Experts feel overall the index has been rangebound and the surpassing 17,200-17,300 mark in coming days can be concluded as a completion of recent corrective phase.

Sunil Shankar Matkar

December 27, 2021 / 10:41 AM IST

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

The recovery after Monday’s crash helped the benchmark indices close with moderate gains in the week ended December 24, with the easing of Omicron worries. Experts termed the recovery as a Santa Claus rally, especially on the back of more than 5 percent loss.

The BSE Sensex rose 113 points to 57,124, and the Nifty50 gained 19 points to 17,004 during the week. The index managed to close the week above the crucial 17,000 mark, aided by IT, FMCG and pharma stocks.

Experts feel that overall the index has been rangebound and the surpassing 17,200-17,300 mark in the coming days can be concluded as a completion of recent corrective phase.

“The Nifty maintaining its position beyond 17,000 is an indication that the bears have lost their steam, because we not only surpassed the downside gap area created on Monday but also went on to negate the breakdown,” says Sameet Chavan, Chief Analyst-Technical and Derivatives at Angel One.

According to him, if bulls have to regain the strength, 17,200–17,300 needs to be surpassed with some authority. “This development will confirm the completion of recent corrective phase and the bulls would probably be back at a driver’s seat thereafter,” he said.

If this has to happen, the banking needs to step up which is slightly lagging behind in the recovery, and till then the market is not completely out of the woods, Chavan feels.

As we are inching closer to the calendar year end, he advised traders to stick to the stock-centric approach because the real action lies there and expects it to continue in coming session as well.

Here are top 12 trading ideas by experts for the next 3-4 weeks. Returns are based on the December 24 closing prices:

Expert: Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities

HCL Technologies: Buy | LTP: Rs 1,265.10 | Stop-Loss: Rs 1,220 | Target: Rs 1,355 | Return: 7.1 percent

After a short-term price correction, the stock took the support near 100-DMA (daily moving average) or Rs 1,100 and reversed sharply. After the reversal, it has formed a promising head-and-shoulder formation which support medium term uptrend.

In addition, on weekly charts, the stock has formed strong bullish candle that also indicating further uptrend from current levels.

For the trend following traders, Rs 1,220 would be the key support level. Trading above the same, uptrend continuation wave is likely to continue till Rs 1,355.

ITC: Buy | LTP: Rs 218 | Stop-Loss: Rs 210 | Target: Rs 235 | Return: 7.8 percent

From the level of Rs 245, the stock has witnessed short-term price correction. It corrected over 10 percent from the level of Rs 245. After a sharp fall, finally it took support near Rs 210 and reversed sharply.

Momentum indicators and reversal formation indicating strong possibility of fresh uptrend, if it succeeds to trade above Rs 210 support level. Unless it is trading below Rs 210 and 200-day SMA (simple moving average), positional traders retain an optimistic stance and look for an upside of Rs 235.

Fresh buying can be considered now and on dips, if any between Rs 220 and Rs 215 levels with a stop-loss below Rs 210.

Godrej Consumer Products: Buy | LTP: Rs 966.25 | Stop-Loss: Rs 932 | Target: Rs 1,035 | Return: 7.1 percent

After a medium term correction, the stock took the support near 200-day SMA. After the correction, it showed a robust double bottom formation.

On weekly charts, it has formed strong bullish candle and after a long time, it succeeded to close above Rs 960 mark which is broadly positive.

For the positional traders, now Rs 932 would be the sacrosanct level to watch out, above the same uptrend momentum will continue up to Rs 1,035.

Expert: Nagaraj Shetti, Technical Research Analyst at HDFC Securities

Sharda Cropchem: Buy | LTP: Rs 339.50 | Stop-Loss: Rs 310 | Target: Rs 372 | Return: 9.6 percent

The weekly timeframe chart of Sharda Cropchem indicates a larger consolidation pattern as per weekly chart in the last few months. The stock price has moved above the crucial resistance of the consolidation at Rs 340 levels on Friday and closed at the edge of the said hurdle. Hence, there is a higher possibility of an upside breakout of this range movement in the coming week.

Volume has started to expand during upside breakout in the stock price and weekly 14 period RSI (relative strength index) shows positive indication. Hence, one may expect further strengthening of upside momentum in the stock price ahead.

Buying can be initiated in Sharda Cropchem at LTP and add more on dips down to Rs 322. One can wait for the upside target of Rs 372 in the next 3-4 weeks and place a stop-loss of Rs 310.

Caplin Point Laboratories: Buy | LTP: Rs 807.45 | Stop-Loss: Rs 750 | Target: Rs 890 | Return: 10.2 percent

After showing weakness in the previous week, the stock price has witnessed a decisive upside bounce in last week and closed higher. The weekly candle pattern indicate a formation of bullish Piercing line type pattern. This is positive indication.

The larger negative sequence of lower lows and highs is expected to be negated soon, as one may expect upside breakout of the down sloping trend line at Rs 830-835 levels in the coming week. Volume has expanded on Friday during upside breakout and the weekly 14 period RSI shows positive indication.

One may look to buy Caplin Point at CMP (Rs 807.45), add more on dips down to Rs 775. One can wait for the upside target of Rs 890 in the next 3-4 weeks and place a stop-loss of Rs 750.

Century Textiles & Industries: Buy | LTP: Rs 913.65 | Stop-Loss: Rs 850 | Target: Rs 1,005 | Return: 10 percent

After moving in a rangebound action over the last 6-7 weeks, the stock price has moved up sharply in the last week and closed above the hurdle of Rs 900 levels. This bullish action could be considered as an attempt of decisive upside breakout of the range movement for the short term.

The stock price has been sustaining above the crucial support of 20-week EMA (exponential moving average) as per weekly chart and showed a significant up move recently. The volume has also expanded during upside breakout. Weekly 14 period RSI and weekly ADX/DMI signal chances of further strengthening of upside momentum for the stock price ahead.

One may look to buy Century Textiles at LTP, and add more on dips down to Rs 875. One can wait for the upside target of Rs 1,005 in the next 3-4 weeks and place a stop loss of Rs 850.

Expert: Vijay Dhanotiya, Lead of Technical Research at CapitalVia Global Research

Ajanta Pharma: Buy | LTP: Rs 2,122.70 | Stop-Loss: Rs 1,990 | Target: Rs 2,450 | Return: 15.4 percent

The stock is trading near the lower band of an ascending channel. We expect a reversal from the support of lower band of the channel. It has also taken a support of EMA 200 line.

We have observed indicators like MACD (moving average convergence divergence) and RSI indicating the momentum in the stock is likely to continue.

We recommend a buy above Rs 2,180 with a target of Rs 2,450 with a stop-loss of Rs 1,990.

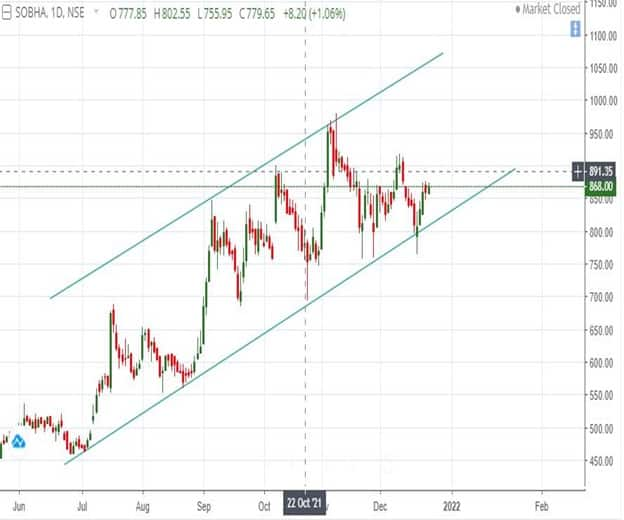

Sobha: Buy | LTP: Rs 869.60 | Stop-Loss: Rs 750 | Target: Rs 1,050 | Return: 20.7 percent

The stock has reversed from the support level near Rs 800. It has taken the support of lower band of an ascending channel.

We recommend a buy above Rs 875 with a target of Rs 1,050 and with a stop-loss of Rs 750.

JK Lakshmi Cement: Buy | LTP: Rs 550.70 | Stop-Loss: Rs 520 | Target: Rs 750 | Return: 36.2 percent

The stock is trading near the lower band of an ascending channel. We expect a reversal from the support of lower band of the channel.

It is near the level of EMA 200 line. We have observed indicators like MACD and RSI indicating the momentum in the stock is likely to continue.

We recommend a buy above Rs 560 with a target of 750 and with a stop-loss at Rs 520.

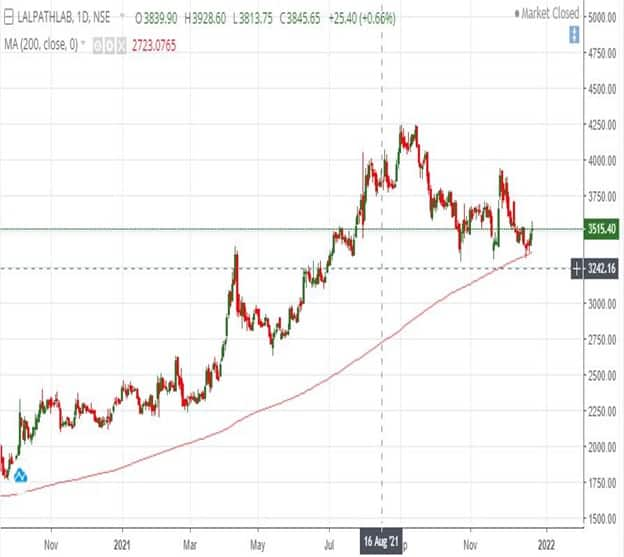

Dr Lal PathLabs: Buy | LTP: Rs 3,514.80 | Stop-Loss: Rs 3,250 | Target: Rs 4,200 | Return: 19.5 percent

The stock has been trading in a positive manner and has reversed from the previous level of Rs 3,250. It has also taken a support of 200 EMA and reversed from the same support level.

We recommend a buy above Rs 3,600 with a target of 4,200 and with a stop-loss of Rs 3,250.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.