Retirees and near-retirees have every reason to gloat over the stunning losses that meme stocks have suffered in recent weeks.

That’s because earlier this year, when meme stocks were all the rage, the graybeards were dismissed as irrelevant has-beens.

They just didn’t “get” the meme stock phenomenon; their concerns about earnings and balance sheets were hopelessly old-fashioned. Warren Buffett, arguably the most successful investor alive today, and very much a graybeard at age 91, was all “washed up,” according to one widely followed blogger.

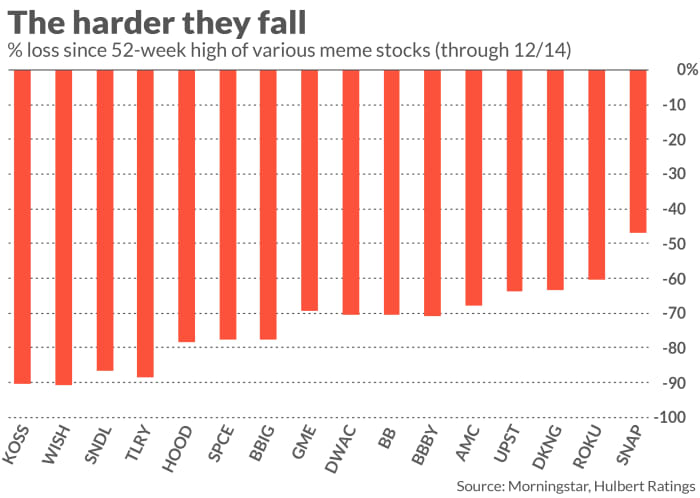

The tables are now turned. Consider a group of 16 of the most popular meme stocks from earlier this year. The list was constructed by Morningstar by determining which stocks experienced the biggest social-media-induced jumps in both trading volume and prices. On average, as you can see from the accompanying chart, they currently are trading 72% below their respective 52-week highs. (These performance numbers reflect Dec. 15 prices.)

The reason to point this out is not to take sides in a gloating war, however. It instead is important because it reinforces the time-tested truth that it’s extremely difficult for stock pickers to beat the market over the long term.

You might object that, even though these stocks are all off their 52-week highs, some are still well ahead for year-to-date performance. AMC Entertainment AMC, +20.37%, for example, is sitting on a greater-than-1000% gain since the beginning of the year, despite being 66% off its 52-week high. GameStop GME, +8.00% is up nearly 700% for year-to-date performance, despite being 69% below its high. Both are well ahead of the S&P 500 SPX, -0.36%, needless to say.

But relatively few meme stock investors are sitting on gains this large, since most of these stocks’ trading volume came after they started skyrocketing in price. Though there is no way of knowing for sure, my hunch from analyzing the data is that the average buy price for current holders of these stocks is closer to these stocks’ 52-week highs than it is to their beginning-of-year prices. That in turn means many current holders of these stocks are sitting on losses.

Wall Street’s food chain

It’s not Monday-morning quarterbacking to point out that meme stocks have poor performance prospects. One academic study making this assertion was posted on the Social Science Research Network on Feb. 1 of this year, within days of when the majority of these 16 meme stocks hit their 52-week highs. Entitled “Retail Trader Sophistication and Stock Market Quality: Evidence from Brokerage Outages,” the study was conducted by Gregory Eaton and Brian Roseman of Oklahoma State University and T. Clifton Green and Yanbin Wu of Emory University.

The researchers were able to determine the chronological order of three separate market phenomena:

- The day on which retail volume in a stock hits its peak.

- The day on which mentions of that stock hit a peak on the Reddit forum WallStreetBets. (This forum is the go-to social media platform for the meme stock crowd.)

- The day on which trading volume for the stock on Robinhood hits a peak. (Robinhood, of course, is the zero-commission brokerage that is popular among meme stock investors.)

The ordering of these three days tells us whether the meme stock traders on WallStreetBets and at Robinhood are leaders or followers, on average. The researchers found strong evidence of the latter: “Aggregate retail volume leads WallStreetBets mentions by a couple of days and therefore also leads Robinhood activity by nearly a week. The delayed pattern suggests that Robinhood investors trade after other retail traders in aggregate.”

Being late to the party isn’t necessarily a bad thing. But in this case it seems to be, according to a separate academic study conducted by Brad Barber of the University of California at Davis, Xing Huang of Washington University, Terrance Odean of the University of California at Berkeley, and Chris Schwarz of the University of California at Irvine. This study was posted on SSRN in October 2020. The researchers found that “betting against Robinhood users is a profitable business; the top stocks bought by Robinhood users fall by 5% over the next month while the most extreme herding events see reversals of 9%.”

Joachim Klement, a trustee of the CFA Institute Research Foundation and former head of equity strategy for UBS Wealth Management, in March summarized the implication of these two studies for the meme stock phenomenon. He referred to a now famous comment that Warren Buffett made in his 1987 letter to Berkshire Hathaway shareholders: “As they say in poker, ‘If you’ve been in the game for 30 minutes and don’t know who the patsy is, you’re the patsy’.” Klement’s point: Far from revolutionizing the market, as many meme stock investors were claiming at the time, they were “instead the patsies on the table.”

The investment lesson to take away from this, as I hinted above, is that it’s difficult for a stock picker to beat the market over the long run. On the one hand, there will be short-term periods when the individual stocks you pick will beat the market, as was the case earlier this year for meme stocks. But, on the other hand, there will be other times when your stocks will lag behind the market. Over the long run it is extremely unlikely that you’ll come out ahead.

In almost all cases, therefore, that means you should have the bulk of the equity allocations in your retirement portfolios invested in broad-market index funds.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com