Shriram Properties: The company will make its debut on the bourses on December 20. The issue price has been fixed at Rs 118 per share.

Shriram Properties: The company will make its debut on the bourses on December 20. The issue price has been fixed at Rs 118 per share.

Rategain Travel Technologies: Goldman Sachs Funds – Goldman Sachs India Equity Portfolio acquired 7,19,727 equity shares in the company at Rs 361.71 per share. However, Rajasthan Global Securities sold 9,35,105 equity shares in the company at Rs 362.18 per share, Edelweiss Mutual Fund offloaded 6,82,110 equity shares at Rs 360.7 per share, and Integrated Core Strategies Asia Pte sold 8,78,838 equity shares at Rs 356.22 per share on the NSE, the bulk deals data showed.

Rategain Travel Technologies: Goldman Sachs Funds – Goldman Sachs India Equity Portfolio acquired 7,19,727 equity shares in the company at Rs 361.71 per share. However, Rajasthan Global Securities sold 9,35,105 equity shares in the company at Rs 362.18 per share, Edelweiss Mutual Fund offloaded 6,82,110 equity shares at Rs 360.7 per share, and Integrated Core Strategies Asia Pte sold 8,78,838 equity shares at Rs 356.22 per share on the NSE, the bulk deals data showed.

Sintex Industries: Spring Ventures bought 30.5 lakh equity shares in the company at Rs 12.7 per share on the NSE, the bulk deals data showed.

Sintex Industries: Spring Ventures bought 30.5 lakh equity shares in the company at Rs 12.7 per share on the NSE, the bulk deals data showed.

India Infrastructure Trust: Rapid Holdings 2 Pte Limited sold 1.72 crore equity shares in the company at Rs 101 per share, however, IIFL Wealth Prime Limited bought 1.48 crore equity shares in the company at Rs 101 per share on the BSE, the bulk deals data showed.

India Infrastructure Trust: Rapid Holdings 2 Pte Limited sold 1.72 crore equity shares in the company at Rs 101 per share, however, IIFL Wealth Prime Limited bought 1.48 crore equity shares in the company at Rs 101 per share on the BSE, the bulk deals data showed.

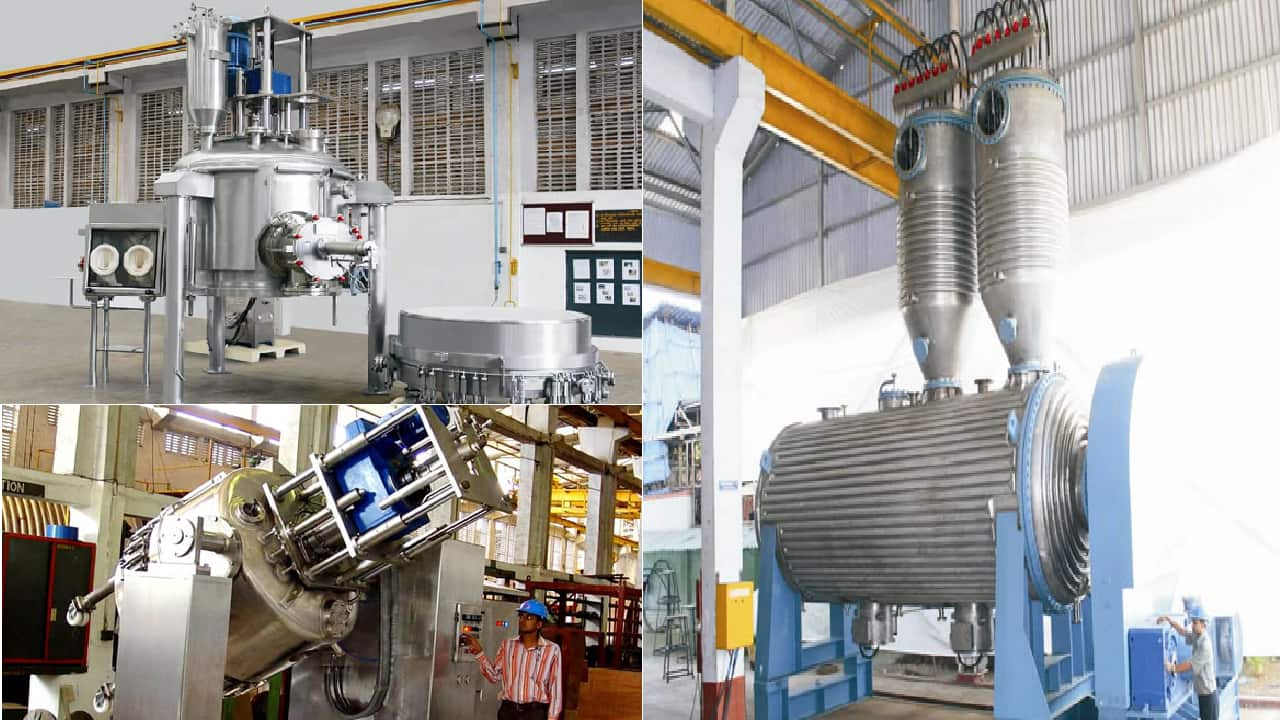

HLE Glascoat: The company successfully completed the acquisition of global business of Thaletec GmbH, along with its wholly owned subsidiary Thaletec Inc., USA, after receiving all necessary regulatory approvals.

HLE Glascoat: The company successfully completed the acquisition of global business of Thaletec GmbH, along with its wholly owned subsidiary Thaletec Inc., USA, after receiving all necessary regulatory approvals.

Zomato: The company has completed acquisition of 7.89 percent of Bigfoot Retail Solutions.

Zomato: The company has completed acquisition of 7.89 percent of Bigfoot Retail Solutions.

Indiabulls Real Estate: The company on December 22 will consider raising of funds through issuing equity shares and/or any other convertible or exchangeable securities.

Indiabulls Real Estate: The company on December 22 will consider raising of funds through issuing equity shares and/or any other convertible or exchangeable securities.

Future Retail: Competition Commission of India suspended Amazon’s deal with Future Group after it reviewed complaints that the American e-commerce giant concealed information while seeking regulatory approval.

Future Retail: Competition Commission of India suspended Amazon’s deal with Future Group after it reviewed complaints that the American e-commerce giant concealed information while seeking regulatory approval.

Brookfield India Real Estate Trust: The REIT approved the acquisition of Seaview Developers, which owns Candor Techspace N2, a special economic zone located in Noida.

Brookfield India Real Estate Trust: The REIT approved the acquisition of Seaview Developers, which owns Candor Techspace N2, a special economic zone located in Noida.

Kotak Mahindra Bank: Subsidiary Kotak Securities has entered into a definitive agreement to acquire 7.50 percent equity stake in Entroq Technologies.

Kotak Mahindra Bank: Subsidiary Kotak Securities has entered into a definitive agreement to acquire 7.50 percent equity stake in Entroq Technologies.

Sheela Foam: CRISIL has upgraded its long-term rating to AA-/Stable, from ‘A+/Positive.

Sheela Foam: CRISIL has upgraded its long-term rating to AA-/Stable, from ‘A+/Positive.

Mindteck (India): The company added a new manufacturing client headquartered in the United States to its roster.

Mindteck (India): The company added a new manufacturing client headquartered in the United States to its roster.

Aurum PropTech: The company approved acquisition to effectively hold 51% in Monk Tech Labs Pte. Ltd., Singapore, a SaaS platform company focused on rental management in real estate, for $ 2 million. It also approved rights issue price of Rs 80 per share, and rights entitlement ratio of 3 equity shares for every 2 equity shares held by eligible shareholders as on the record date.

Aurum PropTech: The company approved acquisition to effectively hold 51% in Monk Tech Labs Pte. Ltd., Singapore, a SaaS platform company focused on rental management in real estate, for $ 2 million. It also approved rights issue price of Rs 80 per share, and rights entitlement ratio of 3 equity shares for every 2 equity shares held by eligible shareholders as on the record date.

Safari Industries (India): Subsidiary Safari Manufacturing has executed a Deed of Conveyance with Lear Automotive (India).

Safari Industries (India): Subsidiary Safari Manufacturing has executed a Deed of Conveyance with Lear Automotive (India).

Ircon International: The company emerged as the lowest bidder for the project floated by National Highways Authority of India. The company entered into Share Subscription and Shareholders’ Agreement with Ayana Renewable Power for the execution of the project of setting-up 500 MW solar power plant through joint venture company which will be incorporated by IRCON and Ayana.

Ircon International: The company emerged as the lowest bidder for the project floated by National Highways Authority of India. The company entered into Share Subscription and Shareholders’ Agreement with Ayana Renewable Power for the execution of the project of setting-up 500 MW solar power plant through joint venture company which will be incorporated by IRCON and Ayana.

Technocraft Industries: The company proposed to sell 100% shareholding in Technocraft Australia Pty Ltd (TAPL) to SSS Group Holdings Pty Ltd, a scaffolding and edge protection services company of Australia. The company is also entering in to a 5-year exclusive distribution agreement with SSS for sale of scaffolding and formwork products to be manufactured and/or supplied by the company to SSS exclusively in the Australian market.

Technocraft Industries: The company proposed to sell 100% shareholding in Technocraft Australia Pty Ltd (TAPL) to SSS Group Holdings Pty Ltd, a scaffolding and edge protection services company of Australia. The company is also entering in to a 5-year exclusive distribution agreement with SSS for sale of scaffolding and formwork products to be manufactured and/or supplied by the company to SSS exclusively in the Australian market.

IRB Infrastructure Developers: The company has emerged as the selected bidder for development of access controlled six lane Greenfield ‘Ganga Expressway’ in Uttar Pradesh on DBFOT (Toll) basis under PPP and has received Letter of Award (LOA) from Uttar Pradesh Expressways Industrial Development Authority (UPEIDA).

IRB Infrastructure Developers: The company has emerged as the selected bidder for development of access controlled six lane Greenfield ‘Ganga Expressway’ in Uttar Pradesh on DBFOT (Toll) basis under PPP and has received Letter of Award (LOA) from Uttar Pradesh Expressways Industrial Development Authority (UPEIDA).

Gujarat Alkalies & Chemicals: The company and GAIL have signed Memorandum of Understanding for setting up a 500 KLD bioethanol plant in Gujarat. The estimated project cost is to the tune of Rs 1,000 crore and it is expected to generate annual revenue of approximately Rs 1,500 crore.

Gujarat Alkalies & Chemicals: The company and GAIL have signed Memorandum of Understanding for setting up a 500 KLD bioethanol plant in Gujarat. The estimated project cost is to the tune of Rs 1,000 crore and it is expected to generate annual revenue of approximately Rs 1,500 crore.

Pennar Industries: The company has bagged orders worth Rs 582 crore.

Pennar Industries: The company has bagged orders worth Rs 582 crore.

Prakash Industries: CARE has assigned the credit rating BB (CWD) for long term bank facilities of the company.

Prakash Industries: CARE has assigned the credit rating BB (CWD) for long term bank facilities of the company.

Mold-Tek Packaging: The company closed its QIP issue and raised Rs 103.60 crore, at a price of Rs 740 per share.

Mold-Tek Packaging: The company closed its QIP issue and raised Rs 103.60 crore, at a price of Rs 740 per share.

UltraTech Cement: The company has commenced operations from its bulk terminal at Kalamboli, Navi Mumbai. This is the 7th bulk terminal of the company.

UltraTech Cement: The company has commenced operations from its bulk terminal at Kalamboli, Navi Mumbai. This is the 7th bulk terminal of the company.

RBL Bank: The bank has been authorized by the Reserve Bank of India, to collect indirect taxes on behalf of the Central Board of Indirect Taxes and Customs (CBIC).

RBL Bank: The bank has been authorized by the Reserve Bank of India, to collect indirect taxes on behalf of the Central Board of Indirect Taxes and Customs (CBIC).

V-Mart Retail: ICICI Prudential Asset Management Company acquired 25,002 equity shares in the company via open market transactions, increasing shareholding to 5.09% from 4.96% earlier.

V-Mart Retail: ICICI Prudential Asset Management Company acquired 25,002 equity shares in the company via open market transactions, increasing shareholding to 5.09% from 4.96% earlier.