This article is reprinted by permission from NextAvenue.org.

For years, the Social Security Administration has done a pretty crummy job telling Americans how much they’ll likely receive in Social Security benefits. But I’m glad to say that the agency just replaced its text-heavy, four-page Social Security Statement with a redesigned, more useful, more visual, two-page version.

As a result, I strongly urge you to visit the Social Security website to see the vital, clear information for your retirement security. To do so, you’ll want to either visit your “my Social Security Account” on the site or set one up. Otherwise, you can only see your Statement when it comes in the mail once you turn 60. (Only 63 million Americans have my Social Security Accounts, though 176 million workers pay taxes into the Social Security program.)

“The Statement is streamlined and contains clear messaging and makes it easy to find information at a glance,” Social Security Administration Acting Commissioner Kilolo Kijakazi told me. “So, we’re hoping this will help simplify what can be complex programs for the public.”

Complex is putting it kindly.

Social Security analyst Laurence Kotlikoff, an economics professor at Boston University and creator of software to help people claim Social Security wisely, has told me that there are 2,728 rules in the Social Security Handbook and 11 different Social Security benefits. He thinks at least half of people claiming Social Security “are making major mistakes.”

Kotlikoff has a few issues with the new Social Security Statement, as do some other critics; I’ll explain their concerns shortly.

Also see: Social Security proposal would raise revenue and temporarily enhance benefits

Big improvements in the new Social Security statements

I see a few big improvements in the new Social Security statement:

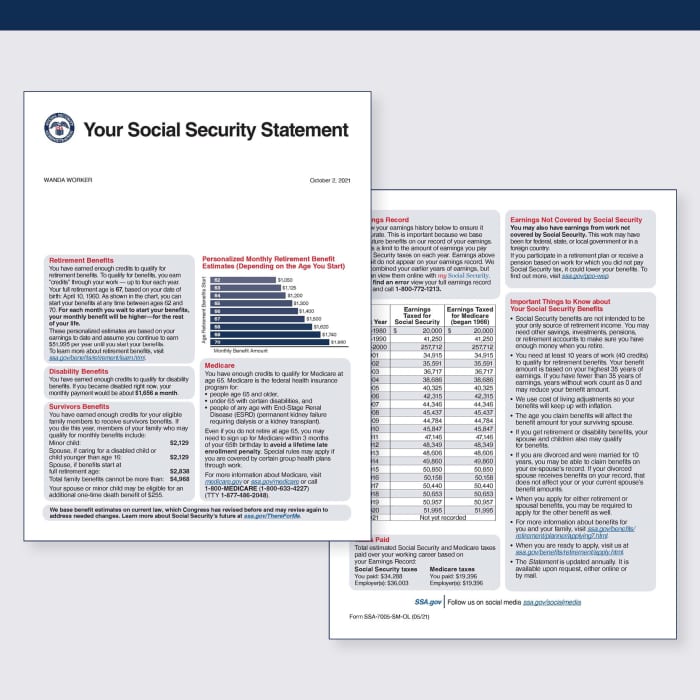

The nifty, simple, colorful bar chart called Personalized Monthly Retirement Benefit Estimates (Depending on the Age You Start). In the Statement’s previous incarnation, you might have been led to believe that it was smart to begin claiming Social Security as early as allowed — at 62 — or at Full Retirement Age (now between age 66 and 67, depending on when you were born). But the new chart shows the advantage of delaying claiming if you can.

Social Security’s rules essentially give you an 8% bigger benefit for each year you postpone claiming benefits after your Full Retirement Age, until age 70. Put another way, if you’re now 66 and wait until 70 to start claiming, you’ll see 32% larger benefits than if you filed at your Full Retirement Age. But 62 is one of the most popular ages for people to begin claiming Social Security.

The new statement

Social Security Administration

The new statement puts the value of delayed claiming into sharp focus through its bar charts. As an example, someone born in 1960 who’d continue to earn about $ 50,000 a year until starting benefits might see that claiming at 62 would provide a $ 1,050 monthly benefit but waiting to 70 would deliver $ 1,860 a month.

“People should be aware that if they retire early, that means an actuarial deduction the amount they’re going to receive and that continues on to the rest of their retirement,” said Kijakazi. “Having that visual makes it clear instinctively for people what their choices are as they make their [claiming] decisions.”

Your personalized Earnings Record. Your Social Security Statement now lists most of your year-by-year earnings taxed for Social Security and bunches together some of your earlier years of employment. You can find any year’s earnings in your “my Social Security” online account.

Survivors Benefits. The Statement shows precisely how much your spouse or a minor child could receive in monthly benefits from Social Security if you die this year.

The bulleted list called Important Things to Know About Your Social Security Benefits. This explains, for instance, that after a married person dies the age they claimed benefits will affect the benefit amount for their surviving spouse.

What Social Security analysts think

Gary Koenig, vice president for financial security at AARP, said the new statement “is much better than where it was.” He’s particularly glad the Social Security Administration no longer uses the term “early retirement benefits,” a phrase he thinks is “frankly misleading.” But he wished the agency would have mentioned “a minimum benefit versus your maximum benefit.”

Phil Moeller, co-author of “Get What’s Yours: The Secrets to Maxing Out Your Social Security,” gives the overhauled Social Security statement “a solid B.” He’s a fan of its new graphics, though wishes there were more explanations of claiming rules.

A Social Security Administration staffer told him, however, that the agency is working to include benefit estimates, taxes paid and an earnings record on its sample Statement that “are more representative of a real-life scenario.”

Jim Blair, of Premier Social Security Consulting, applauds the way the new Statement gives people a better idea of benefit reductions for early claiming.

Martha Shedden, co-founder of the National Association of Registered Social Security Analysts, had a mixed review of the new Social Security Statement.

She liked its short length, layout and colored formatting “which make it easier for workers to quickly understand their benefits,” Shedden told me. And she approved of the monthly benefit estimates, the Statement’s “Retirement Ready Fact Sheet” for people (based on their age decade) and links, rather than arcane wording, to some of Social Security’s claiming rules.

But, she said, “I would like to see more emphasis — bold or colored text — on the fact that these personalized estimates are based on your earnings to date and assume you continue to earn $ xx, xxx per year until you start your benefits.”

Kotlikoff — who consulted with the Social Security Administration on the Statement’s redesign — thought the visual improvements were “good,” but had a few beefs.

For one: “I don’t like that you can’t make a PDF of your entire earnings history to check if it’s right,” he said. Shedden complained about this, too.

The Social Security Administration folks tell me that they’re working on updating the statement to show people more of their earnings history.

Kotlikoff also quarreled with what he called “the slightly ridiculous and potentially highly unrealistic” economic assumptions behind the projections for a person’s Social Security benefits.

“They assume no inflation in the future and no wage growth in the economy forever,” he said. Also, Kotlikoff added, Social Security assumes “that you’re going to work up until you retire.”

Time to mail Social Security statements again?

Other Social Security analysts, including AARP, believe the government should go back to routinely mailing all Americans 25 and older Social Security statements as it did until a decade ago.

Not happening at this time, Kijakazi said. “If we were to mail statements to all people 25 and older, it would increase our costs — print and mail — to between $ 80 million and $ 90 million per year,” she noted.

See: Can Social Security afford all this federal spending?

Kijakazi added that she knows a bipartisan bill in Congress — the Know Your Social Security Act — would require a return to paper statements for workers 25 and older who aren’t getting Social Security benefits. “If the bill were to become law, we would work diligently to be mailing as fully as possible. But yet there is a substantial cost,” she said.

Meantime, check out your Social Security Statement to ensure it’s accurate and to see what you might receive in benefits one day. If you find any mistakes in your earnings record, call the Social Security Administration at 800-772-1213 to get things rectified.

Richard Eisenberg is the Senior Web Editor of the Money & Security and Work & Purpose channels of Next Avenue and Managing Editor for the site. He is the author of “How to Avoid a Mid-Life Financial Crisis” and has been a personal finance editor at Money, Yahoo, Good Housekeeping, and CBS Moneywatch.

This article is reprinted by permission from NextAvenue.org, © 2021 Twin Cities Public Television, Inc. All rights reserved.

More from Next Avenue: