards the Rs 553 mark immediately, if the prices manage to break above this level, we might see the prices move higher towards Rs 660.

Investors who hold the stock can continue to hold on to their position with a strict stop loss at Rs 450 on daily closing basis and expect the prices to move higher towards Rs 660 once the hurdle of Rs 553 is crossed.

Glenmark Pharma

Glenmark on the medium-term charts can be seen hovering around the 200-week SMA (Rs 501) since August 2021. On a short time frame, we can be seen moving placed below the 200-Day SMA (Rs 552) which has been acting as resistance for quite some time. The prices seem to be attempting to move higher towards the 200-Day SMA.

On the indicator front, the RSI plotted on the weekly charts has formed a bullish crossover and attempting to move above the 50 mark, indicating increasing bullish momentum in prices.

Short-term traders holding this stock can use the up move towards the 200-Day SMA (Rs 552) to book their profit and exit from the position.

Long-term investors can hold on to their position with a stop loss of Rs 455 on daily closing basis as we expect good momentum build-up as the prices breach above the Rs 552 mark post which we might see the prices move higher towards the Rs 600-645.

Ashoka Buildcon

On the daily charts, Ashoka Buildcon seems to have halted its down move that started ever since the prices tested the Rs 125-mark high in October 2021.

On December 27, the prices moved higher and not only broke but also managed to end the session above the 200-day SMA (Rs 99.85). This up move was backed by good volume build-up, indicating participation in the up move.

On the indicator front, the RSI plotted on the daily chart moved above the 50 mark and is currently moving higher towards the overbought level, indicating increasing bullish momentum in the prices.

Investors can continue to hold on to this stock with a strict stop loss of Rs 95 on daily closing basis, as we expect the stock to move higher towards the Rs 109 and eventually towards the Rs 125 mark.

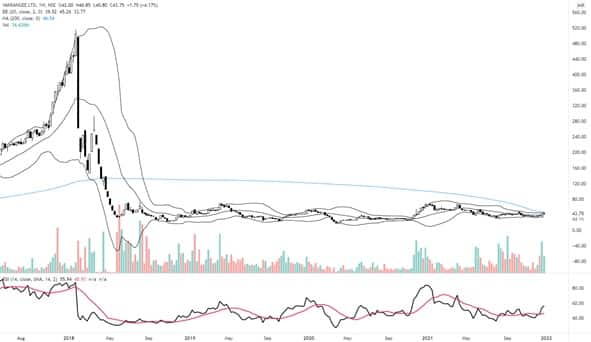

Vakrangee

Vakrangee, from a medium-term perspective, has been consolidating between Rs 71 and Rs 16 since May 2018. On the daily time frame, the stock moved above the 200-day SMA (Rs 43) on December 27, 2021. This up move was backed by good volume build-up, indicating participation in the up move.

On the indicator front the RSI plotted on the weekly time frame can be seen moving higher towards the overbought level after forming a bullish hinge near Rs 40, indicating increasing bullish momentum in prices.

Going ahead we expect the stock to test the Rs 50 mark immediately, after which we might see the stock move higher towards the Rs 71 level.

We would advise the investors to use this up move towards Rs 50 and Rs 71 to exit from this position.

La Opala RG

La Opala RG has been forming a higher high higher low pattern ever since the stock broke out of a consolidation and moved above Rs 252 in the month of May 2021.

On the indicator front, we can see that the RSI plotted in the daily time frame can be seen placed above the Rs 500 mark and is currently moving higher towards the overbought level, indicating increasing bullish momentum in the prices.

In the sessions to come, we expect the prices to move higher towards the Rs 530 mark immediately, if the prices sustain above this level we might see the prices move higher towards the Rs 570 mark eventually.

Investors holding this stock can continue to hold on to their position with a stop-loss of Rs 380 and expect the stock to move higher and test the Rs 570 mark.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.