When it comes to the stock markets, just like cricket, Bollywood, or even politics, everyone has an opinion. But the market opinions that matter the most belong to people actually managing the money. The Moneycontrol Market Sentiment survey aims to gauge the mood of the market and get a sense of its direction by polling money managers.

In recent days, the Indian equity market has been volatile as investors appear jittery about the new coronavirus strain Omicron, worried that it may derail the economic recovery again.

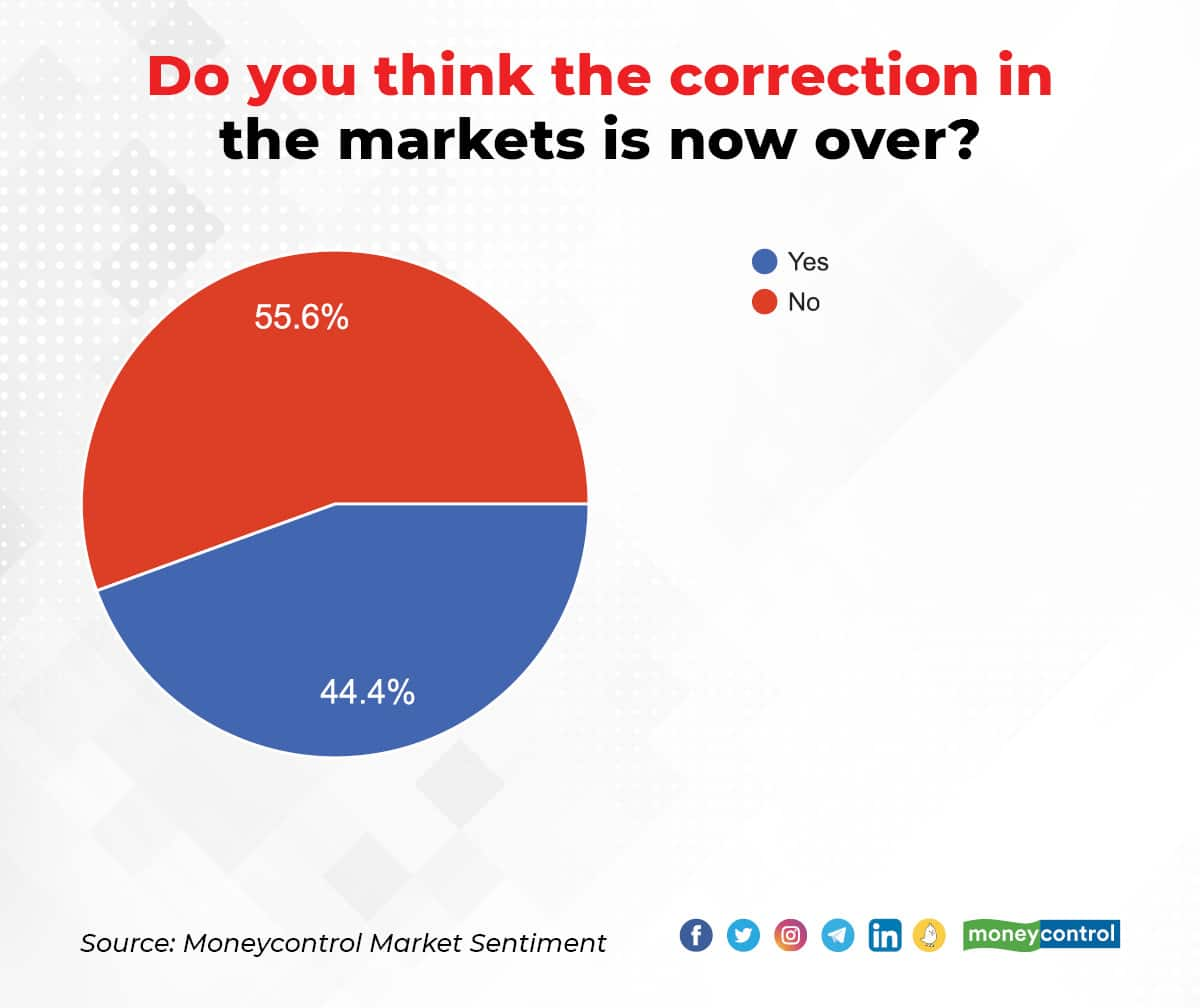

The sixth edition of the money managers’ survey reveals that the correction in the market is not over yet, with about 56 percent of the respondents sharing the view.

The benchmark Sensex has slipped about 8 percent to 57,011 on December 17, 2021 from October’s high of 61,765.

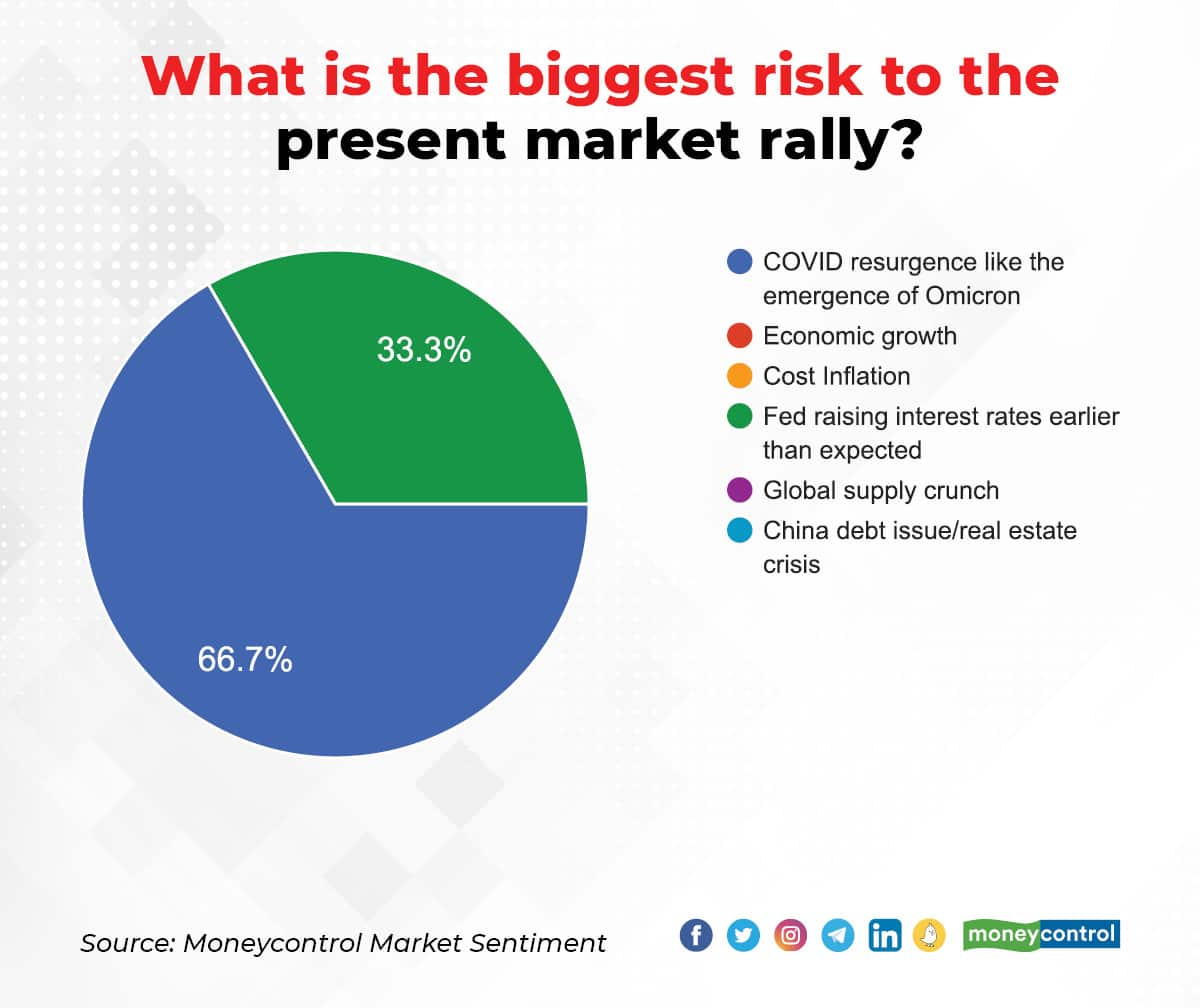

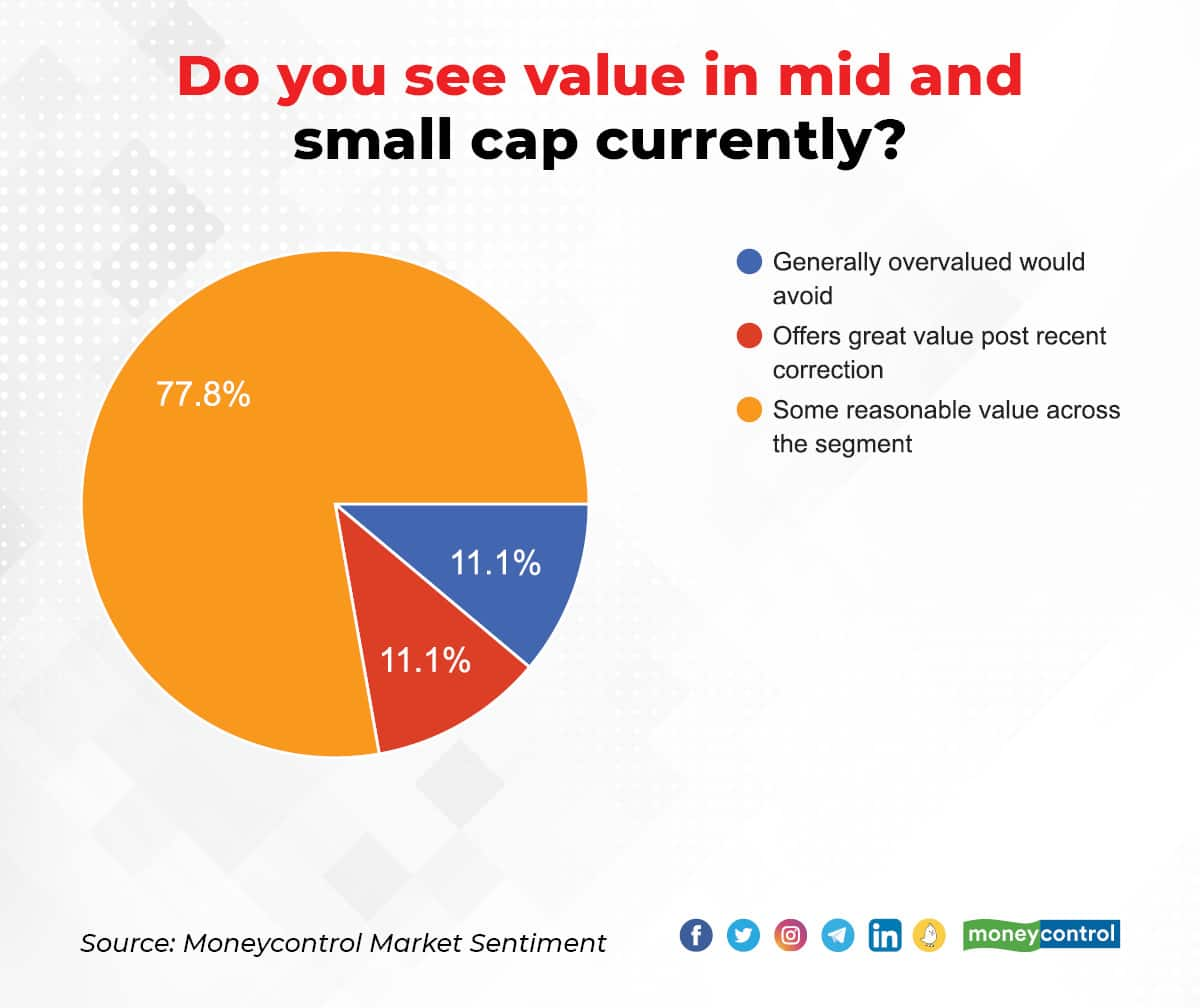

About 66 percent of the respondents see the emergence of Omicron as the biggest threat to the market at the moment, though they believe that there is still some reasonable value left in midcap and smallcap segments.

Nine fund managers, managing about Rs 1.99 lakh crore of assets, participated in the sixth edition of the Moneycontrol survey.

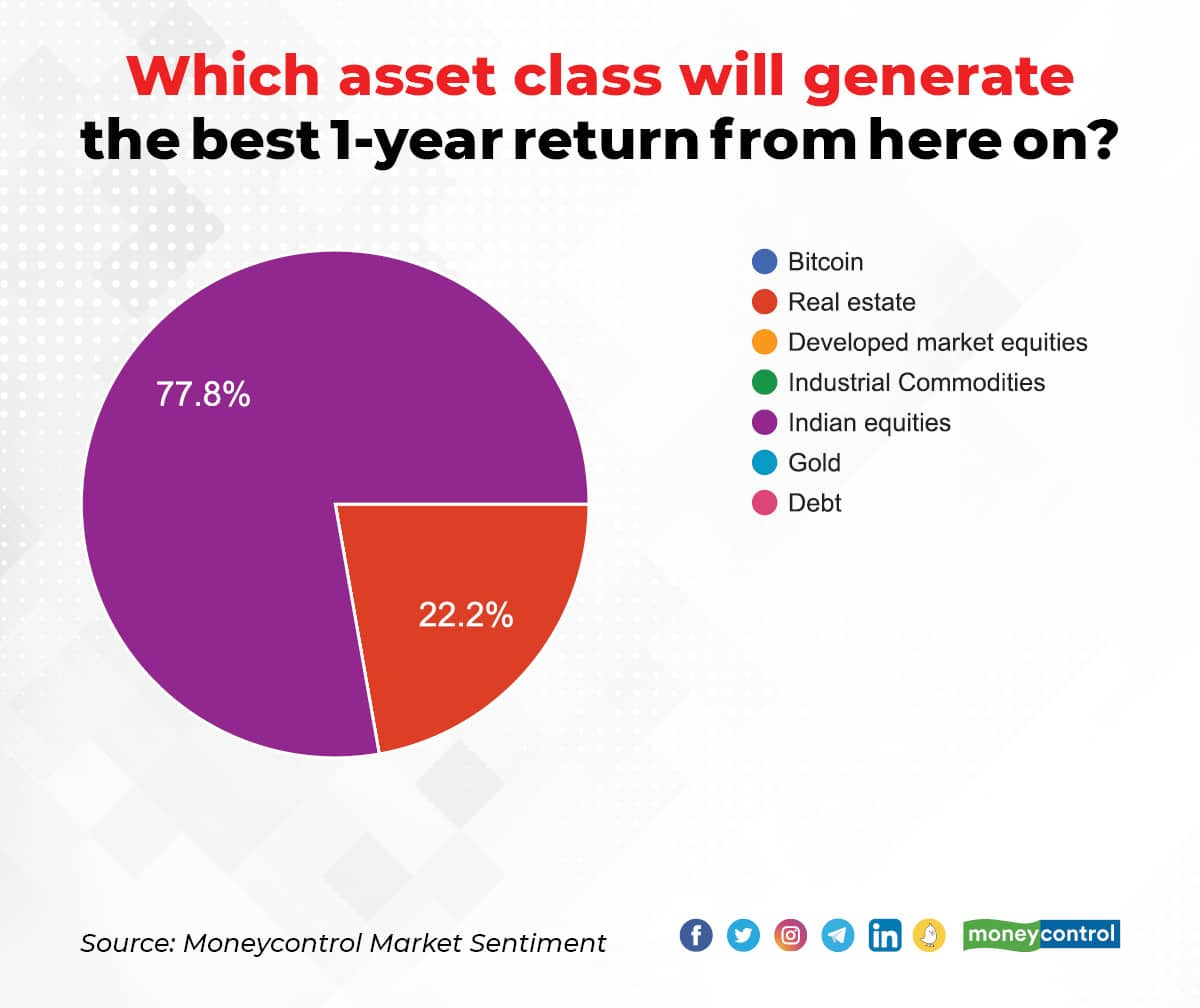

About 78 percent of the fund managers surveyed believe that equities will generate the best return among various asset classes over the next year.

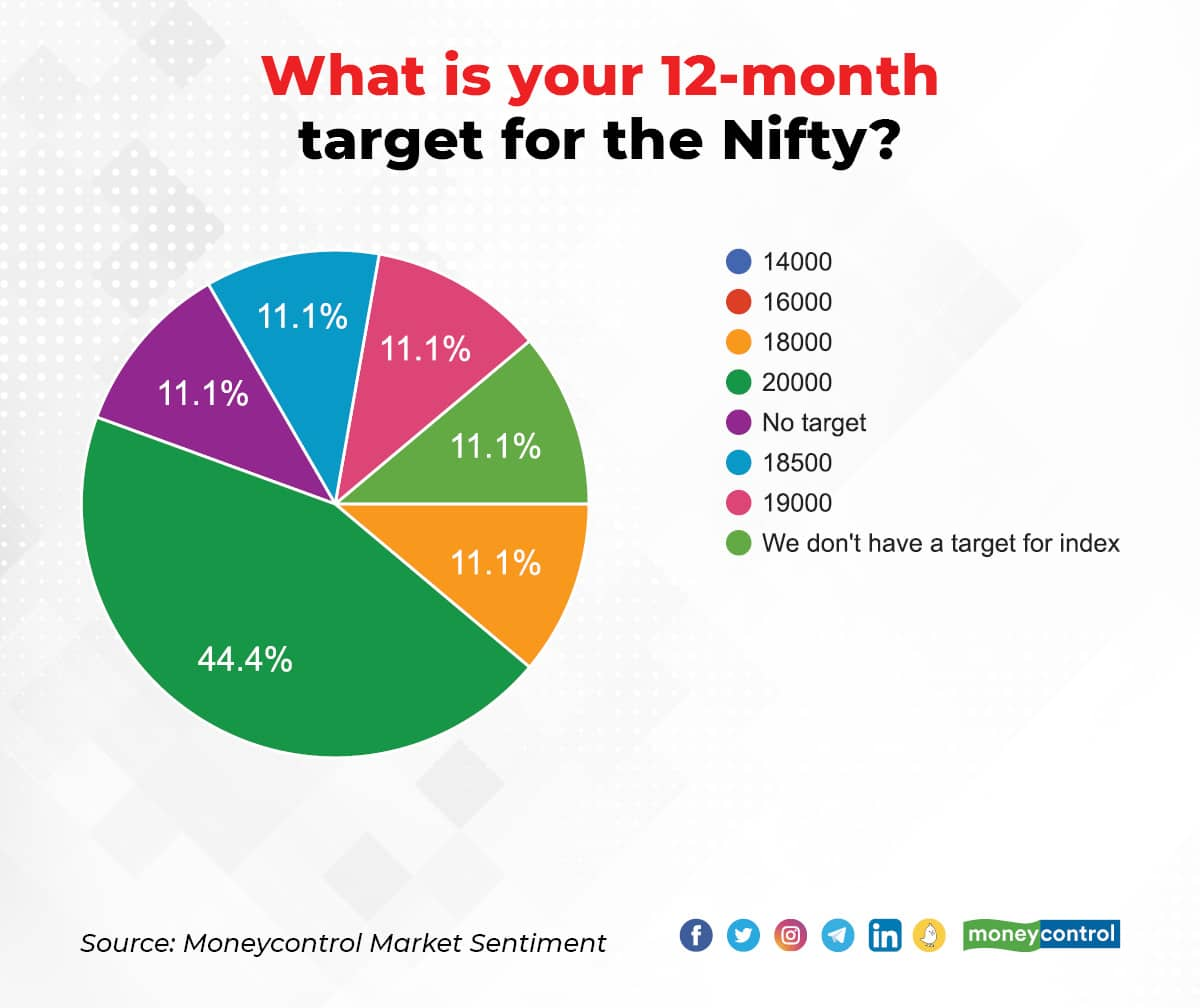

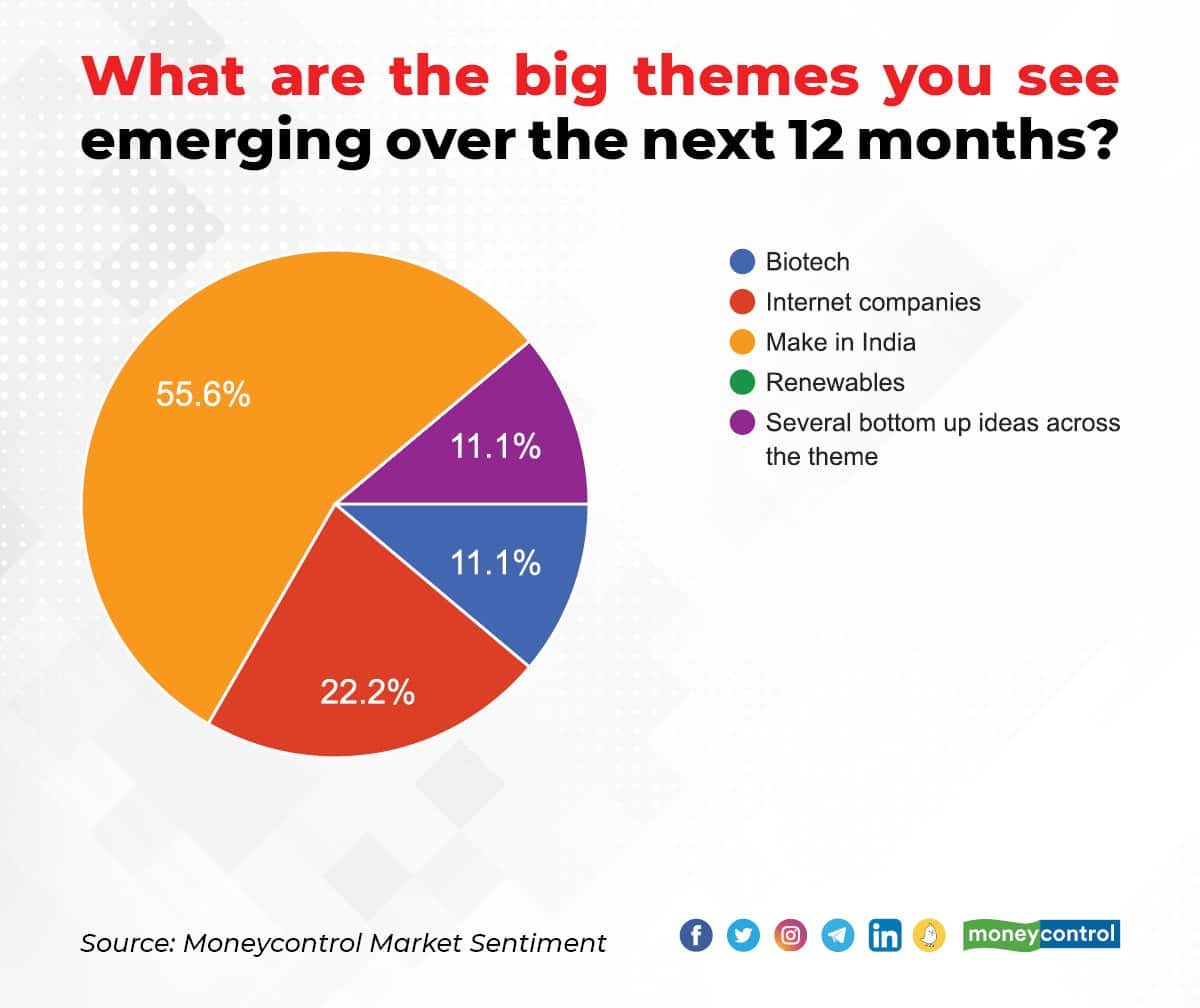

As many as 44 percent see the Nifty reaching the 20,000-mark during the same period. “Make in India” will be the big investment theme over the next 12 months, the survey has found.

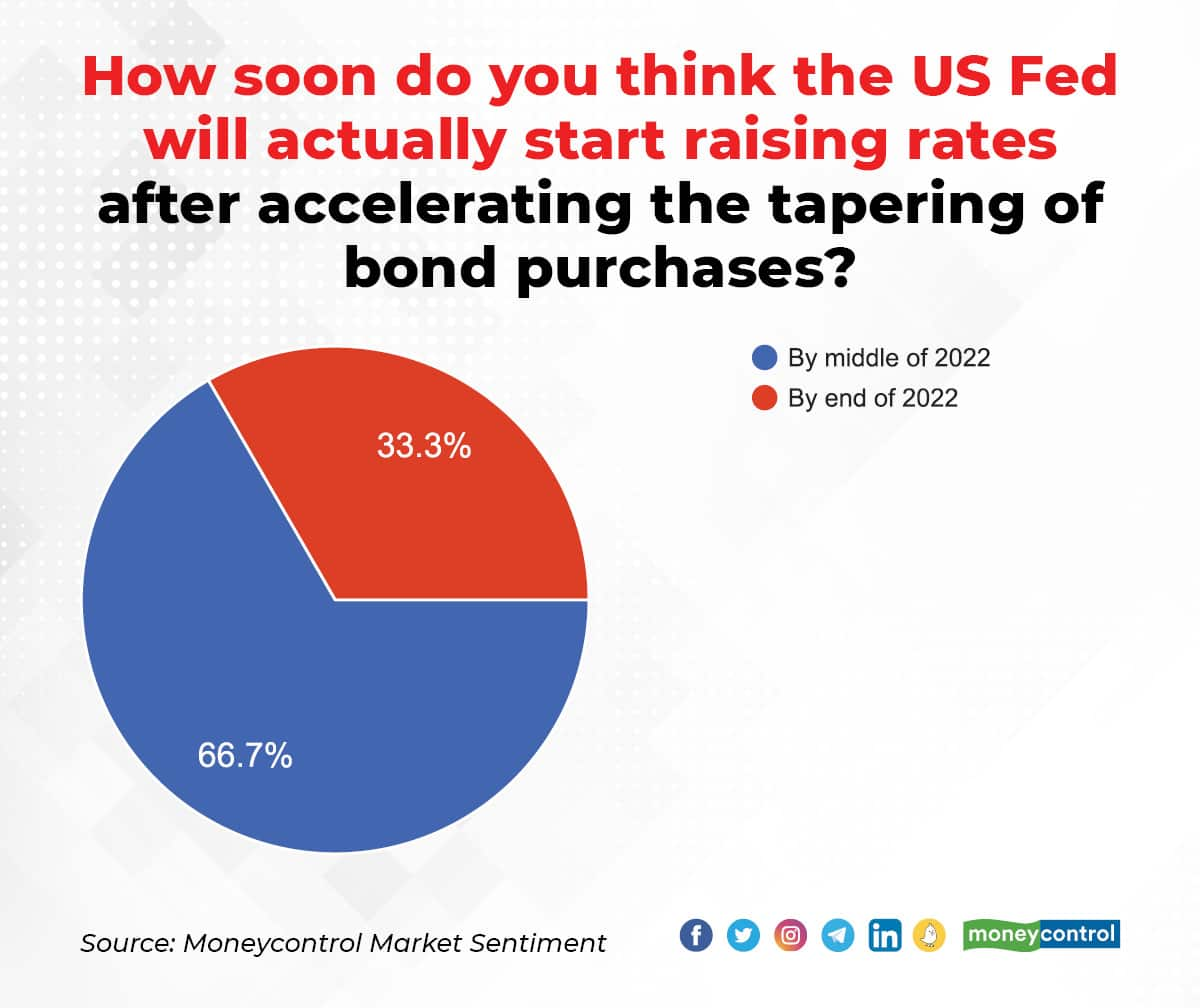

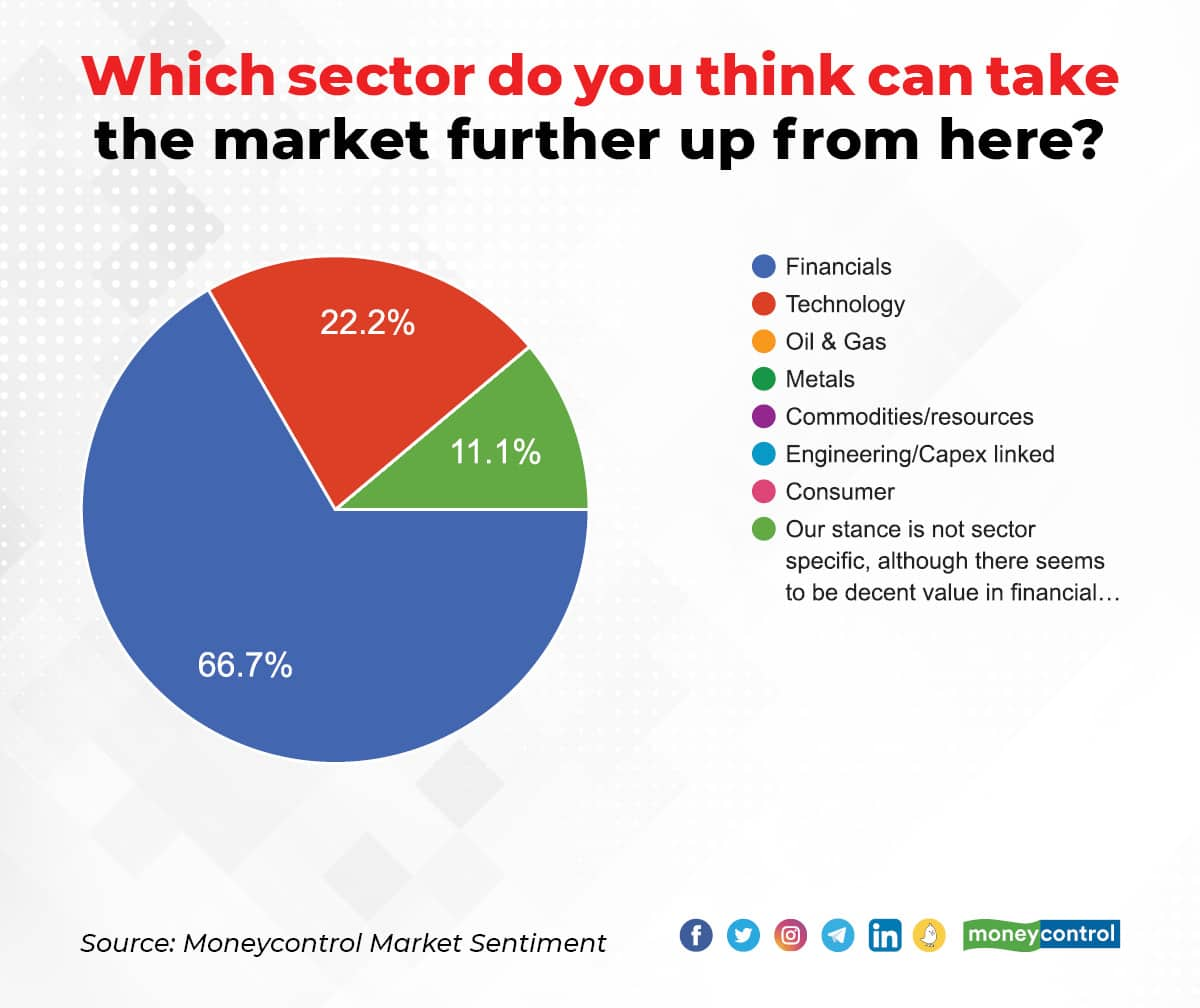

The majority of experts think that it is the financial sector that has the potential to take the markets further up. About 67 percent believe that by the middle of 2022 the US Federal Reserve will start raising rates after accelerating the tapering of bond purchases.

Sharing their investment strategy, slightly over half of the respondents say they will stay invested, as they see further upside. Nearly a third, too, are staying invested but are hedging for a fall and the rest will book profits and stay in cash.

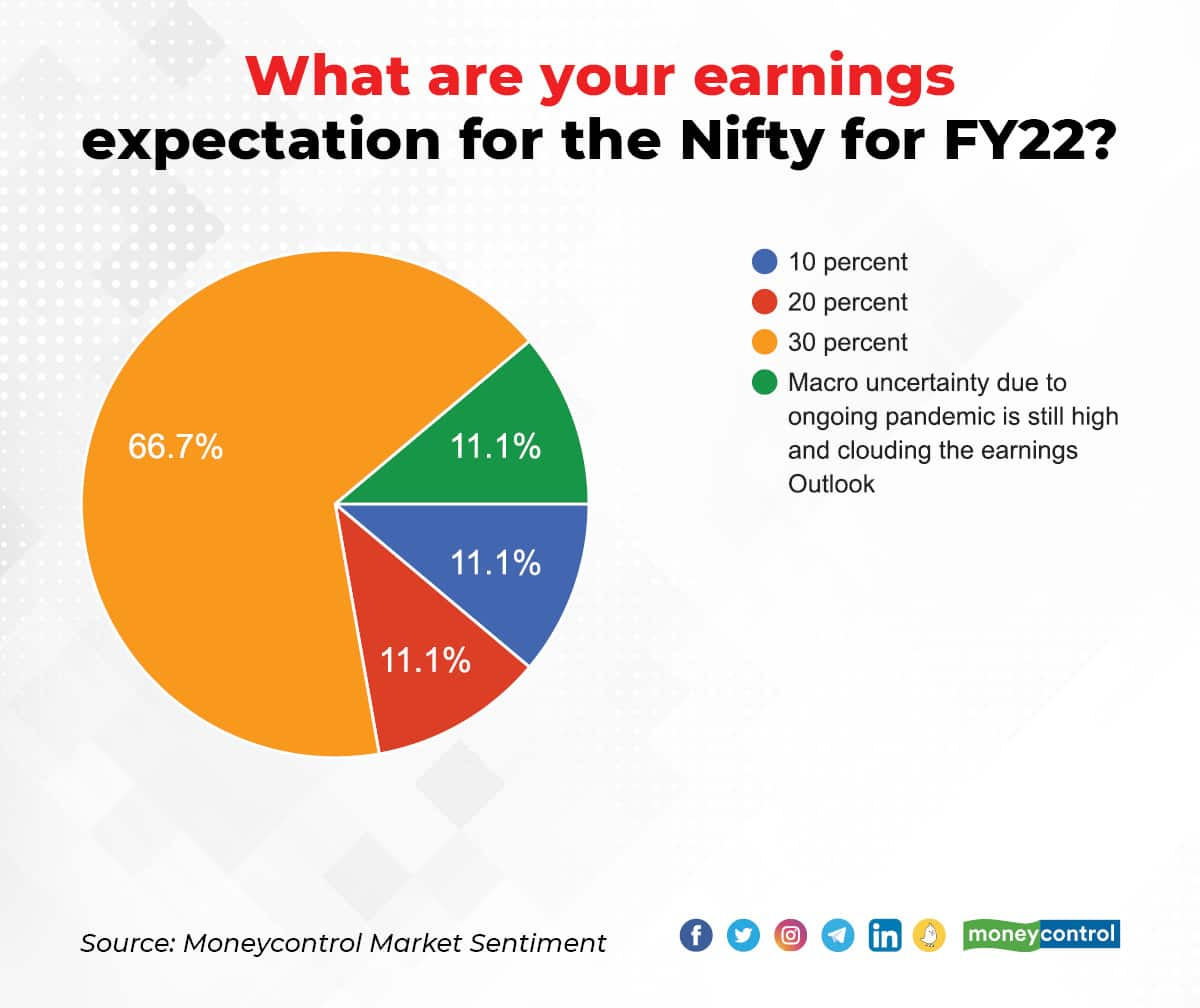

About 68 percent of the fund managers believe that the Nifty will likely see about 30 percent earnings growth in FY22.

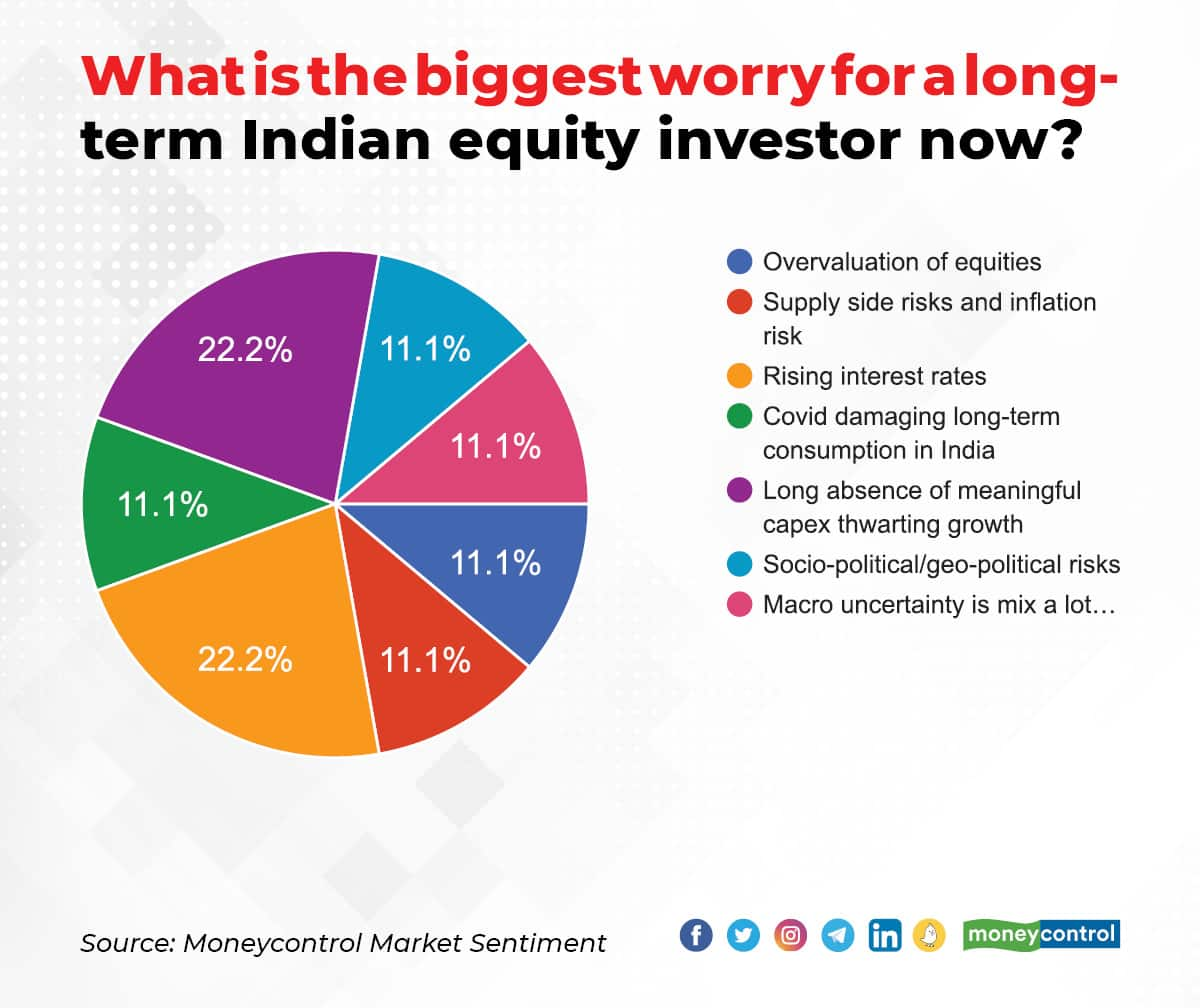

For the long-term investors, the biggest worry is the absence of meaningful capex thwarting growth and rising interest rates.

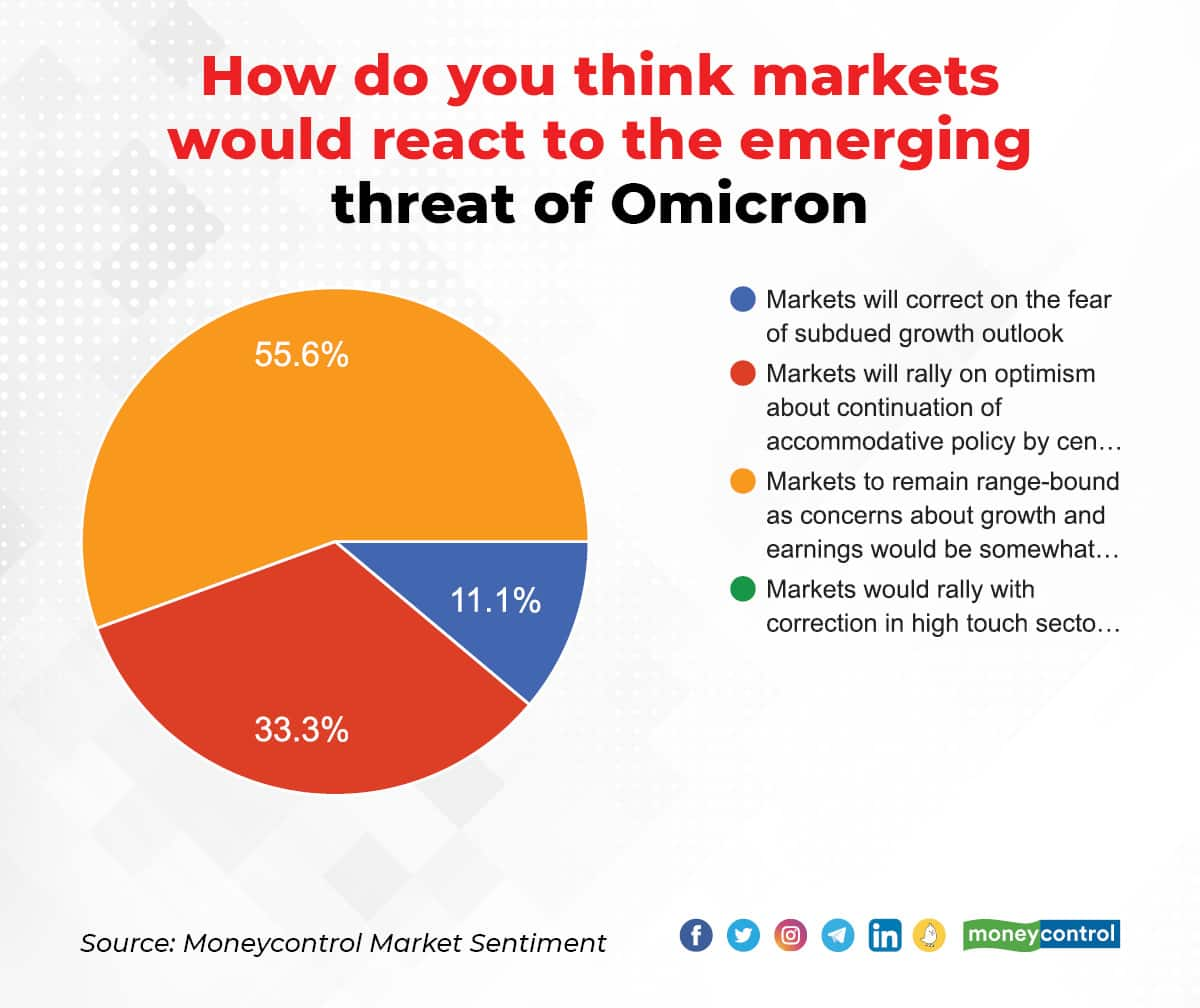

Over 50 percent of experts see that markets staying range-bound on Omicron threat as concerns about growth and earnings will be somewhat offset by a dovish monetary policy stance.

Here’s a look at the responses: