I’m met with the faint scent of sea air. The condo is just how I left it almost three months earlier. Not a thing out of place…

Instinctively, I make my way to the terrace, to the million-dollar views. It’s what drew me to the property when I saw it a year before. But it hits me afresh when I pull back the sliding glass door.

The beach is untouched and wild. From my terrace I can almost hear the millions of grains of sand being sucked out by the ocean’s heaving backwash. Then, like a great exhale, another huge wave comes crashing to shore, spitting ocean spray.

My phone buzzes. A message from my rental manager welcomes me back and tells me that the final payment is in my account. In the 10 weeks I’ve been away, my condo has accumulated $ 10,000, covering my entire year’s mortgage, plus taxes and HOA fees. And now, here I am, getting the $ 1,000-a-week experience for free.

Even after nearly two decades of buying overseas real estate, I wonder how the heck this is even possible…and why more people aren’t doing this. With one purchase I have an asset that pays for itself, that appreciates in value, that I can use as a home, and that makes money when I’m not using it.

Today, I own property in six countries, I have residence or citizenship in five. I spend my time traveling between my international bases. I never have to endure cold, or heat…I time my travels to make the most of perfect weather.

Investing in overseas real estate means you can have the life you want and live in and own homes that make money.

Like I say, I have been investing in real estate overseas for close to two decades, because when you look overseas, there is always opportunity somewhere.

I don’t look for any old international opportunity. I’m focused on the very best ones. The ones that give the biggest upside for the lowest risk. Because if you are willing to look beyond your home borders, you really can have your cake and eat it.

In today’s high-inflationary world, this is the ultimate no-brainer. With real estate you can preserve your savings, and even grow them, by investing in an asset that rises with inflation. And, if you do it right, you can even own an asset that rises in value faster than inflation.

People will always need shelter. The land, and building materials, have a tangible value. You can raise rental rates in line with inflation.

According to data from the U.S. Bureau of Labor Statistics, from 1967 to 2021 the price of housing has gone up 4.16% per year, versus an overall inflation rate of 3.93%. So, if you bought a $ 100,000 home in 1967, it would be worth $ 901,165 today. This doesn’t account for any rental income you could have also collected, and over 54 years that would be a significant amount.

Take a global view, investing in real estate overseas, and you can also benefit from record low interest rates. Buying a property in Portugal for example, maybe you get a fixed-rate, long-term mortgage at 1.5%. On a €250,000 property and a 20% deposit, this means your monthly payments would be €554.

If inflation is here for the long-term, too—and unless governments stop accumulating debt, long-term inflation is probably a safe bet—then your €554 monthly payment essentially shrinks in value over time. By that, I mean €554 today buys you a lot more than €554 10 years from now. Meanwhile, your property might have appreciated to €300,000 and you’re collecting €2,000 per month in rent (a 250% return on your monthly mortgage payment).

This might seem like a fantastic hypothetical, but it’s not. Mortgage rates are at record lows and in places like Portugal, it’s actually possible for you, even as a foreigner, to pay a rate of less than 1%.

That brings us to the main stumbling block that prevents most folks from ever taking advantage of an overseas real estate opportunity: Where to begin…

There’s no easy way to find a profitable real estate opportunity. If there was, everyone would surely be doing it. I personally spend six months of the year on the road, scouting for deals. My team and I spend millions of dollars each year on travel and research. This is what gives us the edge and allows us to identify opportunities ahead of mainstream real estate buyers. I’m talking about the kind of deals that create double-your-money gain. The kind that make you wonder how the heck it was even possible.

Of the hundreds of destinations my team and I have visited, and the thousands of deals I’ve assessed, right now there are three places that stand head and shoulders above the rest in terms of the profits they can deliver. Let’s dive in:

Portugal’s Algarve

Perhaps more than anywhere else in the world, my team and I have been putting boots on the ground on Portugal’s Algarve. A region that’s nearly unparalleled in Europe in terms of the returns it can offer savvy real estate investors.

The Algarve has perfect weather, with 300 days of sunshine a year, amazing beaches, and world-class golf. It’s easy to get there, the cost of living is low, the food is great, and it’s safe and peaceful.

On Portugal’s Algarve, development started in the center and spread west.

Importantly, the Algarve attracts a huge mix of markets. It’s what I call an “internationalized destination” that draws Northern Europeans, North Americans, and even folks from as far away as Asia. As a conservative real estate buyer, I buy in internationalized destinations because they are far more resilient to crisis. It’s a place where, no matter what happens, people always come.

For instance, a contact on the Algarve tells me that in the beach town of Lagos in 2020 the average occupancy for well set up, well located, and well-managed properties was around 35 weeks. And last year, despite the lockdown, I hear some property owners were still pulling in gross yields of 7%. Given what was going on in the world, that’s impressive.

My contact rents his own villa on the Algarve each summer. As lockdowns spread rapidly around the world in 2020, he had most of his reservations cancel, but it took him less than a week to replace every single one with new bookings. Then, just this summer he pulled in approximately $ 44,000 in just two months renting out his home.

When travel bounces back in full force, a rental in an internationalized destination like this will be the first to see a fresh surge in demand.

The short-term rental market in the Algarve is anchored by a red-hot, 10-week peak season. You can add the two weeks at Easter and schools’ (in northern Europe) spring and fall breaks as high season. (The Algarve is very popular as a family destination.) March and September-October are good months to rent to golfers, young couples, and retirees. In recent years, even the previously dead winter months are attracting more visitors.

Buy well in the Algarve, and you can lock in both high yields, and strong appreciation—a two-punch play that I love.

On top of this, in Portugal right now you can get exceptionally cheap bank financing. With a low interest rate mortgage, you can be into opportunities here for very little. In fact, right now, foreigners can borrow as much as 80% in Portugal, at rates of as low as 0.9% or even less.

For instance, in the Central Algarve, I partnered with my contact and used cheap bank financing to buy a luxury condo in a high-end resort community—a bank foreclosure that had been grossly undervalued.

We bought the condo for €410,000, with 100% financing at extremely low rates. That means after closing costs, plus the cost of renovation and furnishings, we were only into the deal for about €55,000. And this summer, we were renting the condo for €3,500 a week.

That gives us wild cash-on-cash rental yields (the mortgage is only €1,400 a month). And I’ve since seen the same unit type listed for over double that at €830,000.

The opportunity on the Central Algarve is to lock down something undervalued, old, or unloved, then polish up, establish a rental stream and sell it. With the right property, you could easily be looking at six-figure gains or more.

However, the Central Algarve is the most established part of the region. Therefore, opportunities here are thinner on the ground, and take a little digging to find. The more immediate opportunity is to look to the Western Algarve. This is where you have the booming town of Lagos, set on a hill overlooking a modern marina. It’s arguably the most historic town on the Algarve. This was home to Henry the Navigator and the adventurers of the Age of Discovery.

It’s a pretty and happening place, compact, low-rise, and walkable. From spots all over town, you can catch breath-taking views of the Bay of Light, fringed by miles of golden sand, with the town of Portimao on the other side.

This is where I’ve uncovered some of the most exciting opportunities on the Algarve in recent years. Best-in-class property is in incredibly hot demand. Demand is surging, supply is scarce, and there are constraints that put serious limitations on availability. By getting in early on the right condos, in the right locations, you can do very well.

For instance, one member of my Real Estate Trend Alert (RETA) group bought two condos as investment properties about five years ago for approximately €430,000 each. They rented them both, bringing in an average of about €30,000 (a 7% gross yield) a year each and recently sold one for €650,000. Those are some serious gains.

And, when you figure we can borrow up to 80% of the purchase price at sub 0.9% rates, the return on cash invested is exceptional.

Last year, I recommended condos in the Adega building in central Lagos to members of my Real Estate Trend Alert group. I got word just recently that a buyer got a soft offer on their condo in Adega that could hand them €160,000 in profits.

And the opportunity looks set to continue as scarcity becomes an ever-growing issue. And thanks to RETA’s group buying power and local connections, we still have a window here to own something rare and profitable ahead of the supply squeeze.

Panama

Panama was the first place I ever invested overseas. That was 2004, and the window of opportunity was brief, but worth serious upside to anyone who got in before it closed.

Today, a second wave is creating an even stronger opportunity than the one I found when I first invested. And that’s one of the most important reasons to invest in international real estate. You get to follow big “once in a lifetime” transformations and play them far more often than once in your life.

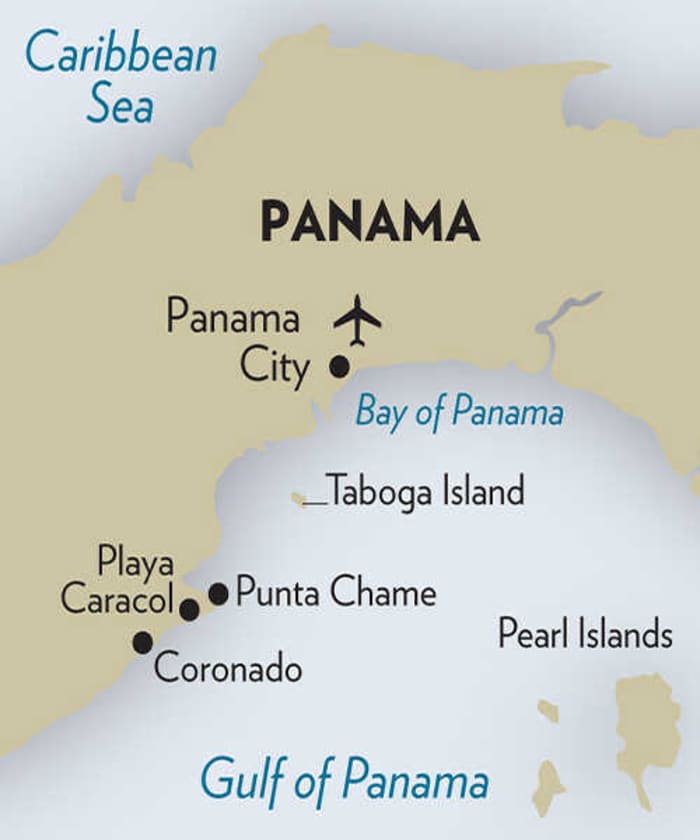

Specifically, I’ve identified two opportunities with the potential to double your money. One of those is again in Panama City, the other is the finest white-sand beach within an easy drive of the city—a beach that’s only become accessible in recent years. Get in on either of those two opportunities and you could ride two waves of development that are bringing strong profit to smart real estate buyers.

There are two big opportunities in Panama City now: buy ahead of a new wave of growth in Panama City…and buy ahead of a Path of Progress on the Pacific Riviera to the south of the city.

Panama’s strategic location for shipping and trade drives its growth. It lies between North and South America with the Panama Canal connecting the Pacific and Atlantic oceans.

Since before I ever set foot in Panama, it’s been rapidly transforming from a sleepy outpost to a regional powerhouse. And boy is it booming. It’s truly global now, attracting wealthy and well-heeled folks from all over the world.

The city has always been a thriving hub of trade, starting with its role in the Spanish Empire’s silver route. But it was during World War II when prosperity hit unprecedented levels as U.S. military personnel and their families took up residence. Entire neighborhoods of the city are like something straight from the U.S., with big, modern malls, and movie theaters where you can catch a movie in English and use the dollars in your pocket—Panama uses the U.S. dollar.

Panama’s success is largely down to following the Singapore model. Like Singapore, Panama created a wealth fund and poured money into infrastructure. Generous tax breaks and easy visa requirements for those setting up a business or hiring employees mirror the Singapore model. Today, Panama is the biggest recipient of foreign direct investment in Central America. And, it’s attracting more and more multinationals looking for a friendly regional base.

In 2019 the World Bank declared that over the past decade Panama has been one of the fastest-growing economies in the world. In fact, Panama is now ranked as a high-income nation by the World Bank. The strong economic growth has added more folks to the upper-middle-class bracket over the last 10 years. And Panama’s safety and stability is a big draw for wealthy Latins, too, who feel comfortable flaunting their designer bling and Lamborghinis.

Panama City has seen a surge of demand in recent years from a growing, upwardly mobile, population. Yet, the city has a shortage of developable land. On one side, it is hemmed in by the Pacific Ocean, and on the other it is constrained by large parcels of protected land and watershed for the Panama Canal.

There’s very little room for urban sprawl. And this will put huge upward pressure on existing real estate prices.

A “Big Squeeze” is coming, but thanks to my contacts in Panama, I have a window to lock down the kind of real estate that the well-heeled folk coming to Panama want.

The kind of place you could rent long term to young entrepreneurs, older retirees, and executives working for a big multinational in the business districts close by. And where you could see rapid appreciation as demand continues to rise against supply in Panama City.

The second opportunity is to meet the same market demand by owning something truly special within a short commute of the city. Playa Caracol is on the Pacific Riviera, the 50-mile or so stretch of coastline west of Panama City. It’s the closest beach to the city on this Riviera of its caliber, in fact, the nicest beach by far within an hour of the city. And it’s set to be even easier to reach thanks to the mammoth Path of Progress.

Investments don’t always come with a view, but that’s another advantage with property.

Ronan McMahon

Millions of dollars of development and infrastructure have poured in. But because of an anomaly in this huge Path of Progress, Caracol was a secret to a few in-the-know insiders.

Now, one of Panama’s preeminent developers is taking on the challenge. He and his group have been behind some extraordinary communities around Panama City. Ocean Reef, for example, is ultra-prime real estate on man-made islands in the Bay of Panama, right in the heart of the city, yet surrounded by ocean.

In Playa Caracol this developer has already delivered well over 300 units. And because of his long history with my Real Estate Trend Alert group, members had the opportunity to buy here at remarkable pricing.

For instance, in September 2019 I brought RETA members a deal on condos there. They could buy best-in-class condos fronting a white-sand beach with a mountain backdrop for $ 184,300, which I figure will be worth $ 299,000 within five years.

It wasn’t the first time I found a killer deal here. In 2017, I was able to bring RETA members an opportunity to buy beachfront condos in Playa Caracol at RETA-only prices starting at $ 199,000. By late 2019, a similar-sized condo farther back from the beach with only a side view listed for $ 299,000…that’s $ 100,000 in paper gains in just two years.

In fact, I believe so strongly in this developer’s vision that I bought here too—getting in on an exclusive RETA deal at Caracol in November 2020.

What we can lock down ahead of the Path of Progress and ahead of Panama City’s next wave of growth, is already on track to become one of the most premium addresses on the Pacific Riviera. It’s where the chic spend their weekends…well-heeled families come to relax and unwind. It’s this desirability that will drive real estate values in the community up as it gets built out.

Mexico’s Riviera Maya

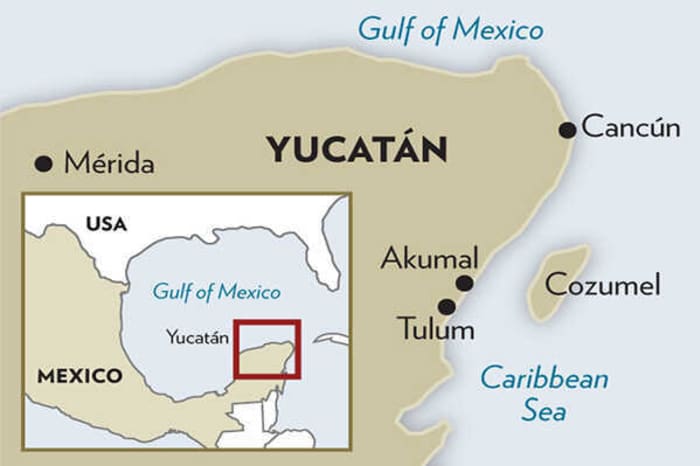

The Riviera Maya is an 80-mile stretch of pristine Caribbean coastline on Mexico’s Yucatán Peninsula that goes from Cancún in the north to Tulum in the south.

It’s a treasure throve of white-sand beaches, glistening turquoise water, and dense jungle that’s bursting with wildlife. It’s also a place that attracts millions of international visitors each year, making it one of the most powerful destinations I know for rental plays.

I first visited in 2004. Cancún was developed. Playa del Carmen still a quiet sleepy beach town. I continued south, took a one-lane road that turned to dirt then stopped when I saw turquoise water sparkle. I walked through an empty palapa restaurant. Then, my jaw hit the floor. Miles of the most pristine white sands I had seen opened up in either direction. It was empty. The beach. The restaurant… welcome to Tulum.

I’ve spent the 17 years since staying ahead of the juggernaut Path of Progress as it rolled south along the stunning Caribbean coast, transforming Playa del Carmen into a booming resort city, and the tiny town of Tulum is an ultra-chic destination that attracts New York fashionistas and Hollywood elites.

The Riviera Maya is what I call “the convenient Caribbean,” every bit as beautiful as any island, but a lot easier to get to for millions of people.

Indeed, the Riviera Maya has been drawing people from right across the world for a while. These folks come for the weather, the beaches…the amazing range of cool stuff you can do. And now they are coming in much greater numbers because they can.

Since the pandemic, the Riviera Maya’s ease of access and proximity to the U.S. and Canada has been crucial. It has made it the perfect destination for a growing mass of people who now take their work with them anywhere. Longer-stay folks have every amenity they need, including international schools for their kids, gourmet supermarkets, and so on.

As towns like Tulum grow, owning real estate that is rare, discreet, and exclusive sets you up beautifully for explosive rental demand and for rapid potential for gains.

From my contacts in the rental industry in Tulum, I’m told a two-bedroom condo will run you $ 1,750 to $ 2,000 per month. A house could go up to $ 2,000 to $ 3,000. And remote workers are more than willing to pay those prices. Even better, it’s not just one type of person coming here. Older people, younger people, families, groups of friends…all want to be in Tulum—and that variety makes the rental market that much stronger.

Members of my Real Estate Trend Alert group have done exceptionally well here.

Condos that RETA members secured for $ 208,440 are now listed at $ 311,000—a six-figure lift. And a condo that was available for the RETA-only price of $ 166,860 is now at $ 239,000…a gain of $ 72,000.

Our group secured our profits by getting in at RETA-only pricing from $ 154,500 for a two-bedroom condo. As we do and say in real estate, we made our money buying. I myself bought one of these entry priced condos and sold my unit in early 2020 for $ 225,000.

In February last year, RETA members could buy two-bed homes in Edena, Tulum, for $ 149,000. A few months later, in October, homes were listing for $ 199,000.

Like I say, few places on my beat have been as profitable as the Riviera Maya. There is strong rental demand from multiple markets pretty much year-round. A big international mix of people, lots of fun things to do, good food…stunning white-sand beaches.

Like the Algarve and Panama, the Riviera Maya is an internationalized place. A place where—with the right real estate—even in bad times you still do OK. Buy well, and you can own a true money-maker, an overseas home, and an asset that protects and grows your wealth for years to come.

This story originally ran in International Living.