Traders are advised to stay light on positions and even if the market attempts to recover, one should avoid aggressive longs till the time 17,700 is not surpassed, says Sameet Chavan of Angel One.

Sunil Shankar Matkar

December 20, 2021 / 07:57 AM IST

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

The market corrected almost every day through the week ended December 17, taking the total weekly loss of the benchmark indices to 3 percent. As a result of which, there was bearish candle formation on the weekly charts, indicating bearishness in the market which experts feel can drag the index towards recent low of 16,782 levels and if this level is broken, then sharp correction can’t be ruled out.

The Nifty50 corrected 526.10 points to close the week below the crucial 17,000 mark, at 16,985.20 as heavy selling was seen across sectors, barring IT. Even the last day of the week turned out to be a Black Friday as there was 1.5 percent correction.

“Now the way the market tumbled on Friday, recent swing low of around 16,800 is in jeopardy now. We will not be surprised to see it happening to test 16,500-16,200 zone,” says Sameet Chavan, Chief Analyst-Technical and Derivatives at Angel One.

He feels that the next couple of sessions would be quite crucial and, if any recovery has to happen, this is the best possible zone from where it should take off. “All eyes are on the banking space because the way it’s placed, it is likely to dictate the short-term trend,” he said.

The broader markets, too, took it on the chin. The Nifty Midcap 100 and Smallcap 100 indices were down 4 percent 3.6 percent during the week, and saw more than 2.4 percent correction on Friday.

“Traders are advised to stay light on positions and even if the market attempts to recover, one should avoid aggressive longs till the time 17,700 is not surpassed. Before this, 17,100-17,200 are to be considered as immediate hurdles,” says Sameet Chavan.

Here are top 12 trading ideas by experts for the next 3-4 weeks. Returns are based on December 17 closing prices:

Expert: Subash Gangadharan, Senior Technical/Derivative Analyst at HDFC Securities

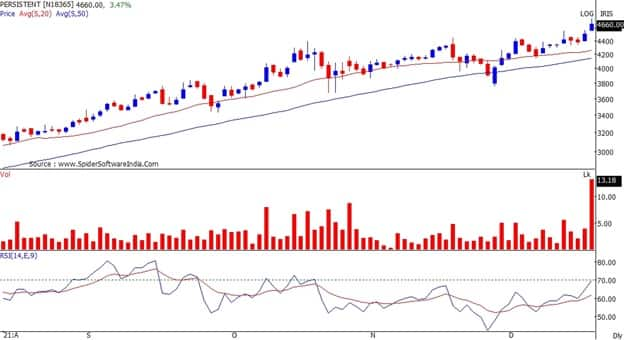

Persistent Systems: Buy | LTP: Rs 4,640.15 | Stop-Loss: Rs 4,400 | Target: Rs 5,200 | Return: 12 percent

Persistent has been consolidating in a range of Rs 4,200-4,560 for the last few sessions. On Friday, the stock broke out of this range on the back of huge volumes. This augurs well for the uptrend to continue.

Technical indicators are giving positive signals as the stock is trading above the 20-day and 50-day SMA (simple moving average). Momentum readings like the 14-day RSI (relative strength index) too are in rising mode and not overbought, which implies potential for further upsides.

We, therefore, expect the stock to move up further and test new life highs in the coming sessions. Buy in the Rs 4,640-4,680 range with a stop loss at Rs 4,400 and target at Rs 5,200.

Cipla: Sell | LTP: Rs 860.20 | Stop-Loss: Rs 908 | Target: Rs 750 | Return: (-12.8) percent

Cipla has been consolidating in a range of Rs 870-1,005 for the last several weeks. This week, the stock broke down from this range on the back of healthy volumes, indicating that selling was intense.

Technical indicators are giving negative signals as the stock is trading below the 20-day and 50-day SMA and both these moving averages are now sloping down. Momentum readings like the 14-week RSI, too, are in decline mode and not oversold, which implies potential for more downsides.

We, therefore, expect the stock to correct further in the coming sessions. Sell between the Rs 854 and Rs 860 levels. Stop loss is at Rs 908, while downside target is at Rs 750.

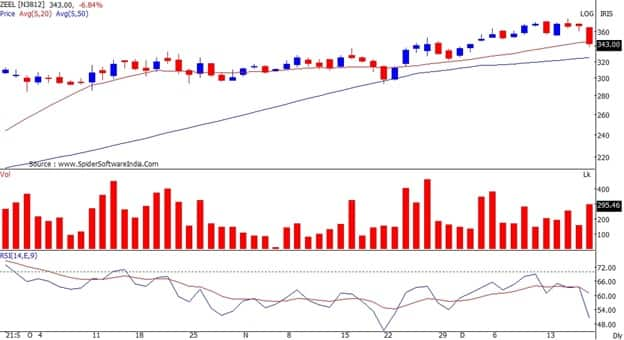

Zee Entertainment Enterprises: Sell | LTP: Rs 342.35 | Stop-Loss: Rs 366 | Target: Rs 300 | Return: (-12.4) percent

Zee Entertainment was steadily climbing higher over the last few weeks. However, on Friday, the stock reversed its short term uptrend by breaking its support of Rs 353 and closing below it on the back of above average volumes.

Technical indicators are giving negative signals as Friday’s fall led to the stock closing below the 20-day SMA. Momentum readings like the 14-day RSI, too, are in decline mode and not oversold, which implies potential for more downsides.

We, therefore, expect the stock to correct further in the coming sessions. Sell between the Rs 341-345 levels. Stop loss is at Rs 366 while downside target is at Rs 300.

Expert: Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities

Hindustan Unilever: Buy | LTP: Rs 2,230.25 | Stop-Loss: Rs 2,180 | Target: Rs 2,350 | Return: 5.4 percent

The stock is down but not out. It is facing relentless selling from a high of Rs 2,860 to Rs 2,230. In the last tree months, we have seen a 22 percent decline from the highs.

Technically, it is on a significant support and has reached oversold levels on a weekly basis. It is advisable to buy in the Rs 2,230-2,220 levels. As the market is down, we need to protect the long position at Rs 2,180 with a tight stop loss. On the upside, resistance would be at the Rs 2,300 and Rs 2,350 levels.

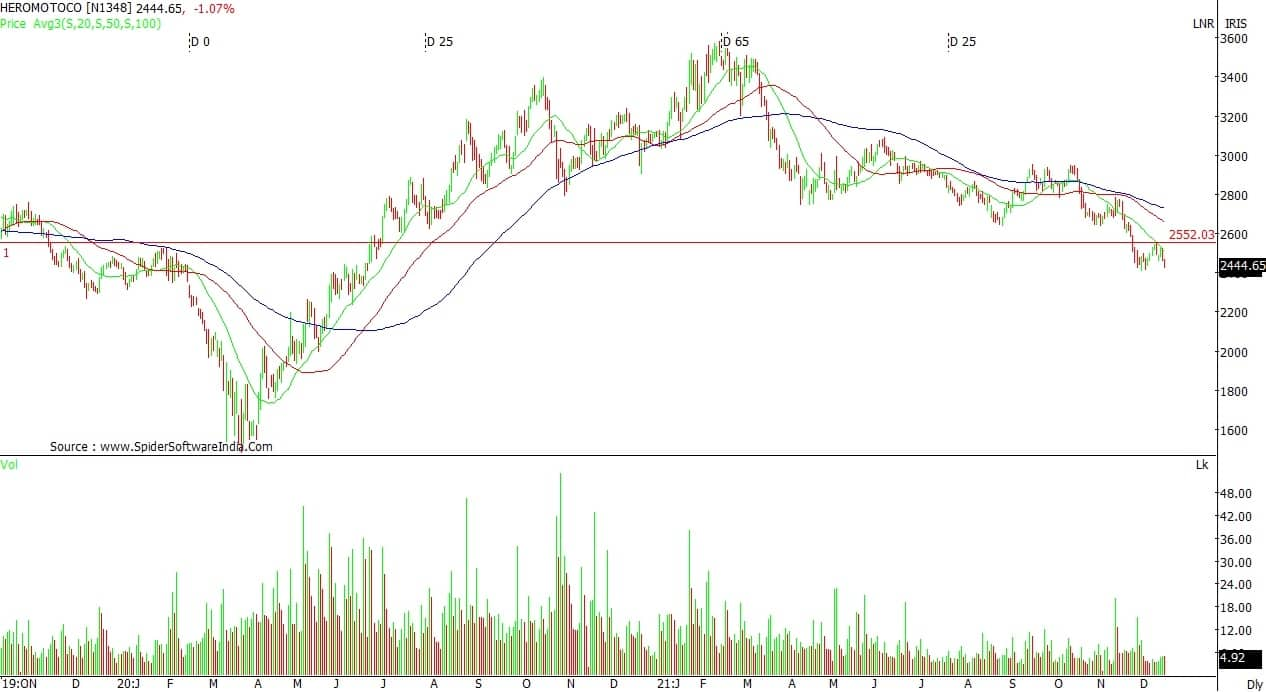

Hero MotoCorp: Sell | LTP: Rs 2,444.65 | Stop-Loss: Rs 2,500 | Target: Rs 2,250 | Return: (-8) percent

The stock is trading below significant support, below the retracement ratio. The entire sector is under tremendous sales pressure, creating a series of lower tops and lower bottoms.

It is advisable to sell at the current level for a target of Rs 2,300 and Rs 2,250. Keep the final stop loss at Rs 2,500.

IndusInd Bank: Sell | LTP: Rs 883 | Stop-Loss: Rs 905 | Target: Rs 810 | Return: (-8.3) percent

The stock has plummeted from Rs 1,242 to Rs 875 without any significant bounce back. After two weeks of consolidation in the trading zones of Rs 875 and Rs 960, the stock has started the downward journey again.

Upon dismissal of Rs 875, it will move to the next support zone, which is between Rs 830-810. It is advisable to trade short sell at the current level. For that, keep a stop loss at Rs 905.

Expert: Vijay Dhanotiya, Lead of Technical Research at CapitalVia

Cyient: Buy | LTP: Rs 984.95 | Stop-Loss: Rs 890 | Target: Rs 1,350 | Return: 37 percent

The stock is trading near the lower band of an ascending channel. We expect a reversal from the support of lower band of the channel.

It has also taken a support of EMA (exponential moving average) 200 line. We have observed indicators like MACD (moving average convergence divergence) and RSI indicating the momentum in the stock is likely to continue. We recommend a buy above Rs 1,020 with a target of Rs 1,350 with a stop loss of Rs 890.

TCS: Buy | LTP: Rs 3,584.35 | Stop-Loss: Rs 3,350 | Target: Rs 4,000 | Return: 11.6 percent

The stock has reversed from the support level near Rs 3,400 after retesting the level of an ascending triangle it has given the breakout in the past. It has also got the support of 200 EMA line. We recommend a buy above Rs 3,670 with a target of Rs 4,000 with a stop loss at Rs 3,350.

Persistent Systems: Buy | LTP: Rs 4,640.15 | Stop-Loss: Rs 4,220 | Target: Rs 5,150 | Return: 11 percent

Persistent is trading in an ascending channel and has taken the support of 55 EMA line. It has reversed from the support of lower band of the channel as well.

We have observed indicators like MACD and RSI, indicating the momentum in the stock. We recommend a buy above Rs 4,750 with a target of Rs 5,150 and a stop loss at Rs 4,220.

Expert: Aprajita Saxena, Research Analyst at Trustline Securities

Larsen & Tourbo Infotech: Buy | LTP: Rs 6,978.30 | Stop-Loss: Rs 6,620 | Target: Rs 7,450-7,630 | Return: 6.75-9.3 percent

Stock has given symmetrical triangle break out with jump in volumes on the daily chart. Stock price managed to close above its 21-day exponential moving average which has added further strength to stock.

Daily RSI lines are placed above 50 and are sloping upwards, indicating strength in the current uptrend. L&T Infotech seems to be a good buying candidate with upside targets of Rs 7,450 and Rs 7,600. We recommend a stop loss of Rs 6,620 on daily closing basis.

SBI Card: Sell | LTP: Rs 903.05 | Stop-Loss: Rs 955 | Target: Rs 875-810 | Return: (-3.1-10.3) percent

The stock is trading in a lower highs and lower lows formation and has given rounded top breakdown. This pattern indicates there is a likelihood that the stock is providing selling opportunities for traders.

SBI Card is trading below its 21, 50 and 100-day exponential moving averages on the daily time frame, which is negative for the prices in the near term. During the week, the stock prices slipped below its weekly ’50-EMA’ (exponential moving average) as well on weekly chart.

One can look to short in the range of Rs 925–900 for a near-term target of Rs 875-810. The stop loss can be placed at Rs 955.

Grindwell Norton: Buy | LTP: Rs 1,896.25 | Stop-Loss: Rs 1,700 | Target: Rs 2,000-2,200 | Return: 5.5-16 percent

At the current juncture, the stock has formed triangle pattern broken out on the daily charts. Primary trend of the stock has been bullish with higher tops and higher bottoms. The stock has been holding levels above its medium to long term moving averages. Daily RSI lines are placed above 60 and sloping upwards, indicating strength in the current uptrend.

If the price sustains above Rs 1,830-1,850 mark, we might see the price move higher towards the Rs 2,000 and Rs 2,200 eventually. One can buy Grindwell Norton at current levels and hold it for a target of Rs 2,000 and Rs 2,200 with a strict stop-loss at Rs 1,700 on daily closing basis.

City Union Bank: Sell | LTP: Rs 140 | Stop-Loss: Rs 155 | Target: Rs 128-115 | Return: (-8.6-18) percent

Indian markets are witnessing a strong sell off. City Union Bank failed to surpass the crucial resistance of 21-day EMA (exponential moving average), Momentum oscillator RSI (14) is showing a signs of weakness on daily as well as the weekly chart whereas the MACD indicator is also reading below its centerline.

The stock has given rounded top breakdown. The price has broken through and the candle has closed below the neckline marked on the daily chart. The stock is offering selling opportunity for traders.

Traders can look to short on a small bounce towards Rs 145-143 for a short term target of Rs 128-115. The stop loss can be placed at Rs 155.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.